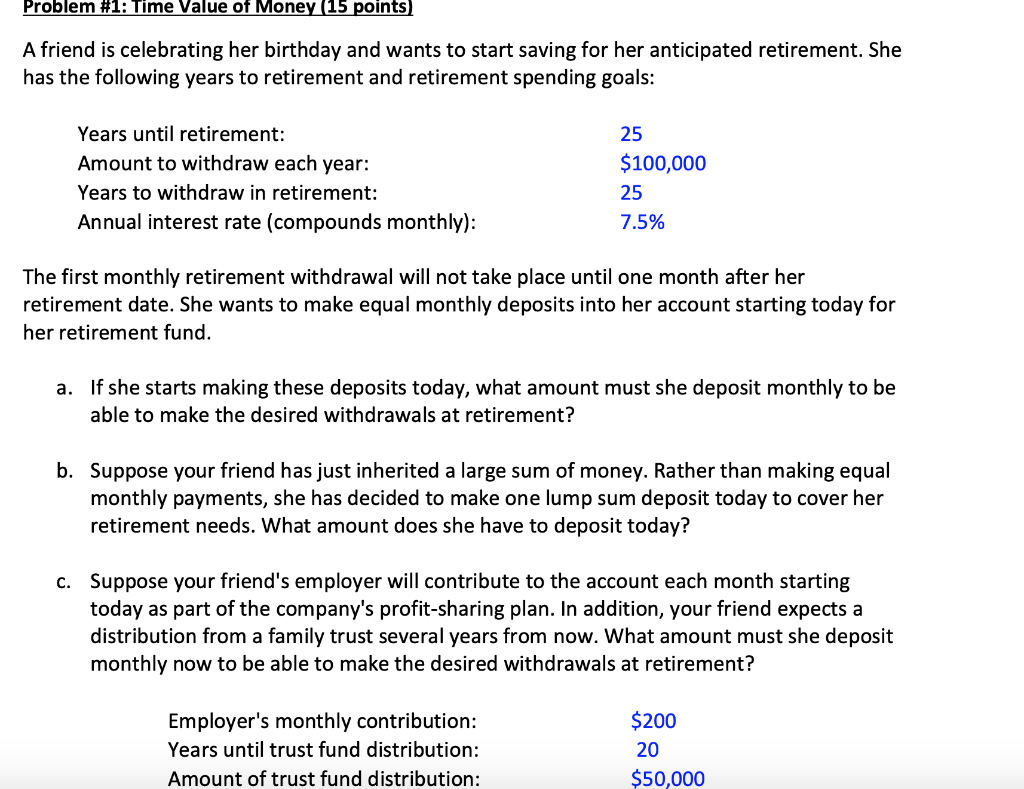

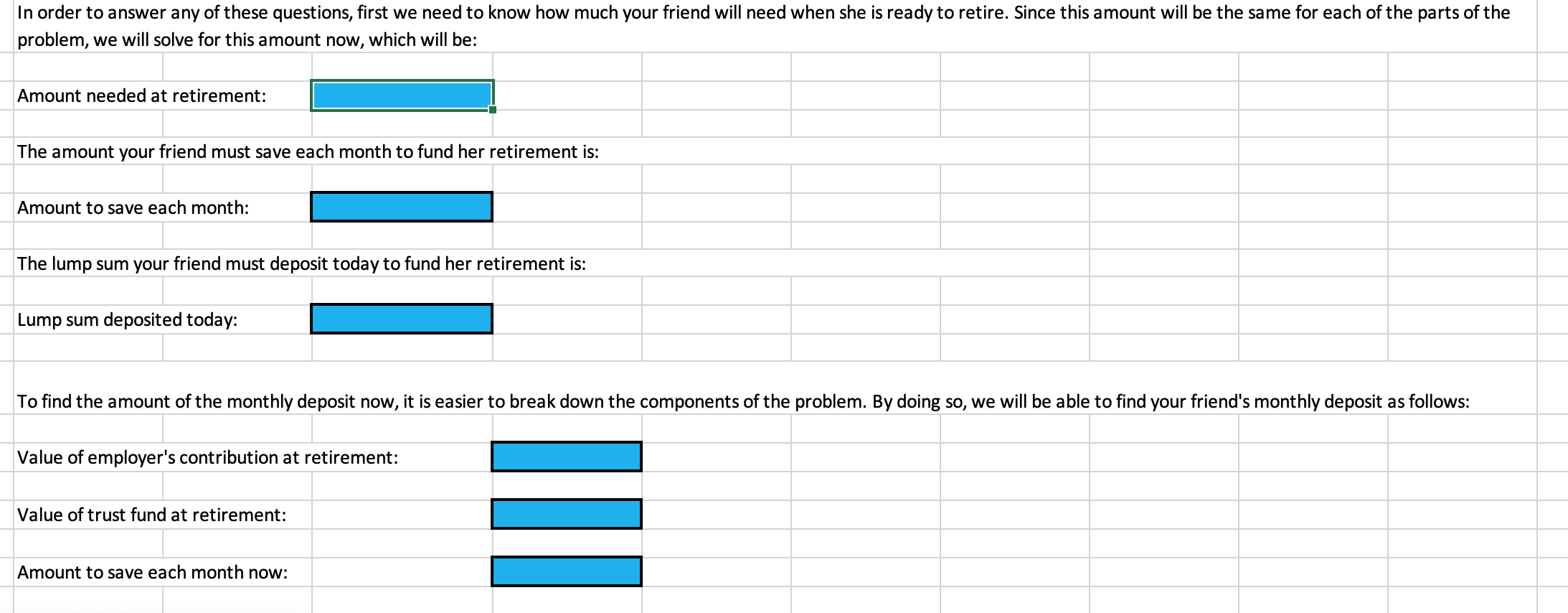

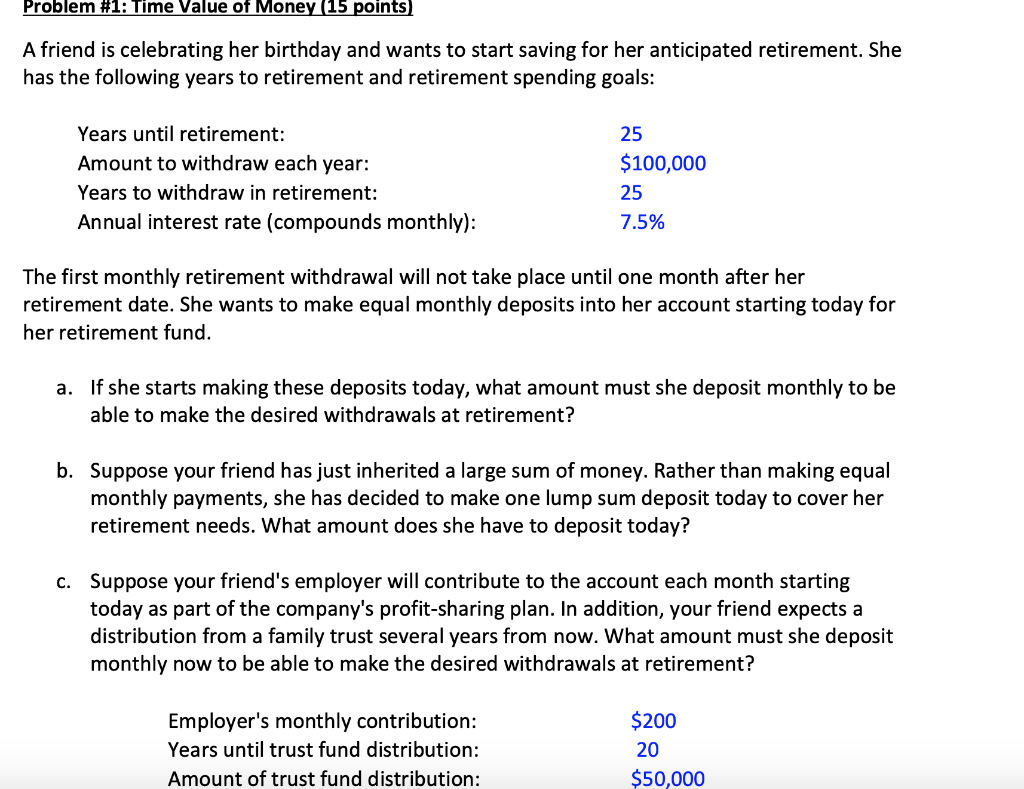

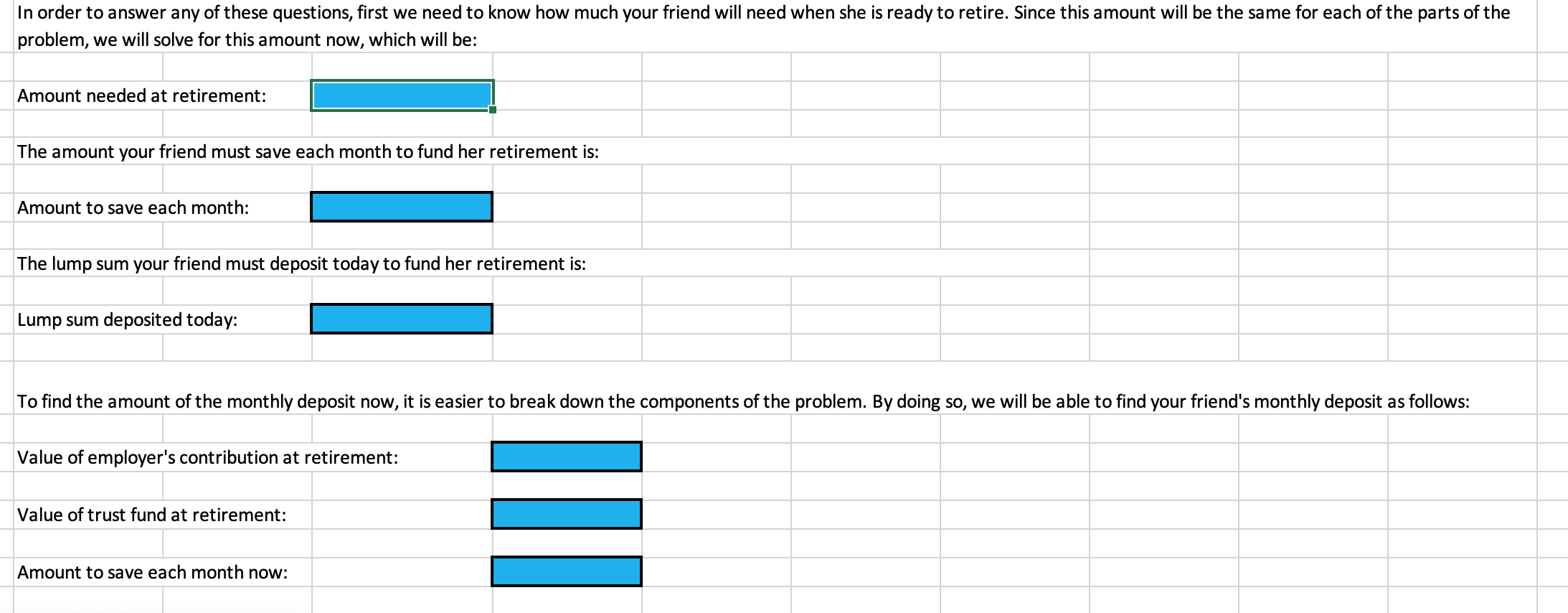

Problem #1: Time Value of Money (15 points) A friend is celebrating her birthday and wants to start saving for her anticipated retirement. She has the following years to retirement and retirement spending goals: Years until retirement: Amount to withdraw each year: Years to withdraw in retirement: Annual interest rate (compounds monthly): 25 $100,000 25 7.5% The first monthly retirement withdrawal will not take place until one month after her retirement date. She wants to make equal monthly deposits into her account starting today for her retirement fund. a. If she starts making these deposits today, what amount must she deposit monthly to be able to make the desired withdrawals at retirement? b. Suppose your friend has just inherited a large sum of money. Rather than making equal monthly payments, she has decided to make one lump sum deposit today to cover her retirement needs. What amount does she have to deposit today? C. Suppose your friend's employer will contribute to the account each month starting today as part of the company's profit-sharing plan. In addition, your friend expects a distribution from a family trust several years from now. What amount must she deposit monthly now to be able to make the desired withdrawals at retirement? Employer's monthly contribution: Years until trust fund distribution: Amount of trust fund distribution: $200 20 $50,000 In order to answer any of these questions, first we need to know how much your friend will need when she is ready to retire. Since this amount will be the same for each of the parts of the problem, we will solve for this amount now, which will be: Amount needed at retirement: The amount your friend must save each month to fund her retirement is: Amount to save each month: The lump sum your friend must deposit today to fund her retirement is: Lump sum deposited today: To find the amount of the monthly deposit now, it is easier to break down the components of the problem. By doing so, we will be able to find your friend's monthly deposit as follows: Value of employer's contribution at retirement: = Value of trust fund at retirement: Amount to save each month now