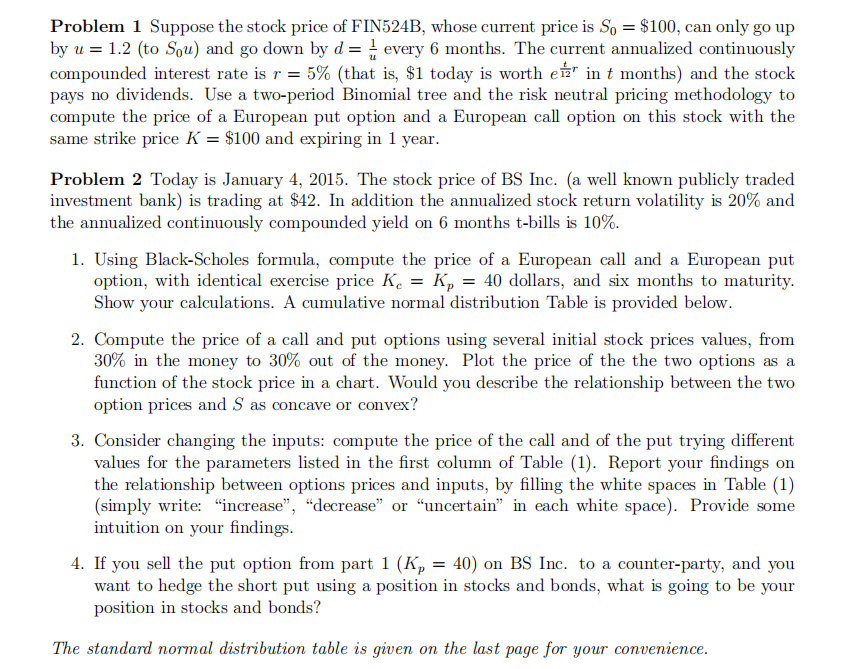

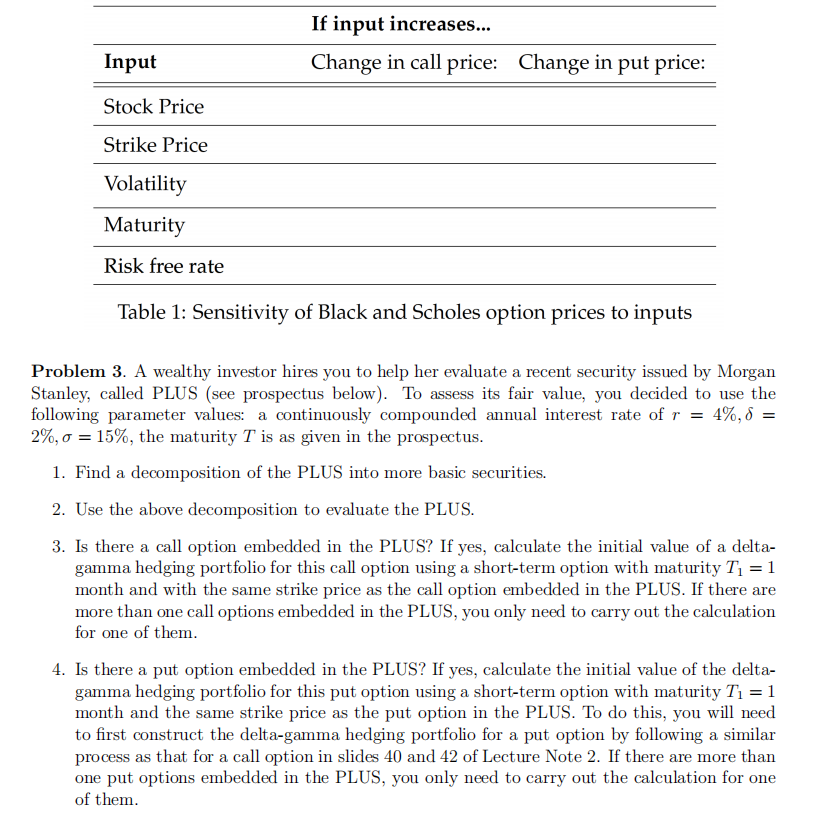

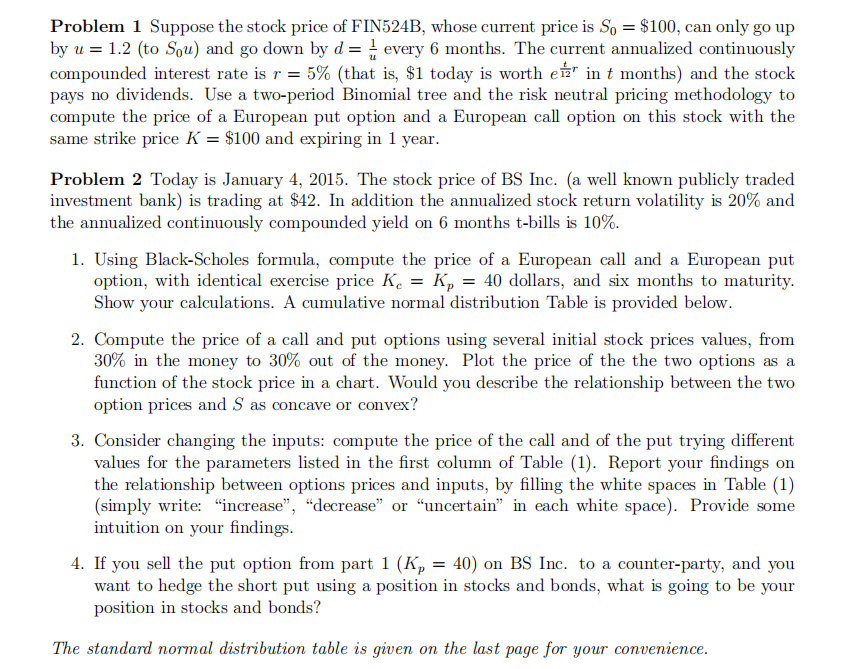

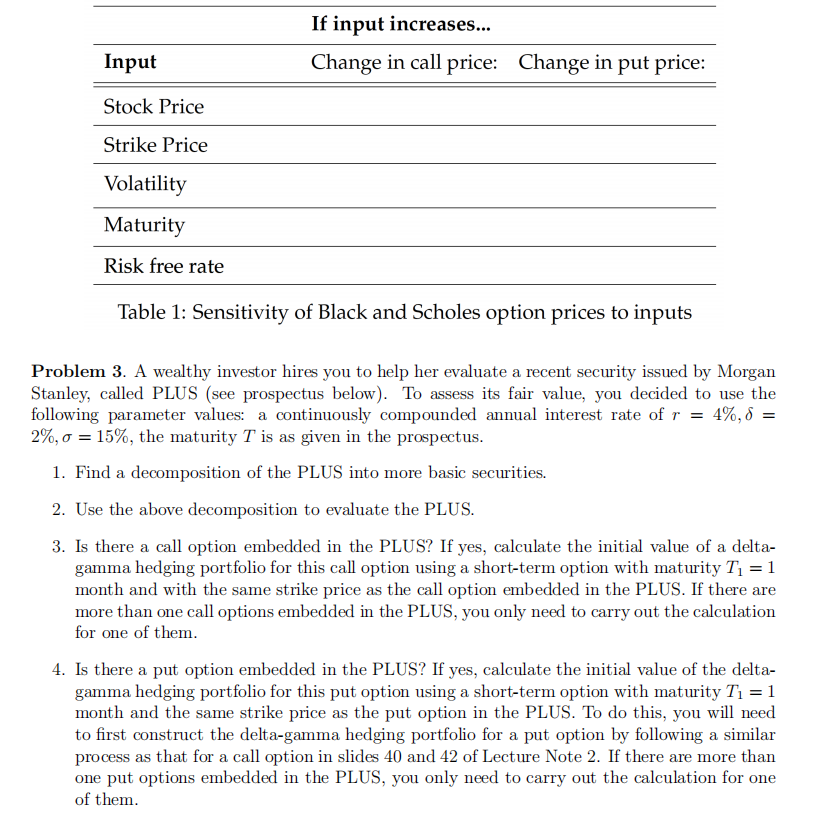

Problem 1 Suppose the stock price of FIN524B, whose current price is S0=$100, can only go up by u=1.2 (to S0u ) and go down by d=u1 every 6 months. The current annualized continuously compounded interest rate is r=5% (that is, $1 today is worth e12tr in t months) and the stock pays no dividends. Use a two-period Binomial tree and the risk neutral pricing methodology to compute the price of a European put option and a European call option on this stock with the same strike price K=$100 and expiring in 1 year. Problem 2 Today is January 4, 2015. The stock price of BS Inc. (a well known publicly traded investment bank) is trading at $42. In addition the annualized stock return volatility is 20% and the annualized continuously compounded yield on 6 months t-bills is 10%. 1. Using Black-Scholes formula, compute the price of a European call and a European put option, with identical exercise price Kc=Kp=40 dollars, and six months to maturity. Show your calculations. A cumulative normal distribution Table is provided below. 2. Compute the price of a call and put options using several initial stock prices values, from 30% in the money to 30% out of the money. Plot the price of the the two options as a function of the stock price in a chart. Would you describe the relationship between the two option prices and S as concave or convex? 3. Consider changing the inputs: compute the price of the call and of the put trying different values for the parameters listed in the first column of Table (1). Report your findings on the relationship between options prices and inputs, by filling the white spaces in Table (1) (simply write: "increase", "decrease" or "uncertain" in each white space). Provide some intuition on your findings. 