PROBLEM #1

The aim of the exercise is to compare three existing mutual funds managed by Goldman Sachs or Morgan Stanley in the United States:

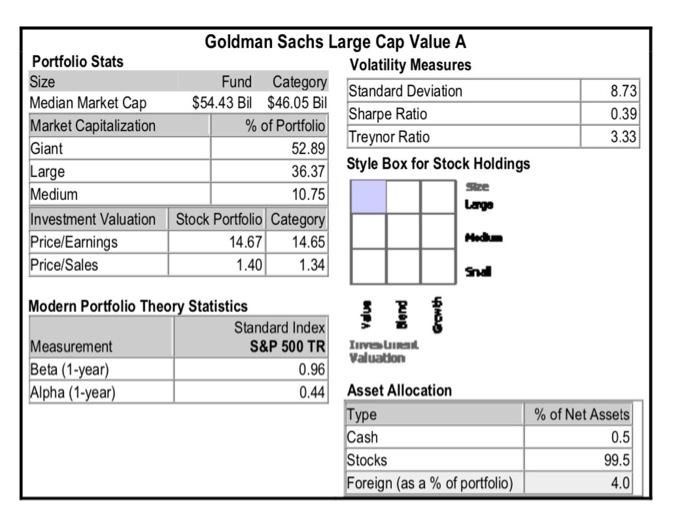

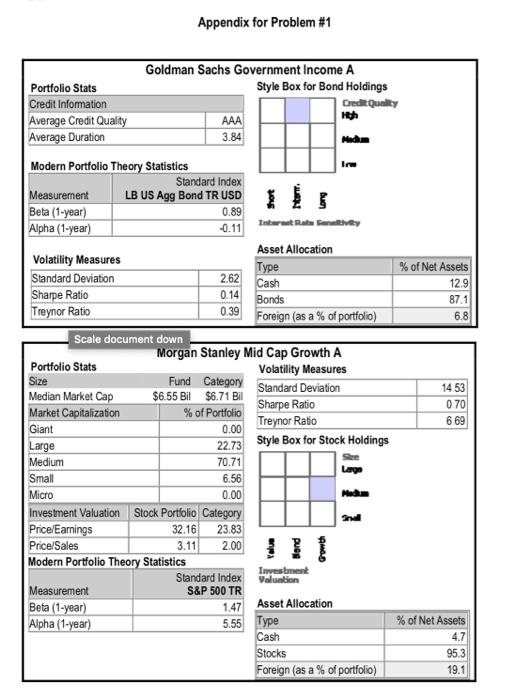

- Goldman Sachs Large Cap Value A,

- Goldman Sachs Government Income A,

- Morgan Stanley Mid Cap Growth A.

Browsing on the Internet, you found the characteristics for each of those four funds. Those characteristics, given in the appendix, are to be carefully read before you start answering any question.

1) Is it possible to compare the Beta and Alpha that are given for each of those three funds? What benchmark do you use to compare those funds? (3 points)

2) Give a ranking of the risk-adjusted return of the three portfolios, and justify your answer. Explain why you may prefer one indicator to another. (6 points)

3) What are the different risks you may face by buying a GS Government Income A? Can you hedge against those risks? (3 points)

4) Finally, you are given the yearly % returns on those three funds. Identify each fund number with its appropriate name. Explain and justify your answer. (10 points)

