Question

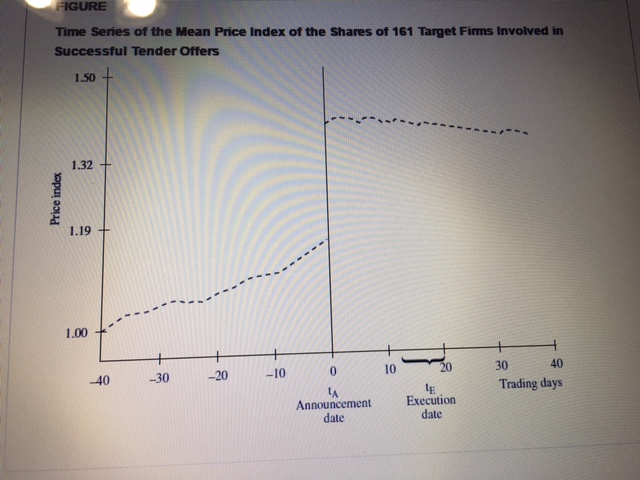

Problem #10 Suppose in Figure 5:3 on page 172, that the stock prices of target firms in acquisitions responded to acquisition announcements over a three

Problem #10

Problem #10

Suppose in Figure 5:3 on page 172, that the stock prices of target firms in acquisitions responded to acquisition announcements over a three day period rather than almost instantly.

a. Would you describe such an acquisition market as efficient? Why or why not?

b. Can you think of any trading strategy to take advantage of the delayed price response?

c. If you and many others pursued this trading strategy, what would happen to the price response to acquisition announcements?

d. Some argue that market inefficiencies contain the seeds of their own destruction. In what ways does your answer to this problem illustrate the logic of this statement, if at all?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started