Answered step by step

Verified Expert Solution

Question

1 Approved Answer

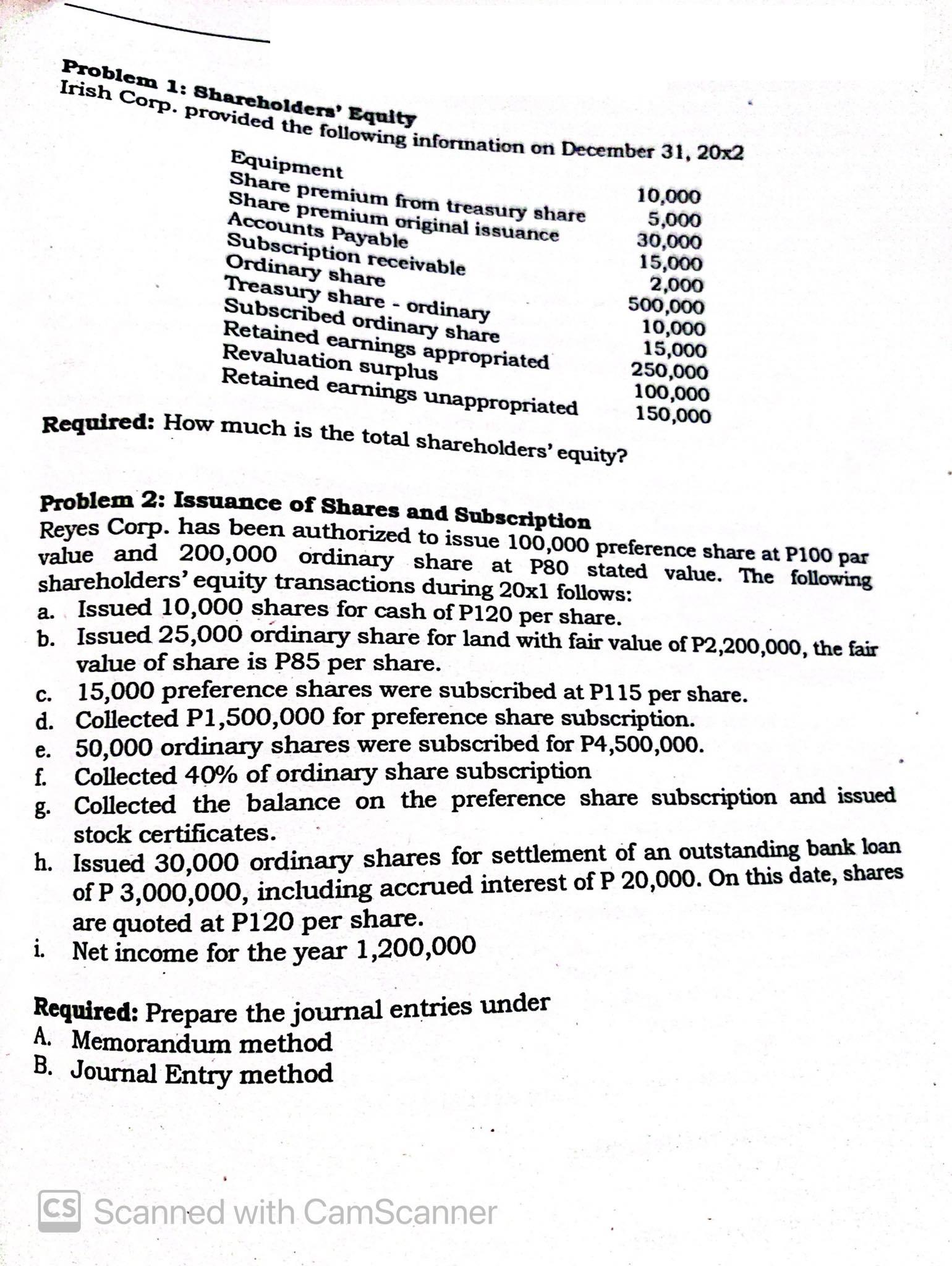

Problem 1: Shareholders' Equity Irish Corp. provided the following information on December 31, 20x2 Equipment Share premium from treasury share Share premium original issuance

Problem 1: Shareholders' Equity Irish Corp. provided the following information on December 31, 20x2 Equipment Share premium from treasury share Share premium original issuance Accounts Payable Subscription receivable Ordinary share Treasury share - ordinary Subscribed ordinary share Retained earnings appropriated Revaluation surplus Retained earnings unappropriated Required: How much is the total shareholders' equity? 10,000 5,000 30,000 15,000 2,000 500,000 10,000 15,000 Problem 2: Issuance of Shares and Subscription Reyes Corp. has been authorized to issue 100,000 preference share at P100 par value and 200,000 ordinary share at P80 stated value. The following shareholders' equity transactions during 20x1 follows: a. Issued 10,000 shares for cash of P120 per share. b. Issued 25,000 ordinary share for land with fair value of P2,200,000, the fair value of share is P85 per share. 250,000 100,000 150,000 C. 15,000 preference shares were subscribed at P115 per share. d. Collected P1,500,000 for preference share subscription. Required: Prepare the journal entries under A. Memorandum method B. Journal Entry method 50,000 ordinary shares were subscribed for P4,500,000. e. f. Collected 40% of ordinary share subscription g. Collected the balance on the preference share subscription and issued stock certificates. h. Issued 30,000 ordinary shares for settlement of an outstanding bank loan of P 3,000,000, including accrued interest of P 20,000. On this date, shares are quoted at P120 per share. i. Net income for the year 1,200,000 CS Scanned with CamScanner

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 Total shareholders equity Share premium from treasury share Share premium original issuance Ordinary share Treasury share ordinary Subscribe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started