Answered step by step

Verified Expert Solution

Question

1 Approved Answer

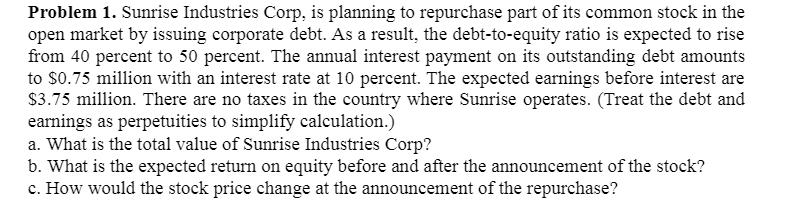

Problem 1. Sunrise Industries Corp, is planning to repurchase part of its common stock in the open market by issuing corporate debt. As a

Problem 1. Sunrise Industries Corp, is planning to repurchase part of its common stock in the open market by issuing corporate debt. As a result, the debt-to-equity ratio is expected to rise from 40 percent to 50 percent. The annual interest payment on its outstanding debt amounts to $0.75 million with an interest rate at 10 percent. The expected earnings before interest are $3.75 million. There are no taxes in the country where Sunrise operates. (Treat the debt and earnings as perpetuities to simplify calculation.) a. What is the total value of Sunrise Industries Corp? b. What is the expected return on equity before and after the announcement of the stock? c. How would the stock price change at the announcement of the repurchase?

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a What is the total value of Sunrise Industries Corp ANS WER 15 million WORK ING E BIT 3 75 million ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started