Question

Problem 1 S&P 500 and Individual Stocks Suppose you are holding the passive S&P 500 Index originally but are considering becoming slightly more active. You

Problem 1 S&P 500 and Individual Stocks

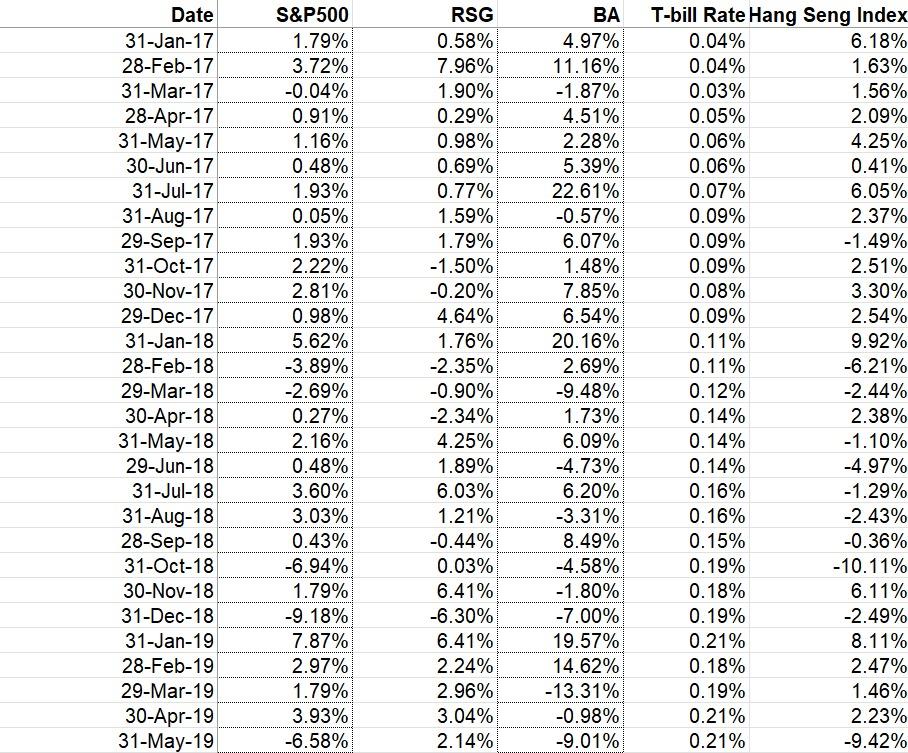

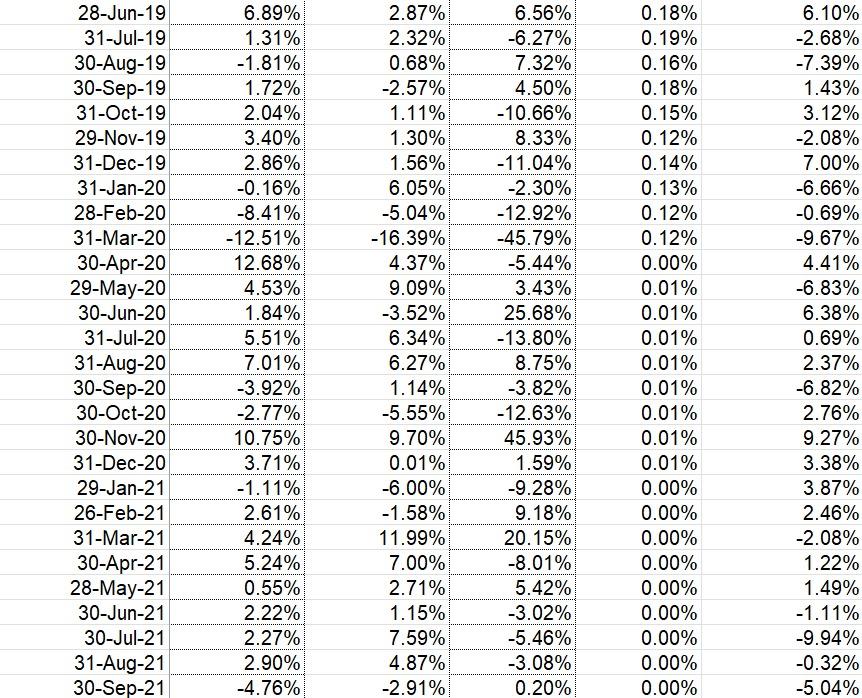

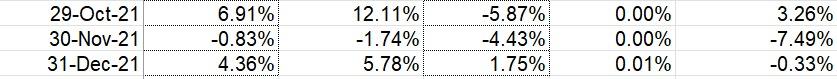

Suppose you are holding the passive S&P 500 Index originally but are considering becoming slightly more active. You are now thinking about two options: a portfolio with 99% in S&P 500 Index and 1% in Republic Services Inc (RSG), or a portfolio with 99% in S&P 500 Index and 1% in Boeing Co (BA).

a) Suppose your position had been 99% invested in the S&P 500 Index and either 1% in RSG or 1% in BA. Calculate the return of the two resulting portfolios for each month. Estimate the average return and standard deviation of the portfolios. Is the standard deviation of the portfolios higher or lower than that of the S&P 500 Index?

b) Perform a regression of each stocks monthly excess returns on the S&P 500 Index excess returns to find the beta for each stock.1 How does beta relate to your answer in part (a)?

c) Assume that you are risk-averse. So, in which stock, RSG or BA, should you invest 1%? Or should you remain passive by holding the S&P 500 Index only?

Problem 2 S&P 500 and Hang Seng Index

a) Estimate the Sharpe ratio of S&P 500 and Hang Seng Index. Use the average U.S. Treasury bill rate as the estimate of the riskfree rate.

b) Some financial analysts in Hong Kong argue that we should completely avoid the Hong Kong stock market and invest only in the U.S. stock market. Do you agree? Use data and what you have learned in the course to support your answer.

