Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tasty Foods bakes and sells 2,000 dozen muffins each week. Among the costs are bakers' wages, $24,000; production management salaries, $16,000; production equipment operating

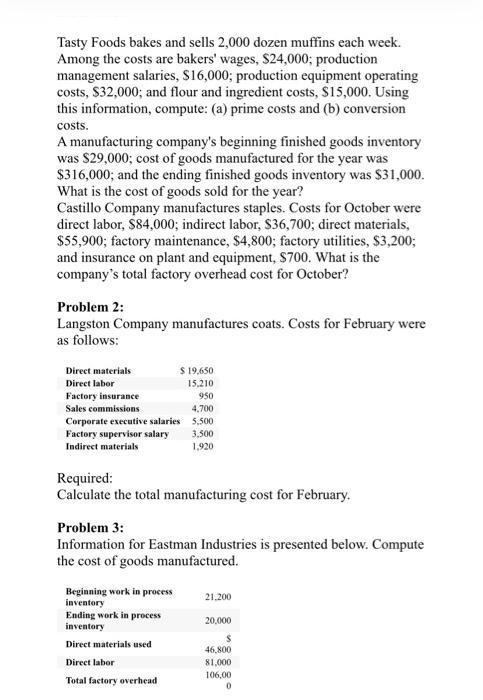

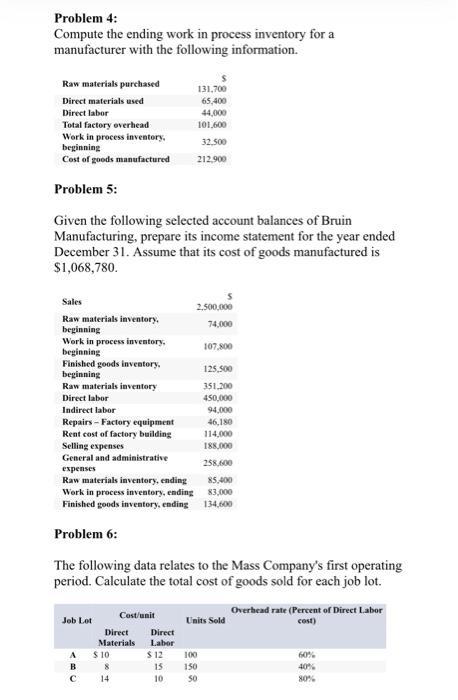

Tasty Foods bakes and sells 2,000 dozen muffins each week. Among the costs are bakers' wages, $24,000; production management salaries, $16,000; production equipment operating costs, $32,000; and flour and ingredient costs, $15,000. Using this information, compute: (a) prime costs and (b) conversion costs. A manufacturing company's beginning finished goods inventory was $29,000; cost of goods manufactured for the year was $316,000; and the ending finished goods inventory was $31,000. What is the cost of goods sold for the year? Castillo Company manufactures staples. Costs for October were direct labor, $84,000; indirect labor, $36,700; direct materials, $55,900; factory maintenance, $4,800; factory utilities, $3,200; and insurance on plant and equipment, $700. What is the company's total factory overhead cost for October? Problem 2: Langston Company manufactures coats. Costs for February were as follows: Direct materials Direct labor Factory insurance Sales commissions Corporate executive salaries Factory supervisor salary Indirect materials $ 19,650 15,210 950 4,700 5,500 3,500 1,920 Required: Calculate the total manufacturing cost for February. Problem 3: Information for Eastman Industries is presented below. Compute the cost of goods manufactured. Beginning work in process inventory Ending work in process inventory Direct materials used Direct labor Total factory overhead 21,200 20,000 $ 46,800 81,000 106,00 0 Problem 4: Compute the ending work in process inventory for a manufacturer with the following information. Raw materials purchased Direct materials used Direct labor Total factory overhead Work in process inventory. beginning Cost of goods manufactured Problem 5: Given the following selected account balances of Bruin Manufacturing, prepare its income statement for the year ended December 31. Assume that its cost of goods manufactured is $1,068,780. Sales Raw materials inventory. beginning Work in process inventory. beginning Finished goods inventory. beginning Raw materials inventory Direct labor Indirect labor Repairs - Factory equipment Rent cost of factory building Selling expenses General and administrative expenses Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending Problem 6: Job Lot A B The following data relates to the Mass Company's first operating period. Calculate the total cost of goods sold for each job lot. Direct Materials $ 10 8 Cost/unit 14 131,700 65,400 44,000 101,600 32,500 212,900 Direct Labor $ 12 15 10 2.500,000 74,000 107,800 125,500 351,200 450,000 94,000 46,180 114,000 188,000 258,600 85,400 83,000 134,600 100 150 50 Units Sold Overhead rate (Percent of Direct Labor cost) 60% 40% 80%

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 a Prime Costs Prime costs include all the direct costs involved in the production of goods In this case it includes bakers wages and flour and ingredient costs Prime Costs Bakers wages Flour ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started