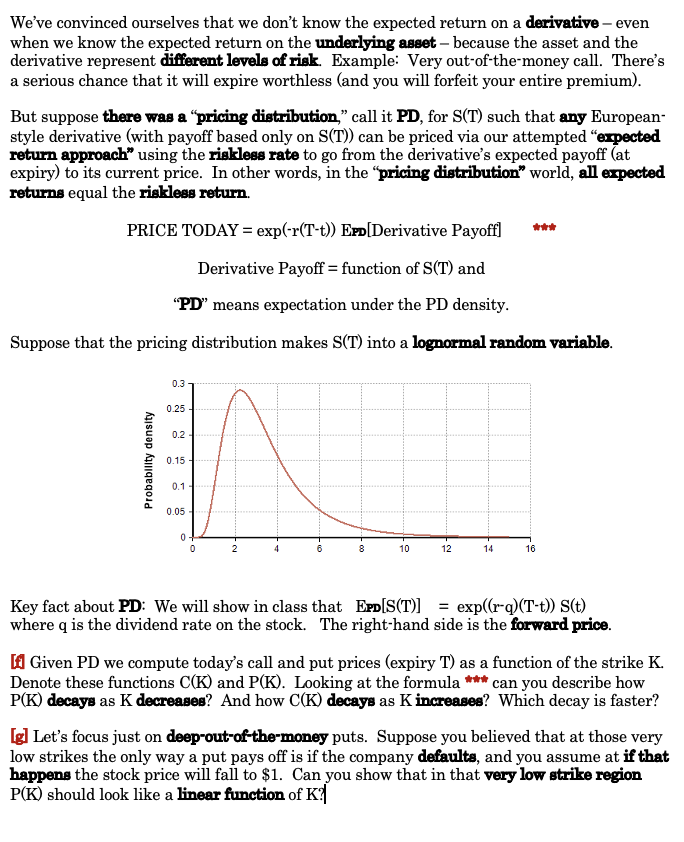

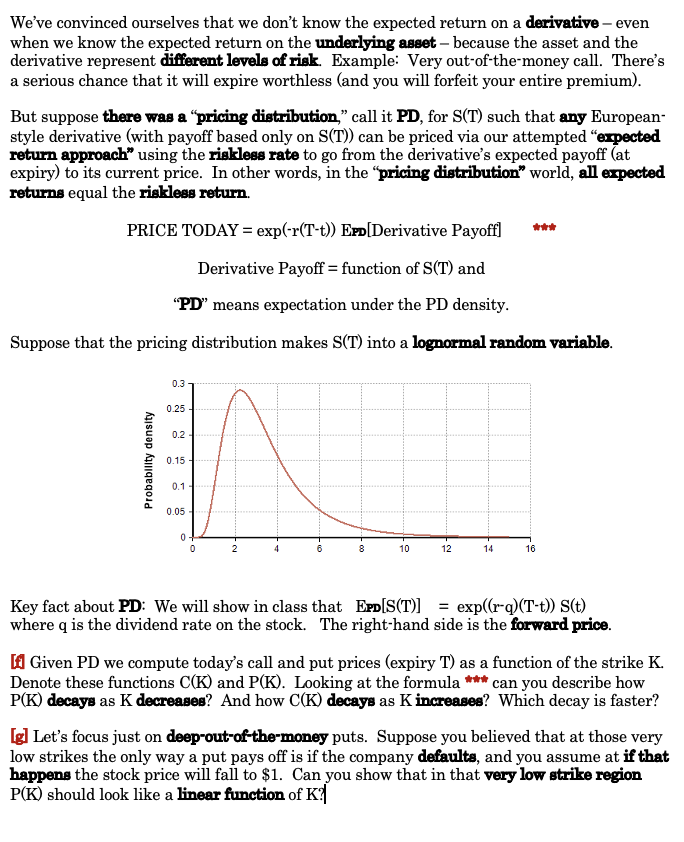

[PROBLEM 1] Suppose we model a stock's value six months from today, denoted S(T), as a random variable satisfying: S(T) = exp(z) where Z is a normally-distributed random variable. Denote the variance of Z, VAR[Z], by 02. s(t) denotes today's price (which we know). [a] Under the assumption that the expected return on the stock is believed to be 4% where must we set the mean of Z? (The answer will depend on 02.) Hint: Can you demonstrate that: E[S(TL= E[exp(Z)] = exp(E[Z] + 0.5 VAR[Z]) ? [b] Can you work our VAR[S(T)]? [c] Do you think it's true that for any random variable U (not necessarily normally- distributed) we have: E[exp(U)] = exp(E[U] + 0.5 VAR[U]) ? Hint: Let's try it with a random variable W having the exponential distribution. f(x; 2) is W's pdf: f(x; 1) = x>0 0 2 0 te-xx Can you work out E[exp(W)] and compare it to exp(E[W])? [d] Going back to our modeled stock price S(T): Consider the square derivative SQR: Its payoff at time T equals (S(T))2. Under the assumption that the expected returns of the stock and the square derivative are the same can you write an integral expression for today's price of SQR in terms of today's stock price S(t)? No need to work out the integral. [e] Suppose S(t) = $5. Without having worked out part [a], can you explain why we can assert that SQR(t) should be larger than $25 (as long as o is not zero)? We've convinced ourselves that we don't know the expected return on a derivative - even when we know the expected return on the underlying asset - because the asset and the derivative represent different levels of risk. Example: Very out-of-the-money call. There's a serious chance that it will expire worthless (and you will forfeit your entire premium). But suppose there was a pricing distribution," call it PD, for S(T) such that any European- style derivative (with payoff based only on S(T)) can be priced via our attempted "expected return approach using the riskless rate to go from the derivative's expected payoff (at expiry) to its current price. In other words, in the pricing distribution" world, all expected returns equal the riskless return. PRICE TODAY = exp(-r(T-t)) EPD[Derivative Payoff) Derivative Payoff = function of S(T) and "PD means expectation under the PD density. Suppose that the pricing distribution makes S(T) into a lognormal random variable. 0.3 0.25 0.2 Probability density 0.15 0.1 0.05 0 - 10 12 14 16 Key fact about PD: We will show in class that EPD[S(T)] exp((r-g)(T-t)) S(t) where q is the dividend rate on the stock. The right-hand side is the forward price. [ Given PD we compute today's call and put prices (expiry T) as a function of the strike K. Denote these functions C(K) and P(K). Looking at the formula *** can you describe how P(K) decays as K decreases? And how C(K) decays as K increases? Which decay is faster? [g] Let's focus just on deep-out-of-the-money puts. Suppose you believed that at those very low strikes the only way a put pays off is if the company defaults, and you assume at if that happens the stock price will fall to $1. Can you show that in that very low strike region