Date 31-Jan-17 28-Feb-17 31-Mar-17 28-Apr-17 31-May-17 30-Jun-17 31-Jul-17 31-Aug-17 29-Sep-17 31-Oct-17 30-Nov-17 29-Dec-17 31-Jan-18 28-Feb-18 29-Mar-18 30-Apr-18 31-May-18 29-Jun-18 31-Jul-18 31-Aug-18 28-Sep-18 31-Oct-18 30-Nov-18 31-Dec-18 31-Jan-19 28-Feb-19 29-Mar-19 30-Apr-19 31-May-19 S&P500 1.79% 3.72% -0.04% 0.91% 1.16% 0.48% 1.93% 0.05% 1.93% 2.22% 2.81% 0.98% 5.62% -3.89% -2.69% 0.27% 2.16% 0.48% 3.60% 3.03% 0.43% -6.94% 1.79% -9.18% 7.87% 2.97% 1.79% 3.93% -6.58% RSG 0.58% 7.96% 1.90% 0.29% 0.98% 0.69% 0.77% 1.59% 1.79% -1.50% -0.20% 4.64% 1.76% -2.35% -0.90% -2.34% 4.25% 1.89% 6.03% 1.21% -0.44% 0.03% 6.41% -6.30% 6.41% 2.24% 2.96% 3.04% 2.14% BA 4.97% 11.16% -1.87% 4.51% 2.28% 5.39% 22.61% -0.57% 6.07% 1.48% 7.85% 6.54% 20.16% 2.69% -9.48% 1.73% 6.09% -4.73% 6.20% -3.31% 8.49% -4.58% -1.80% -7.00% 19.57% 14.62% -13.31% -0.98% -9.01% T-bill Rate Hang Seng Index 0.04% 6.18% 0.04% 1.63% 0.03% 1.56% 0.05% 2.09% 0.06% 4.25% 0.06% 0.41% 0.07% 6.05% 0.09% 2.37% 0.09% -1.49% 0.09% 2.51% 0.08% 3.30% 0.09% 2.54% 0.11% 9.92% 0.11% -6.21% 0.12% -2.44% 0.14% 2.38% 0.14% -1.10% 0.14% -4.97% 0.16% -1.29% 0.16% -2.43% 0.15% -0.36% 0.19% -10.11% 0.18% 6.11% 0.19% -2.49% 0.21% 8.11% 0.18% 2.47% 0.19% 1.46% 0.21% 2.23% 0.21% -9.42% 28-Jun-19 31-Jul-19 30-Aug-19 30-Sep-19 31-Oct-19 29-Nov-19 31-Dec-19 31-Jan-20 28-Feb-20 31-Mar-20 30-Apr-20 29-May-20 30-Jun-20 31-Jul-20 31-Aug-20 30-Sep-20 30-Oct-20 30-Nov-20 31-Dec-20 29-Jan-21 26-Feb-21 31-Mar-21 30-Apr-21 28-May-21 30-Jun-21 30-Jul-21 31-Aug-21 30-Sep-21 6.89% 1.31% -1.81% 1.72% 2.04% 3.40% 2.86% -0.16% -8.41% -12.51% 12.68% 4.53% 1.84% 5.51% 7.01% -3.92% -2.77% 10.75% 3.71% -1.11% 2.61% 4.24% 5.24% 0.55% 2.22% 2.27% 2.90% -4.76% 2.87% 2.32% 0.68% -2.57% 1.11% 1.30% 1.56% 6.05% -5.04% -16.39% 4.37% 9.09% -3.52% 6.34% 6.27% 1.14% -5.55% 9.70% 0.01% -6.00% -1.58% 11.99% 7.00% 2.71% 1.15% 7.59% 4.87% -2.91% 6.56% -6.27% 7.32% 4.50% -10.66% 8.33% -11.04% -2.30% -12.92% -45.79% -5.44% 3.43% 25.68% -13.80% 8.75% -3.82% -12.63% 45.93% 1.59% -9.28% 9.18% 20.15% -8.01% 5.42% -3.02% -5.46% -3.08% 0.20% 0.18% 0.19% 0.16% 0.18% 0.15% 0.12% 0.14% 0.13% 0.12% 0.12% 0.00% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 6.10% -2.68% -7.39% 1.43% 3.12% -2.08% 7.00% -6.66% -0.69% -9.67% 4.41% -6.83% 6.38% 0.69% 2.37% -6.82% 2.76% 9.27% 3.38% 3.87% 2.46% -2.08% 1.22% 1.49% -1.11% -9.94% -0.32% -5.04% 29-Oct-21 30-Nov-21 31-Dec-21 6.91% -0.83% 4.36% 12.11% -1.74% 5.78% -5.87% -4.43% 1.75% 0.00% 0.00% 0.01% 3.26% -7.49% -0.33% Date 31-Jan-17 28-Feb-17 