2000 2001 2002 2003 2004 2005 2006 2007

Fund n1 -22.7 -26.2 -28 40.6 21.6 18.2 10.1 22.2

Fund n2 10.2 -5.4 -12.3 25 19 5.8 18.4 3.5

Fund n3 12.1 7.4 9.5 3.1 3.7 2.1 3.8 6.9

S&P 500 -9.1 -11.9 -22.1 28.7 10.8 4.9 15.8 5.5

Size 8.73 0.39 3.33 Goldman Sachs Large Cap Value A Portfolio Stats Volatility Measures Fund Category Median Market Cap Standard Deviation $54.43 Bil $46.05 Bil Sharpe Ratio Market Capitalization % of Portfolio Treynor Ratio Giant 52.89 Large 36.37 Style Box for Stock Holdings Medium 10.75 Lange Investment Valuation Stock Portfolio Category Price/Earnings 14.67 14.65 Media Price/Sales 1.40 1.34 Snel Modern Portfolio Theory Statistics Standard Index Measurement S&P 500 TR LULU Valuation Beta (1-year) 0.96 Alpha (1-year) 0.44 Asset Allocation Type Cash Stocks Foreign (as a % of portfolio) % of Net Assets 0.5 99.5 4.0 Appendix for Problem #1 3.84 Goldman Sachs Government Income A Portfolio Stats Style Box for Bond Holdings Credit Information Credit Quality Average Credit Quality AAA Average Duration Modern Portfolio Theory Statistics Standard Index Measurement LB US Agg Bond TR USD Beta (1-year) 0.89 Alpha (1-year) -0.11 Asset Allocation Volatility Measures Type % of Net Assets Standard Deviation 2.62 Cash 12.9 Sharpe Ratio 0.14 Bonds 87.1 Treynor Ratio 0.39 Foreign (as a % of portfolio) 6.8 Scale document down Morgan Stanley Mid Cap Growth A Portfolio Stats Volatility Measures Size 14 53 Median Market Cap $6.55 Bil $6.71 Bil 070 Market Capitalization Sharpe Ratio % of Portfolio Giant 6 69 0.00 Treynor Ratio Large 22.73 Style Box for Stock Holdings Medium 70.71 Lage Small 6.56 Micro 0.00 Investment Valuation Stock Portfolio Category Price/Earnings 32.16 23.83 Price/Sales 3.11 2.00 Modern Portfolio Theory Statistics Investment Standard Index Valuation Measurement S&P 500 TR Beta (1-year) 1.47 Asset Allocation Alpha (1-year) 5.55 Type % of Net Assets Cash 4.7 Stocks 95.3 Foreign (as a % of portfolio) 19.1 Fund Category Standard Deviation Size 8.73 0.39 3.33 Goldman Sachs Large Cap Value A Portfolio Stats Volatility Measures Fund Category Median Market Cap Standard Deviation $54.43 Bil $46.05 Bil Sharpe Ratio Market Capitalization % of Portfolio Treynor Ratio Giant 52.89 Large 36.37 Style Box for Stock Holdings Medium 10.75 Lange Investment Valuation Stock Portfolio Category Price/Earnings 14.67 14.65 Media Price/Sales 1.40 1.34 Snel Modern Portfolio Theory Statistics Standard Index Measurement S&P 500 TR LULU Valuation Beta (1-year) 0.96 Alpha (1-year) 0.44 Asset Allocation Type Cash Stocks Foreign (as a % of portfolio) % of Net Assets 0.5 99.5 4.0 Appendix for Problem #1 3.84 Goldman Sachs Government Income A Portfolio Stats Style Box for Bond Holdings Credit Information Credit Quality Average Credit Quality AAA Average Duration Modern Portfolio Theory Statistics Standard Index Measurement LB US Agg Bond TR USD Beta (1-year) 0.89 Alpha (1-year) -0.11 Asset Allocation Volatility Measures Type % of Net Assets Standard Deviation 2.62 Cash 12.9 Sharpe Ratio 0.14 Bonds 87.1 Treynor Ratio 0.39 Foreign (as a % of portfolio) 6.8 Scale document down Morgan Stanley Mid Cap Growth A Portfolio Stats Volatility Measures Size 14 53 Median Market Cap $6.55 Bil $6.71 Bil 070 Market Capitalization Sharpe Ratio % of Portfolio Giant 6 69 0.00 Treynor Ratio Large 22.73 Style Box for Stock Holdings Medium 70.71 Lage Small 6.56 Micro 0.00 Investment Valuation Stock Portfolio Category Price/Earnings 32.16 23.83 Price/Sales 3.11 2.00 Modern Portfolio Theory Statistics Investment Standard Index Valuation Measurement S&P 500 TR Beta (1-year) 1.47 Asset Allocation Alpha (1-year) 5.55 Type % of Net Assets Cash 4.7 Stocks 95.3 Foreign (as a % of portfolio) 19.1 Fund Category Standard Deviation