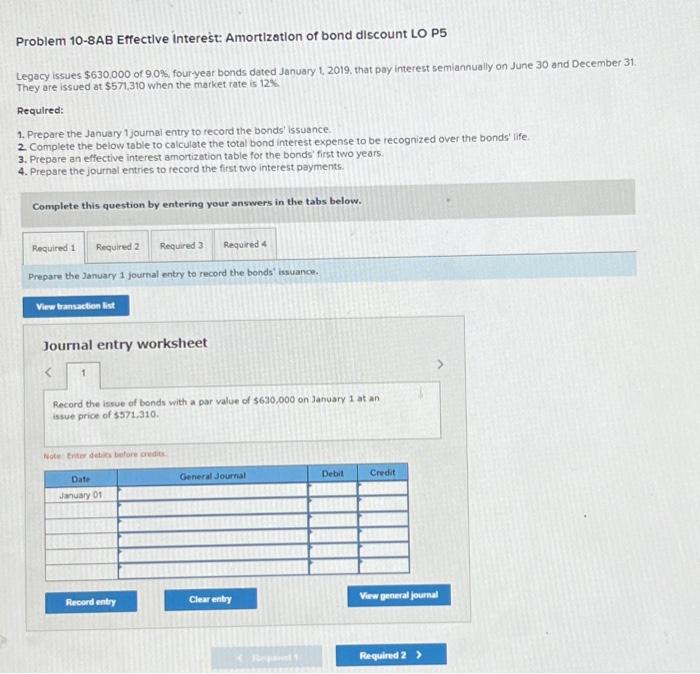

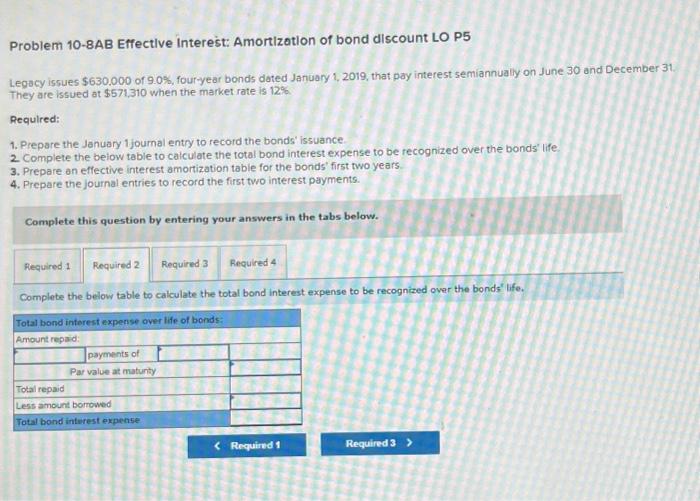

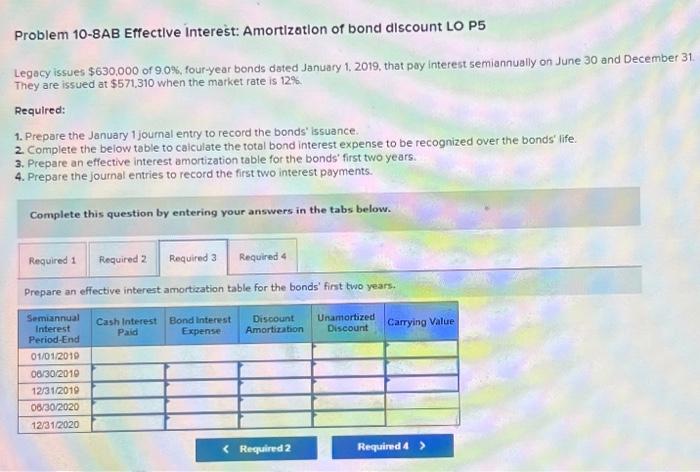

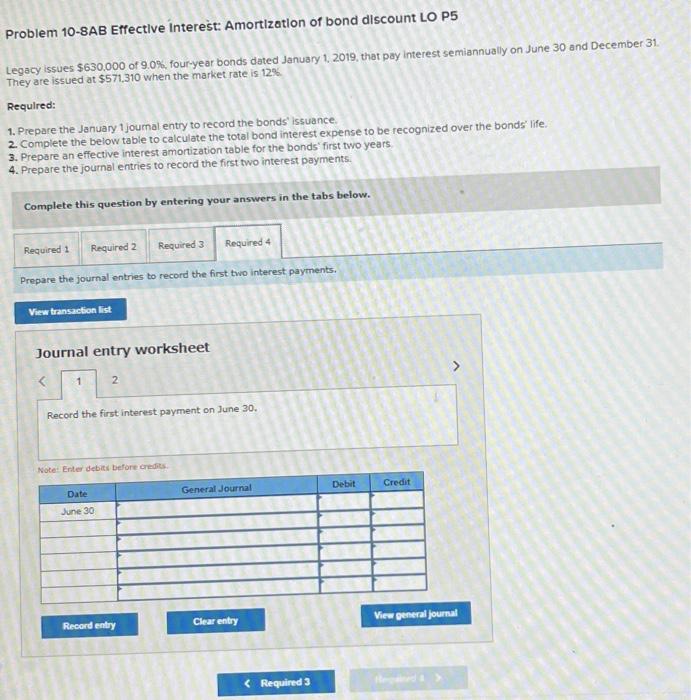

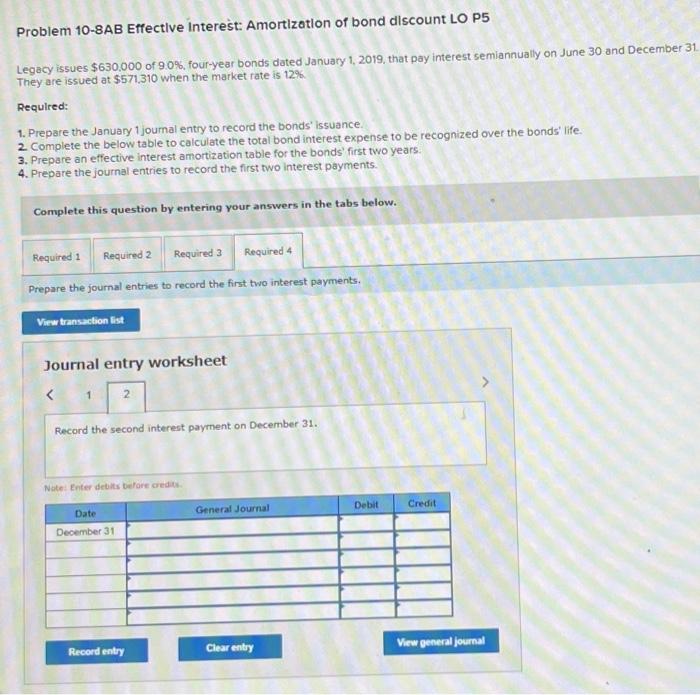

Problem 10-8AB Effectlve interest: Amortization of bond discount LO P5 Legacy issues $630,000 of 9.0% fouryear bonds dated January 1,2019 , that pay interest semiannually on June 30 and December 31 They are issued at $571,310 when the market rate is 12%. Requlred: 1. Prepare the January 1 joumai entry to record the bonds' issuance. 2. Complete the below table to calculate the total bond interest expense to be tecognized over the bonds' life. 3. Prepare an effective interest amortization table for the bonds' first two years. 4. Prepare the journal entries to record the first owo interest payments. Complete this question by entering your answers in the tabs below. Prepare the January 1 journal entry to record the bonds' issuance. Journal entry worksheet Record the issue of bonds with a par value of $630,000 on January 1 at an issue price of 5971.310. Problem 10-8AB Effectlve interest: Amortization of bond discount LO P5 Legacy issues $630.000 of 9.0%, four-year bonds dated January 1, 2019, that pay interest semiannualy on June 30 and December 31 . They are issued at $571,310 when the market rate is 12%. Requlred: 1. Prepare the January 1 joumal entry to record the bonds' issuance. 2 Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life: 3. Prepare an effective interest amortization table for the bonds' first two years. 4. Prepare the journal entries to record the first two interest payments. Complete this question by entering your answers in the tabs below. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life. Problem 10-8AB Effectlve Interest: Amortization of bond discount LO P5 Legacy issues $630,000 of 9.0%, four-year bonds dated January 1,2019 , that pay interest semiannually on June 30 and December 31 They are issued at $571,310 when the market rate is 12%. Required: 1. Prepare the January 1 joumal entry to record the bonds' issuance. 2. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life. 3. Prepare an effective interest amortization table for the bonds' first two years. 4. Prepare the journal entries to record the first two interest payments. Complete this question by entering your answers in the tabs below. Prepare an effective interest amortization table for the bonds' first two years. Problem 10-8AB Effectlve Interest: Amortization of bond discount LO P5 Legacy issues $630.000 of 9.0%, fouryyear bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31 They are issued at $571,310 when the market rate is 12%. Requlred: 1. Prepare the January 1 joumal entry to record the bonds' issuance. 2. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life. 3. Prepare an effective interest amortization table for the bonds' first two years 4. Prepare the journal entries to record the first two interest payments. Complete this question by entering your answers in the tabs below. Prepare the journal entries to record the first two interest payments. Journal entry worksheet Record the first interest payment on June 30. Note: Erter debiti before cradies. Problem 10-8AB Effectlve Interest: Amortization of bond discount LO P5 Legacy issues $630.000 of 9.0%, four-year bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31 They are issued at $571,310 when the market rate is 12% Requlred: 1. Prepare the January 1 joumal entry to record the bonds' issuance. 2. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life. 3. Prepare an effective interest amortization table for the bonds' first two years. 4. Prepare the journal entries to record the first two interest payments. Complete this question by entering your answers in the tabs below. Prepare the journal entries to record the first two interest payments. Journal entry worksheet Record the second interest payment on December 31. Nate: Eniter Aebits befare oredit