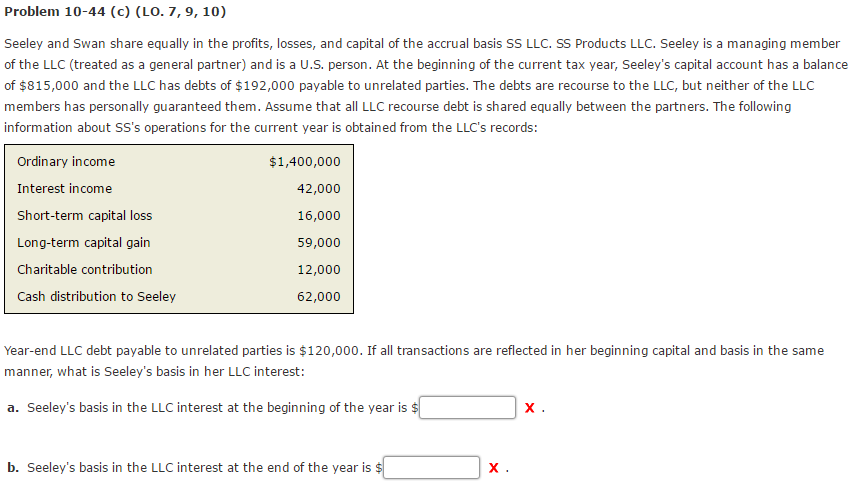

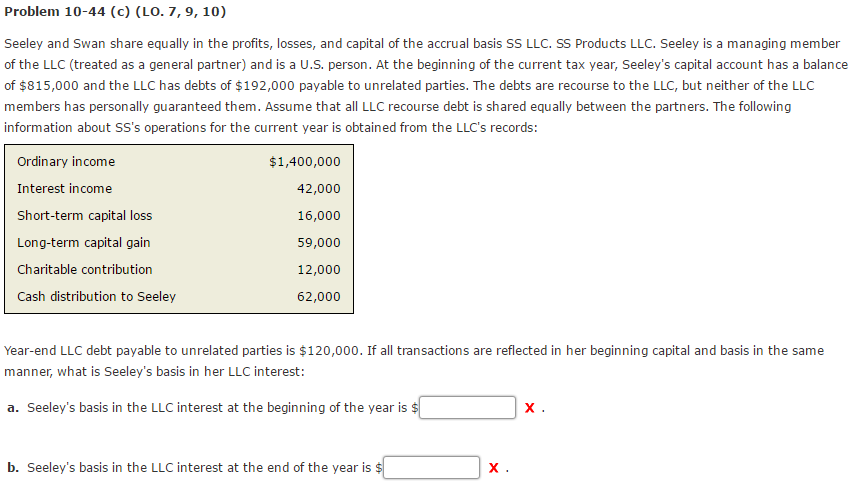

Problem 10-44 (c) (LO. 7, 9,10) Seeley and Swan share equally in the profits, losses, and capital of the accrual basis SS LLC. SS Products LLC. Seeley is a managing member of the LLC (treated as a general partner) and is a U.S. person. At the beginning of the current tax year, Seeley's capital account has a balance of $815,000 and the LLC has debts of $192,000 payable to unrelated parties. The debts are recourse to the LLC, but neither of the LLC members has personally guaranteed them. Assume that all LLC recourse debt is shared equally between the partners. The following information about SS's operations for the current year is obtained from the LLC's records: Ordinary income Interest income Short-term capital loss Long-term capital gain Charitable contribution Cash distribution to Seeley $1,400,000 42,000 16,000 59,000 12,000 62,000 Year-end LLC debt payable to unrelated parties is $120,000. If all transactions are reflected in her beginning capital and basis in the same manner, what is Seeley's basis in her LLC interest: a. Seeley's basis in the LLC interest at the beginning of the year is b. Seeley's basis in the LLC interest at the end of the year is $ Problem 10-44 (c) (LO. 7, 9,10) Seeley and Swan share equally in the profits, losses, and capital of the accrual basis SS LLC. SS Products LLC. Seeley is a managing member of the LLC (treated as a general partner) and is a U.S. person. At the beginning of the current tax year, Seeley's capital account has a balance of $815,000 and the LLC has debts of $192,000 payable to unrelated parties. The debts are recourse to the LLC, but neither of the LLC members has personally guaranteed them. Assume that all LLC recourse debt is shared equally between the partners. The following information about SS's operations for the current year is obtained from the LLC's records: Ordinary income Interest income Short-term capital loss Long-term capital gain Charitable contribution Cash distribution to Seeley $1,400,000 42,000 16,000 59,000 12,000 62,000 Year-end LLC debt payable to unrelated parties is $120,000. If all transactions are reflected in her beginning capital and basis in the same manner, what is Seeley's basis in her LLC interest: a. Seeley's basis in the LLC interest at the beginning of the year is b. Seeley's basis in the LLC interest at the end of the year is $