31-Mar-17 28-Apr-17 31-May-17 30-Jun-17 31-Jul-17 31-Aug-17 29-Sep-17 31-Oct-17 30-Nov-17 29-Dec-17 31-Jan-18 28-Feb-18 29-Mar-18 30-Apr-18 31-May-18 29-Jun-18 31-Jul-18 31-Aug-18 28-Sep-18 31-Oct-18 30-Nov-18 31-Dec-18 31-Jan-19 28-Feb-19 29-Mar-19 30-Apr-19 31-May-19 S&P500 1.79% 3.72% -0.04% 0.91% 1.16% 0.48% 1.93% 0.05% 1.93% 2.22% 2.81% 0.98% 5.62% -3.89% -2.69% 0.27% 2.16% 0.48% 3.60% 3.03% 0.43% -6.94% 1.79% -9.18% 7.87% 2.97% 1.79% 3.93% -6.58% RSG 0.58% 7.96% 1.90% 0.29% 0.98% 0.69% 0.77% 1.59% 1.79% -1.50% -0.20% 4.64% 1.76% -2.35% -0.90% -2.34% 4.25% 1.89% 6.03% 1.21% -0.44% 0.03% 6.41% -6.30% 6.41% 2.24% 2.96% 3.04% 2.14% BA 4.97% 11.16% -1.87% 4.51% 2.28% 5.39% 22.61% -0.57% 6.07% 1.48% 7.85% 6.54% 20.16% 2.69% -9.48% 1.73% 6.09% -4.73% 6.20% -3.31% 8.49% -4.58% -1.80% -7.00% 19.57% 14.62% -13.31% -0.98% -9.01% T-bill Rate Hang Seng Index 0.04% 6.18% 0.04% 1.63% 0.03% 1.56% 0.05% 2.09% 0.06% 4.25% 0.06% 0.41% 0.07% 6.05% 0.09% 2.37% 0.09% -1.49% 0.09% 2.51% 0.08% 3.30% 0.09% 2.54% 0.11% 9.92% 0.11% -6.21% 0.12% -2.44% 0.14% 2.38% 0.14% -1.10% 0.14% -4.97% 0.16% -1.29% 0.16% -2.43% 0.15% -0.36% 0.19% -10.11% 0.18% 6.11% 0.19% -2.49% 0.21% 8.11% 0.18% 2.47% 0.19% 1.46% 0.21% 2.23% 0.21% -9.42% 28-Jun-19 31-Jul-19 30-Aug-19 30-Sep-19 31-Oct-19 29-Nov-19 31-Dec-19 31-Jan-20 28-Feb-20 31-Mar-20 30-Apr-20 29-May-20 30-Jun-20 31-Jul-20 31-Aug-20 30-Sep-20 30-Oct-20 30-Nov-20 31-Dec-20 29-Jan-21 26-Feb-21 31-Mar-21 30-Apr-21 28-May-21 30-Jun-21 30-Jul-21 31-Aug-21 30-Sep-21 6.89% 1.31% -1.81% 1.72% 2.04% 3.40% 2.86% -0.16% -8.41% -12.51% 12.68% 4.53% 1.84% 5.51% 7.01% -3.92% -2.77% 10.75% 3.71% -1.11% 2.61% 4.24% 5.24% 0.55% 2.22% 2.27% 2.90% -4.76% 2.87% 2.32% 0.68% -2.57% 1.11% 1.30% 1.56% 6.05% -5.04% -16.39% 4.37% 9.09% -3.52% 6.34% 6.27% 1.14% -5.55% 9.70% 0.01% -6.00% -1.58% 11.99% 7.00% 2.71% 1.15% 7.59% 4.87% -2.91% 6.56% -6.27% 7.32% 4.50% -10.66% 8.33% -11.04% -2.30% -12.92% -45.79% -5.44% 3.43% 25.68% -13.80% 8.75% -3.82% -12.63% 45.93% 1.59% -9.28% 9.18% 20.15% -8.01% 5.42% -3.02% -5.46% -3.08% 0.20% 0.18% 0.19% 0.16% 0.18% 0.15% 0.12% 0.14% 0.13% 0.12% 0.12% 0.00% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 6.10% -2.68% -7.39% 1.43% 3.12% -2.08% 7.00% -6.66% -0.69% -9.67% 4.41% -6.83% 6.38% 0.69% 2.37% -6.82% 2.76% 9.27% 3.38% 3.87% 2.46% -2.08% 1.22% 1.49% -1.11% -9.94% -0.32% -5.04% 29-Oct-21 30-Nov-21 31-Dec-21 6.91% -0.83% 4.36% 12.11% -1.74% 5.78% -5.87% -4.43% 1.75% 0.00% 0.00% 0.01% 3.26% -7.49% -0.33%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started