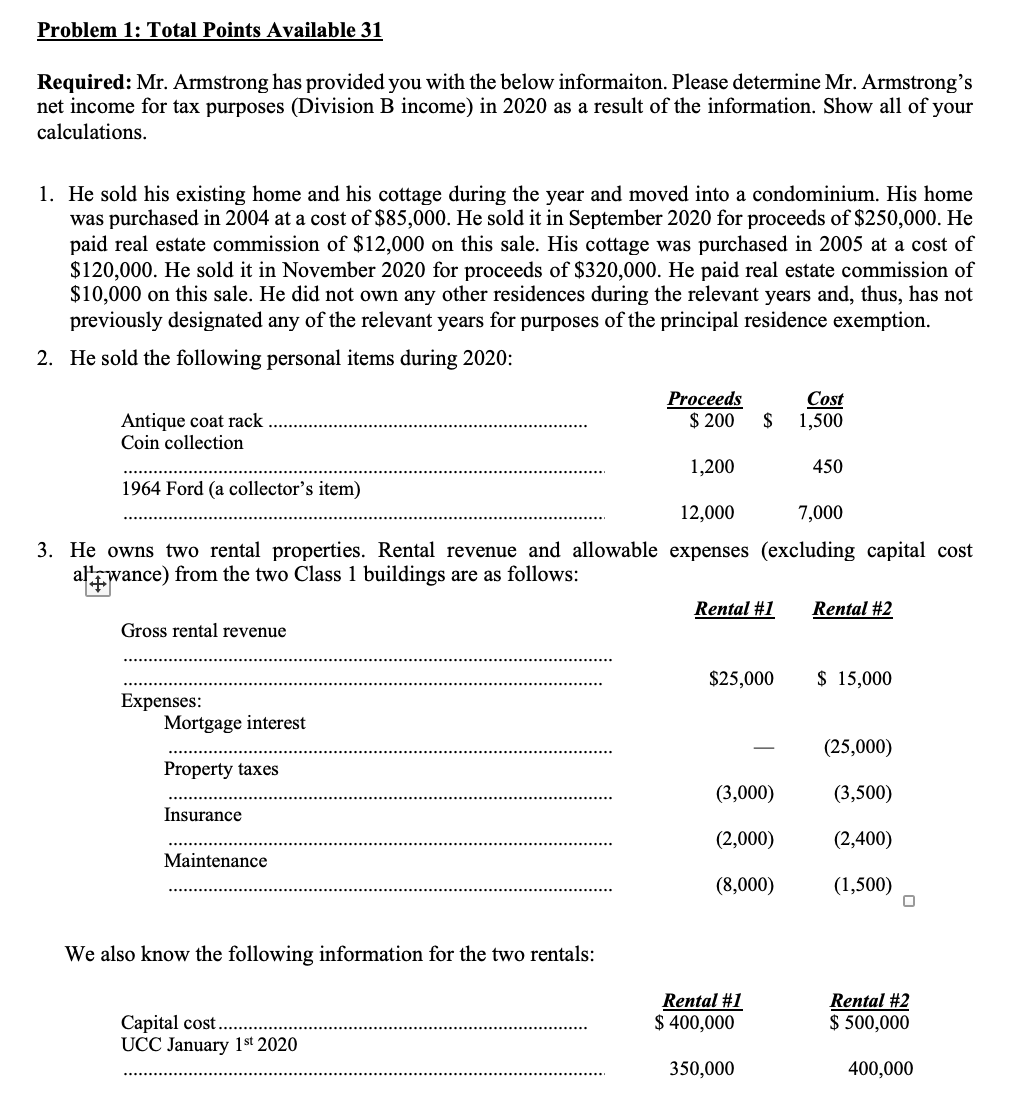

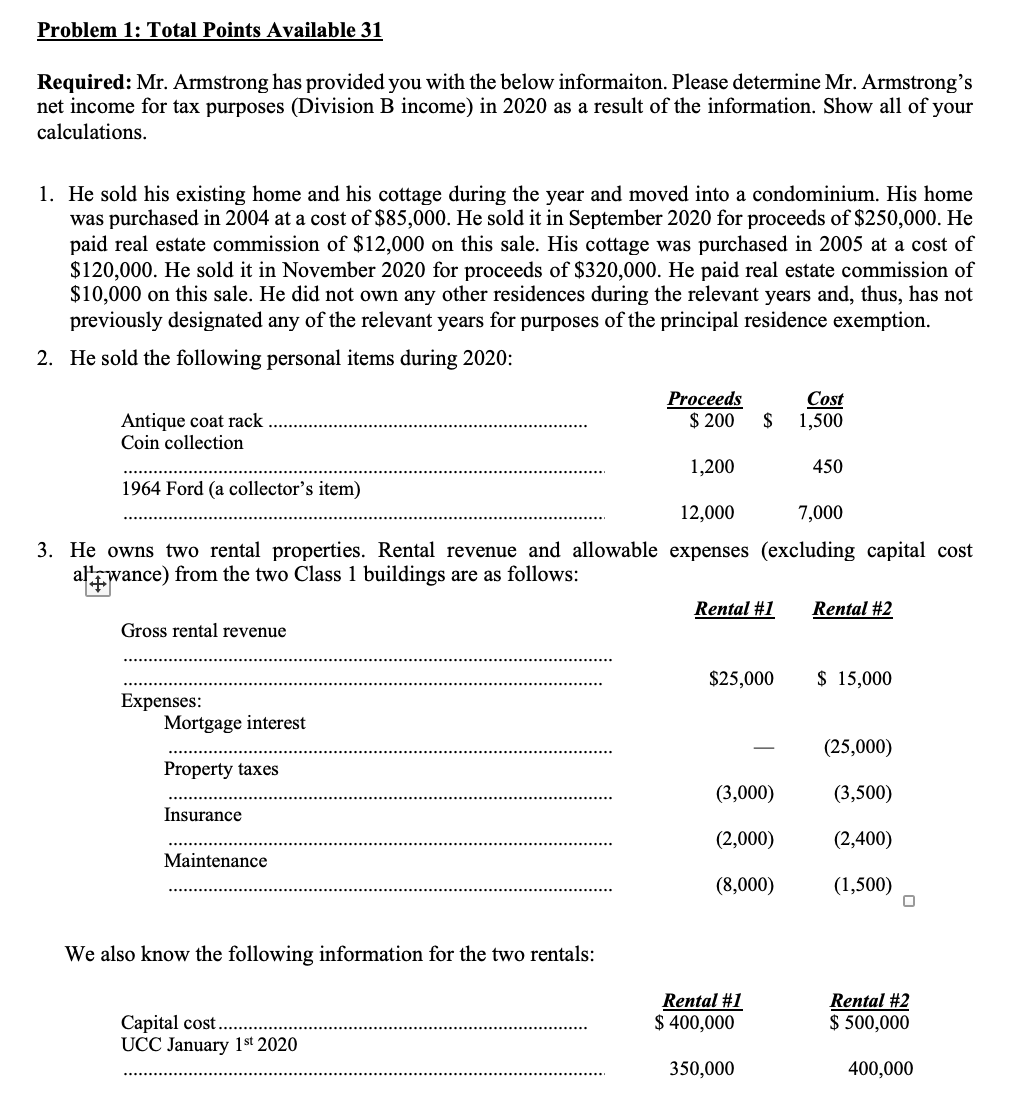

Problem 1: Total Points Available 31 Required: Mr. Armstrong has provided you with the below informaiton. Please determine Mr. Armstrong's net income for tax purposes (Division B income) in 2020 as a result of the information. Show all of your calculations. 1. He sold his existing home and his cottage during the year and moved into a condominium. His home was purchased in 2004 at a cost of $85,000. He sold it in September 2020 for proceeds of $250,000. He paid real estate commission of $12,000 on this sale. His cottage was purchased in 2005 at a cost of $120,000. He sold it in November 2020 for proceeds of $320,000. He paid real estate commission of $10,000 on this sale. He did not own any other residences during the relevant years and, thus, has not previously designated any of the relevant years for purposes of the principal residence exemption. 2. He sold the following personal items during 2020: Proceeds Cost Antique coat rack $ 200 $ 1,500 Coin collection 1,200 450 1964 Ford (a collector's item) 12,000 7,000 3. He owns two rental properties. Rental revenue and allowable expenses (excluding capital cost altwance) from the two Class 1 buildings are as follows: Rental #1 Rental #2 Gross rental revenue $25,000 $ 15,000 Expenses: Mortgage interest (25,000) Property taxes (3,000) (3,500) Insurance (2,000) (2,400) Maintenance (8,000) (1,500) We also know the following information for the two rentals: Rental #1 $ 400,000 Rental #2 $ 500,000 Capital cost. UCC January 1st 2020 350,000 400,000 4. On October 1st, 2018, He purchased a $ 50,000 GIC three-year GIC that pays 4% interest per compounded yearly. No interest is received until the maturity