Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 The following information are presented to you in connection with the determination of the fringe benefits tax of the general manager of

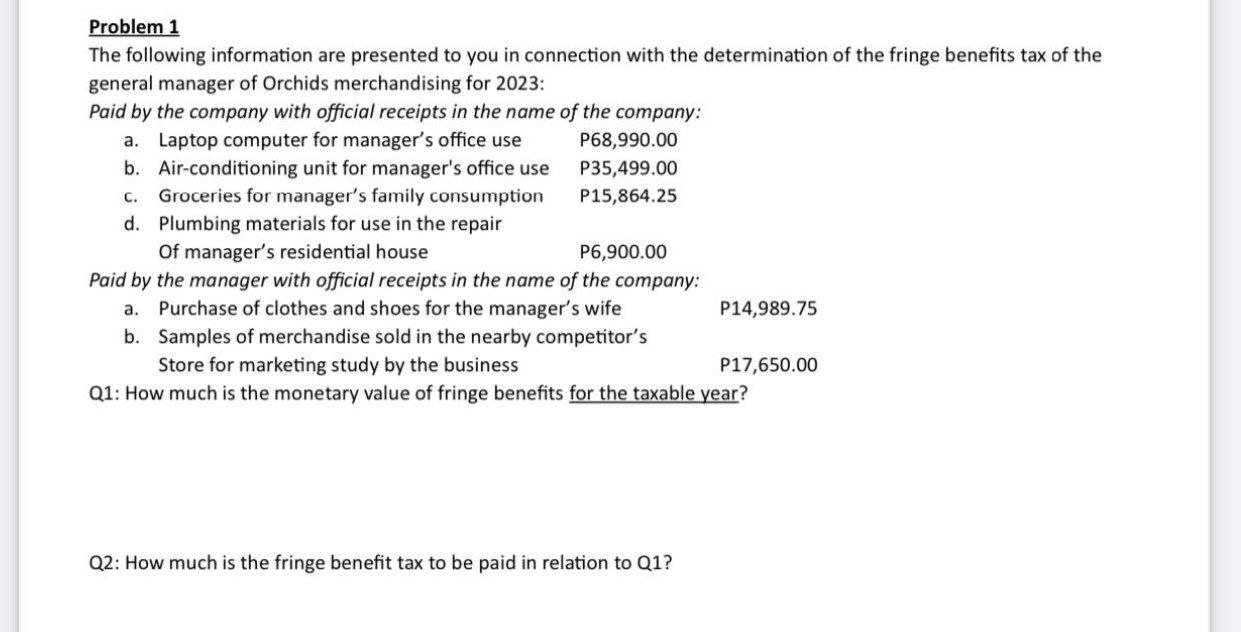

Problem 1 The following information are presented to you in connection with the determination of the fringe benefits tax of the general manager of Orchids merchandising for 2023: Paid by the company with official receipts in the name of the company: a. Laptop computer for manager's office use b. Air-conditioning unit for manager's office use Groceries for manager's family consumption C. d. Plumbing materials for use in the repair Of manager's residential house P68,990.00 P35,499.00 P15,864.25 P6,900.00 Paid by the manager with official receipts in the name of the company: Purchase of clothes and shoes for the manager's wife a. b. Samples of merchandise sold in the nearby competitor's Store for marketing study by the business Q1: How much is the monetary value of fringe benefits for the taxable year? P14,989.75 Q2: How much is the fringe benefit tax to be paid in relation to Q1? P17,650.00

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Fringe Benefit Tax FBT for Orchids Merchandising Manager 2023 Q1 Monetary Value of Fringe Benefits O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started