Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem: 10 The management of a firm is considering an investment project costing USD 150,000 that will have a scrap value of USD 10,000 at

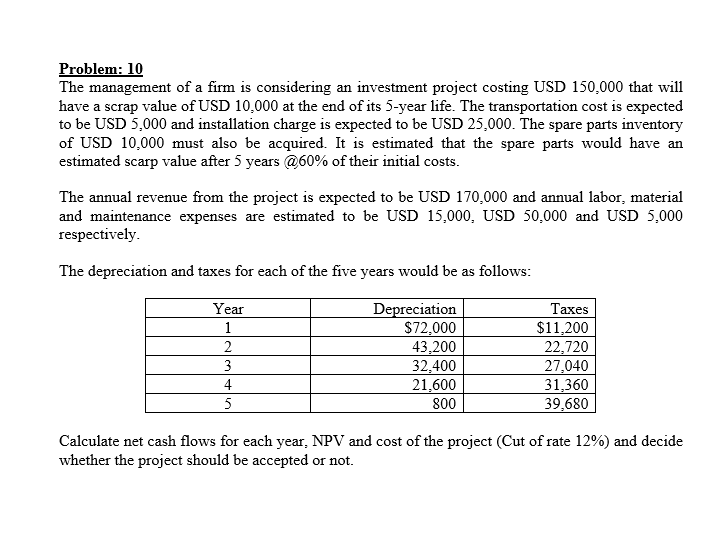

Problem: 10 The management of a firm is considering an investment project costing USD 150,000 that will have a scrap value of USD 10,000 at the end of its 5-year life. The transportation cost is expected to be USD 5,000 and installation charge is expected to be USD 25,000. The spare parts inventory of USD 10,000 must also be acquired. It is estimated that the spare parts would have an estimated scarp value after 5 years @60\% of their initial costs. The annual revenue from the project is expected to be USD 170,000 and annual labor, material and maintenance expenses are estimated to be USD 15,000, USD 50,000 and USD 5,000 respectively. The depreciation and taxes for each of the five years would be as follows: Calculate net cash flows for each year, NPV and cost of the project (Cut of rate 12\%) and decide whether the project should be accepted or not

Problem: 10 The management of a firm is considering an investment project costing USD 150,000 that will have a scrap value of USD 10,000 at the end of its 5-year life. The transportation cost is expected to be USD 5,000 and installation charge is expected to be USD 25,000. The spare parts inventory of USD 10,000 must also be acquired. It is estimated that the spare parts would have an estimated scarp value after 5 years @60\% of their initial costs. The annual revenue from the project is expected to be USD 170,000 and annual labor, material and maintenance expenses are estimated to be USD 15,000, USD 50,000 and USD 5,000 respectively. The depreciation and taxes for each of the five years would be as follows: Calculate net cash flows for each year, NPV and cost of the project (Cut of rate 12\%) and decide whether the project should be accepted or not Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started