date of the GIC on September 30th, 2021. Problem 1: Total Points Available 31 Required: Mr. Armstrong has provided you with the below informaiton. Please determine Mr. Armstrong's net income for tax purposes (Division B income) in 2020 as a result of the information. Show all of your calculations. 1. He sold his existing home and his cottage during the year and moved into a condominium. His home was purchased in 2004 at a cost of $85,000. He sold it in September 2020 for proceeds of $250,000. He paid real estate commission of $12,000 on this sale. His cottage was purchased in 2005 at a cost of $120,000. He sold it in November 2020 for proceeds of $320,000. He paid real estate commission of $10,000 on this sale. He did not own any other residences during the relevant years and, thus, has not previously designated any of the relevant years for purposes of the principal residence exemption. 2. He sold the following personal items during 2020: Proceeds Cost Antique coat rack $ 200 $ 1,500 Coin collection 1,200 450 1964 Ford (a collector's item) 12,000 7,000 3. He owns two rental properties. Rental revenue and allowable expenses (excluding capital cost altwance) from the two Class 1 buildings are as follows: Rental #1 Rental #2 Gross rental revenue $25,000 $ 15,000 Expenses: Mortgage interest (25,000) Property taxes (3,000) (3,500) Insurance (2,000) (2,400) Maintenance (8,000) (1,500) We also know the following information for the two rentals: Rental #1 $ 400,000 Rental #2 $ 500,000 Capital cost. UCC January 1st 2020 350,000 400,000 4. On October 1st, 2018, He purchased a $ 50,000 GIC three-year GIC that pays 4% interest per compounded yearly. No interest is received until the maturity date of the GIC on September 30th, 2021