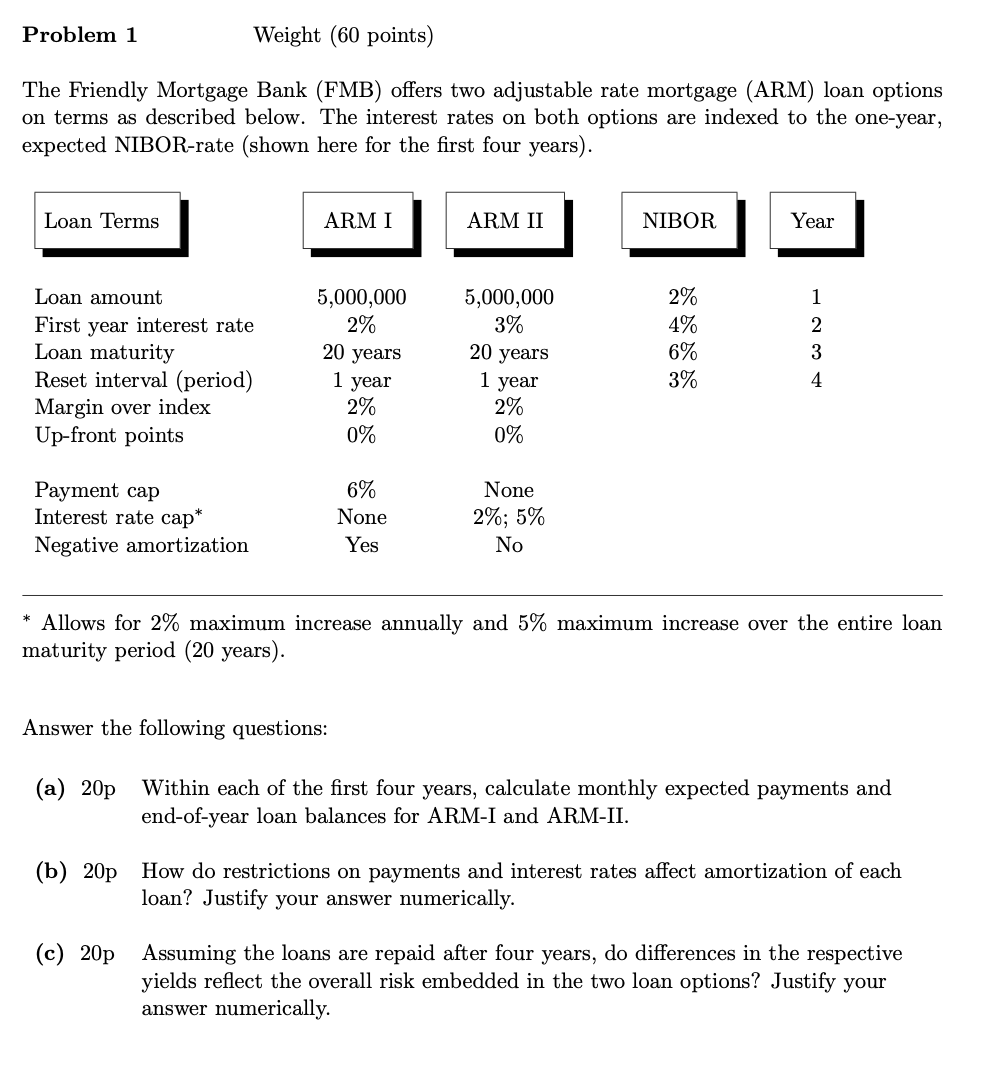

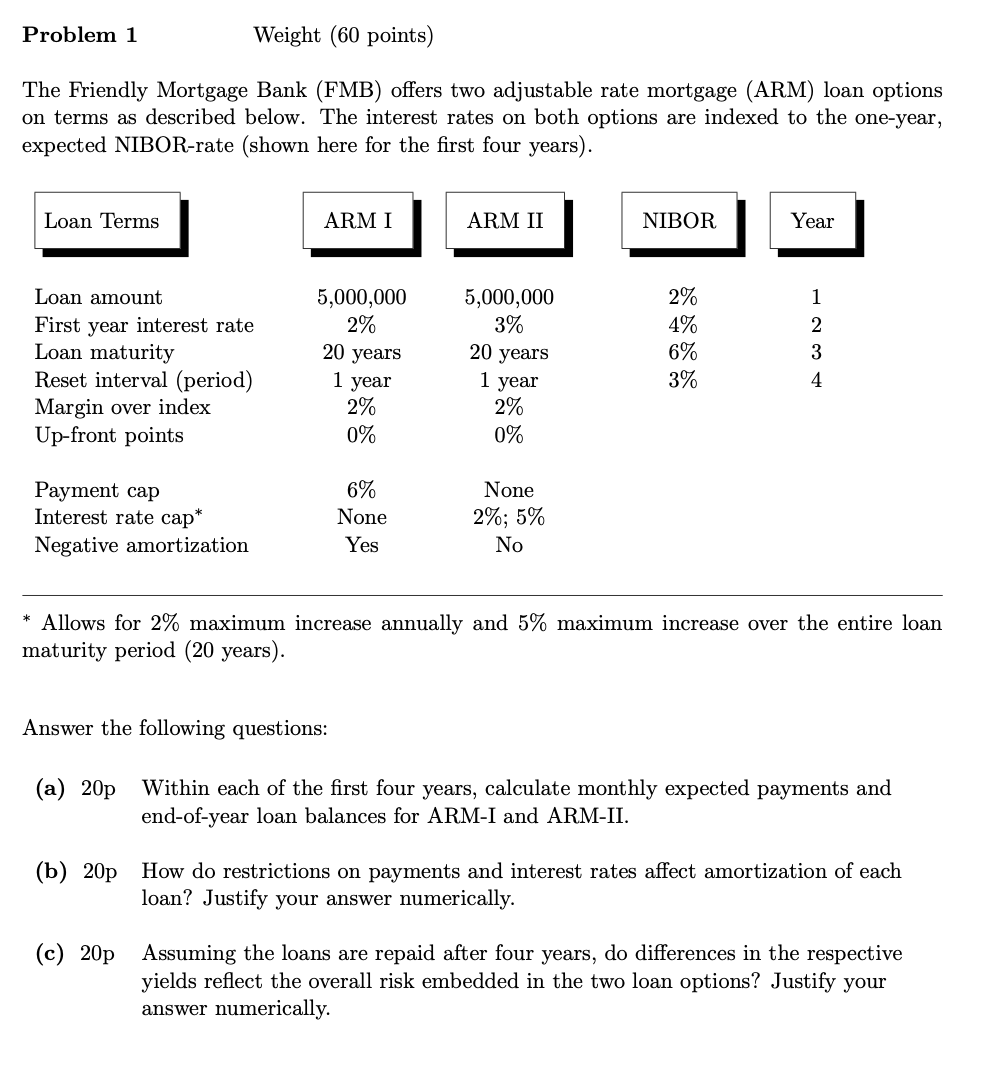

Problem 1 Weight (60 points) The Friendly Mortgage Bank (FMB) offers two adjustable rate mortgage (ARM) loan options on terms as described below. The interest rates on both options are indexed to the one-year, expected NIBOR-rate (shown here for the first four years). Loan Terms ARMI ARM II NIBOR Year 2% 1 5,000,000 2% 5,000,000 3% Loan amount First year interest rate Loan maturity Reset interval (period) Margin over index Up-front points 20 years 1 year 20 years 1 year 4% 6% 3% 2 3 4 2% 0% 2% 0% Payment cap Interest rate cap* Negative amortization 6% None Yes None 2%; 5% No * Allows for 2% maximum increase annually and 5% maximum increase over the entire loan maturity period (20 years). Answer the following questions: (a) 20p Within each of the first four years, calculate monthly expected payments and end-of-year loan balances for ARM-I and ARM-II. (b) 20p How do restrictions on payments and interest rates affect amortization of each loan? Justify your answer numerically. (c) 20p Assuming the loans are repaid after four years, do differences in the respective yields reflect the overall risk embedded in the two loan options? Justify your answer numerically. Problem 1 Weight (60 points) The Friendly Mortgage Bank (FMB) offers two adjustable rate mortgage (ARM) loan options on terms as described below. The interest rates on both options are indexed to the one-year, expected NIBOR-rate (shown here for the first four years). Loan Terms ARMI ARM II NIBOR Year 2% 1 5,000,000 2% 5,000,000 3% Loan amount First year interest rate Loan maturity Reset interval (period) Margin over index Up-front points 20 years 1 year 20 years 1 year 4% 6% 3% 2 3 4 2% 0% 2% 0% Payment cap Interest rate cap* Negative amortization 6% None Yes None 2%; 5% No * Allows for 2% maximum increase annually and 5% maximum increase over the entire loan maturity period (20 years). Answer the following questions: (a) 20p Within each of the first four years, calculate monthly expected payments and end-of-year loan balances for ARM-I and ARM-II. (b) 20p How do restrictions on payments and interest rates affect amortization of each loan? Justify your answer numerically. (c) 20p Assuming the loans are repaid after four years, do differences in the respective yields reflect the overall risk embedded in the two loan options? Justify your answer numerically