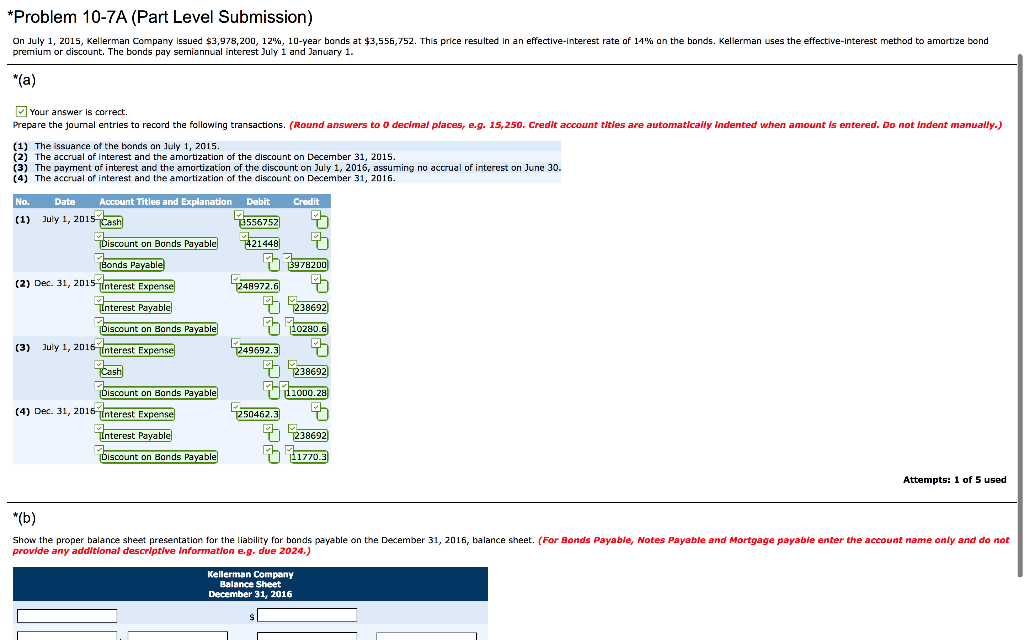

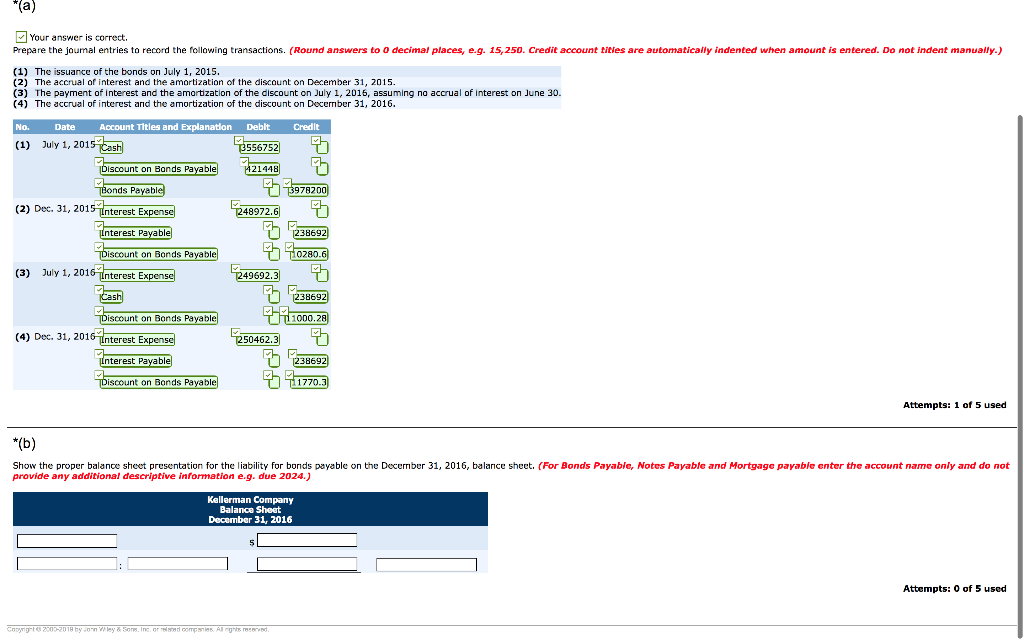

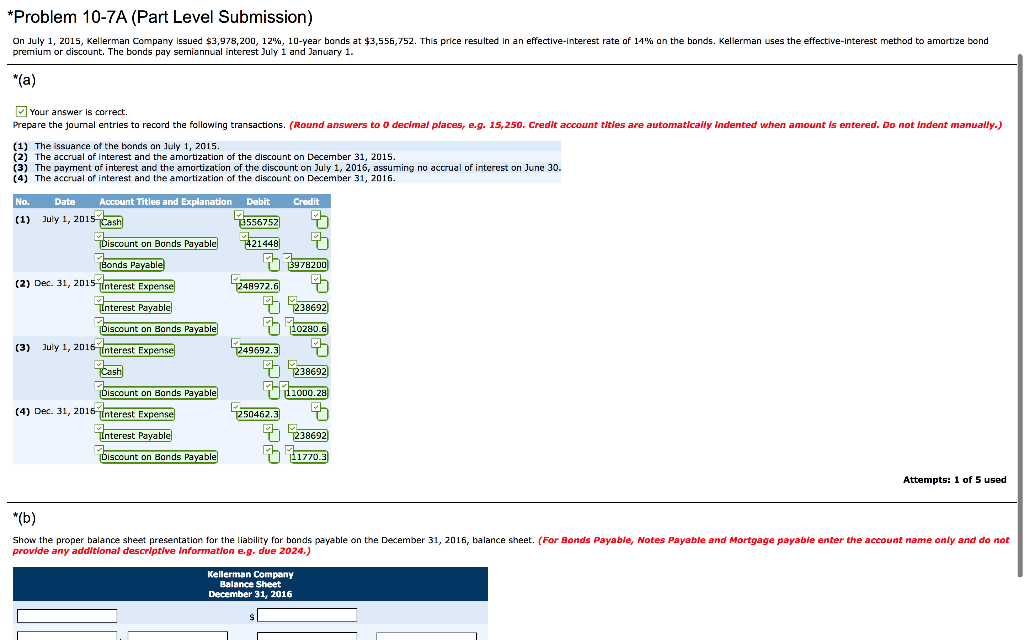

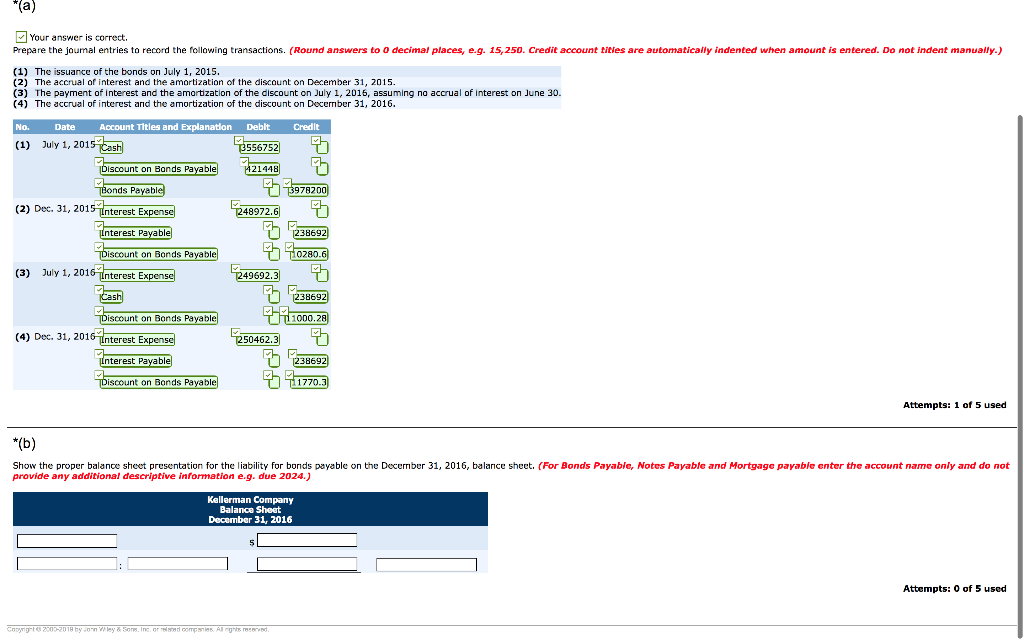

*Problem 10-7A (Part Level Submission) On July 1, 2015, Kellerman Company issued $3,978,200, 12%, 10-year bonds at3,556,752. This price resulted in an effective-interest rate of 14% on the bonds. Kellerman uses the effective-interest method to amortize bond premium or discount. The bonds pay semiannual interest July 1 and January 1. Your answer is correct. Prepare the joumal entries to record the followingtransactions. (Round answers to 0 declmal places, e.g. 15,250. Credit account titles are automatically Indented when amount Is entered. Do not Indent manually.) (1) The issuance of the bonds on luly 1, 2015. (2) The accrual of interest and the amortization of the discount on December 31, 2015. (3) The payment of interest and the amortization of the discount on July 1, 2016, assuming no accrual of interest on June 30. (4) The accrual of interest and the amortization of the discount on December 31, 2016. No. Date Account Titles and Explanation DebitCredit (1) July 1, 2015 iscount on Bonds Payable 21448 191 (2) Dec. 31,2015 interest Expense24972-6O 238692 10230.9 (a) uy 1, 201 nterest Erpencs2947 3b 238692) nds Payabl 9782D0 Interest Payable iscount on Bonds Paya ble 0280 49692 iscount on Bonds Paya ble 000.28 (4) Dec. 31, 2016-interest Expen ? 