P(K) should look like a linear function of K? [PROBLEM 1] Suppose we model a stock's value six months from today, denoted S(T), as a random variable satisfying: S(T) = exp(z) where Z is a normally-distributed random variable. Denote the variance of Z, VAR[Z], by 02. s(t) denotes today's price (which we know). [a] Under the assumption that the expected return on the stock is believed to be 4% where must we set the mean of Z? (The answer will depend on 02.) Hint: Can you demonstrate that: E[S(TL= E[exp(Z)] = exp(E[Z] + 0.5 VAR[Z]) ? [b] Can you work our VAR[S(T)]? [c] Do you think it's true that for any random variable U (not necessarily normally- distributed) we have: E[exp(U)] = exp(E[U] + 0.5 VAR[U]) ? Hint: Let's try it with a random variable W having the exponential distribution. f(x; 2) is W's pdf: f(x; 1) = x>0 0 2 0 te-xx Can you work out E[exp(W)] and compare it to exp(E[W])? [d] Going back to our modeled stock price S(T): Consider the square derivative SQR: Its payoff at time T equals (S(T))2. Under the assumption that the expected returns of the stock and the square derivative are the same can you write an integral expression for today's price of SQR in terms of today's stock price S(t)? No need to work out the integral. [e] Suppose S(t) = $5. Without having worked out part [a], can you explain why we can assert that SQR(t) should be larger than $25 (as long as o is not zero)? We've convinced ourselves that we don't know the expected return on a derivative - even when we know the expected return on the underlying asset - because the asset and the derivative represent different levels of risk. Example: Very out-of-the-money call. There's a serious chance that it will expire worthless (and you will forfeit your entire premium). But suppose there was a pricing distribution," call it PD, for S(T) such that any European- style derivative (with payoff based only on S(T)) can be priced via our attempted "expected return approach using the riskless rate to go from the derivative's expected payoff (at expiry) to its current price. In other words, in the pricing distribution" world, all expected returns equal the riskless return. PRICE TODAY = exp(-r(T-t)) EPD[Derivative Payoff) Derivative Payoff = function of S(T) and "PD means expectation under the PD density. Suppose that the pricing distribution makes S(T) into a lognormal random variable. 0.3 0.25 0.2 Probability density 0.15 0.1 0.05 0 - 10 12 14 16 Key fact about PD: We will show in class that EPD[S(T)] exp((r-g)(T-t)) S(t) where q is the dividend rate on the stock. The right-hand side is the forward price. [ Given PD we compute today's call and put prices (expiry T) as a function of the strike K. Denote these functions C(K) and P(K). Looking at the formula *** can you describe how P(K) decays as K decreases? And how C(K) decays as K increases? Which decay is faster? [g] Let's focus just on deep-out-of-the-money puts. Suppose you believed that at those very low strikes the only way a put pays off is if the company defaults, and you assume at if that happens the stock price will fall to $1. Can you show that in that very low strike region P(K) should look like a linear function of K