4. If you sell the put option from part 1(Kp=40) on BS Inc. to a counter-party, and you want to hedge the short put using a position in stocks and bonds, what is going to be your position in stocks and bonds? Iable 1: Sensitivity of Black and Scholes option prices to inputs Problem 3. A wealthy investor hires you to help her evaluate a recent security issued by Morgan Stanley, called PLUS (see prospectus below). To assess its fair value, you decided to use the following parameter values: a continuously compounded annual interest rate of r=4%,= 2%,=15%, the maturity T is as given in the prospectus. 1. Find a decomposition of the PLUS into more basic securities. 2. Use the above decomposition to evaluate the PLUS. 3. Is there a call option embedded in the PLUS? If yes, calculate the initial value of a deltagamma hedging portfolio for this call option using a short-term option with maturity T1=1 month and with the same strike price as the call option embedded in the PLUS. If there are more than one call options embedded in the PLUS, you only need to carry out the calculation for one of them. 4. Is there a put option embedded in the PLUS? If yes, calculate the initial value of the deltagamma hedging portfolio for this put option using a short-term option with maturity T1=1 month and the same strike price as the put option in the PLUS. To do this, you will need to first construct the delta-gamma hedging portfolio for a put option by following a similar process as that for a call option in slides 40 and 42 of Lecture Note 2 . If there are more than one put options embedded in the PLUS, you only need to carry out the calculation for one of them