Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 10-40 (Algorithmic) (LO. 6, 9) In December each year, Eleanor Young contributes 10% of her gross income to the United Way (a 50% organization).

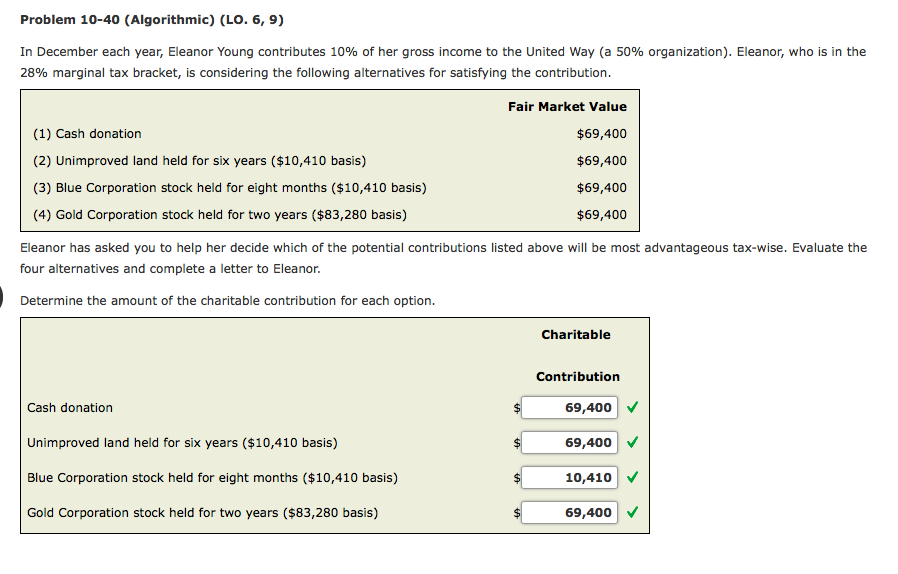

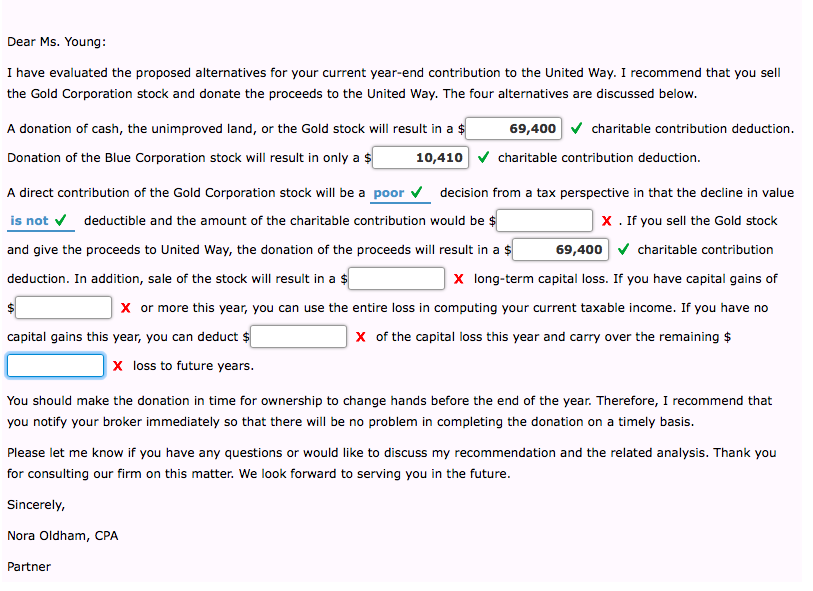

Problem 10-40 (Algorithmic) (LO. 6, 9) In December each year, Eleanor Young contributes 10% of her gross income to the United Way (a 50% organization). Eleanor, who is in the 28% marginal tax bracket, is considering the following alternatives for satisfying the contribution (1) Cash donation (2) Unimproved land held for six years ($10,410 basis) (3) Blue Corporation stock held for eight months ($10,410 basis) (4) Gold Corporation stock held for two years ($83,280 basis) Fair Market Value $69,400 $69,400 $69,400 $69,400 Eleanor has asked you to help her decide which of the potential contributions listed above will be most advantageous tax-wise. Evaluate the four alternatives and complete a letter to Eleanor Determine the amount of the charitable contribution for each option Charitable Contribution 69,400 V 69,400 V 10,410 V 69,400 V Cash donation Unimproved land held for six years ($10,410 basis) Blue Corporation stock held for eight months ($10,410 basis) Gold Corporation stock held for two years ($83,280 basis)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started