2504623 238692 Interest Payable iscount on Bonds Paya ble 1770 Attempts: 1 of 5 used Show the proper balance sheet presentation for the liability for bods payable on the December 31, 2016, balance sheet. (For Bonds Payable, Notes Payable and Mortgage payable enter the account name only and do not provide any additional descrlptive Information e.g. due 2024.) Kellerman Company Balance Sheet December 31, 2016 Your answer is correct. Prepare the jumal entries to record the following transactions. (Round answers to O decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually.) (1) The issuance of the bonds on July 1, 2015. (2) The accrual of interest and the amortization of the discount on December 31, 2015. (3) The payment of interest and the amortization of the discount on July 1, 2016, assuming no accrual of interest on June 30. (4) The accrual of interest and the amortization of the discount on December 31, 2016. No. Date Account Titles and Explanation Deblt Credit 556752 Discount on Bonds Payable 214 ay 1,2015 (1) July 1, 201 nds Payabl 978200 (2) Dec. 31, 201 nterest Expense 2409726b Interest Payable 238692 iscount on Bonds Payable (3) uly 1, 2016 Interest Expense 2496923 238692 iscount on Bonds Payable 2504623b (4) Dec. 31, 2016Interest Expense Interest Payable 238692 iscount on Bonds Payable 1770 Attempts: 1 of 5 used Show the proper balance sheet presentation for the liability for bonds payable on the December 31, 2016, balance sheet. (For Bonds Payable, Notes Payable and Mortgage payable cnter the account name only and do not provide any additional descriptive information e.g. due 2024.) Kellerman Company Balance Sheet December 31, 2016 Attempts: 0 of 5 used