Question

Problem 10-9 (Static) Interest capitalization; specific interest method [LO10-7] On January 1, 2021, the Mason Manufacturing Company began construction of a building to be used

Problem 10-9 (Static) Interest capitalization; specific interest method [LO10-7]

On January 1, 2021, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2022. Expenditures on the project were as follows:

| January 1, 2021 | $ | 1,000,000 | |

| March 1, 2021 | 600,000 | ||

| June 30, 2021 | 800,000 | ||

| October 1, 2021 | 600,000 | ||

| January 31, 2022 | 270,000 | ||

| April 30, 2022 | 585,000 | ||

| August 31, 2022 | 900,000 | ||

On January 1, 2021, the company obtained a $3 million construction loan with a 10% interest rate. The loan was outstanding all of 2021 and 2022. The companys other interest-bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2021 and 2022. Interest is paid annually on all debt. The companys fiscal year-end is December 31.

Required:

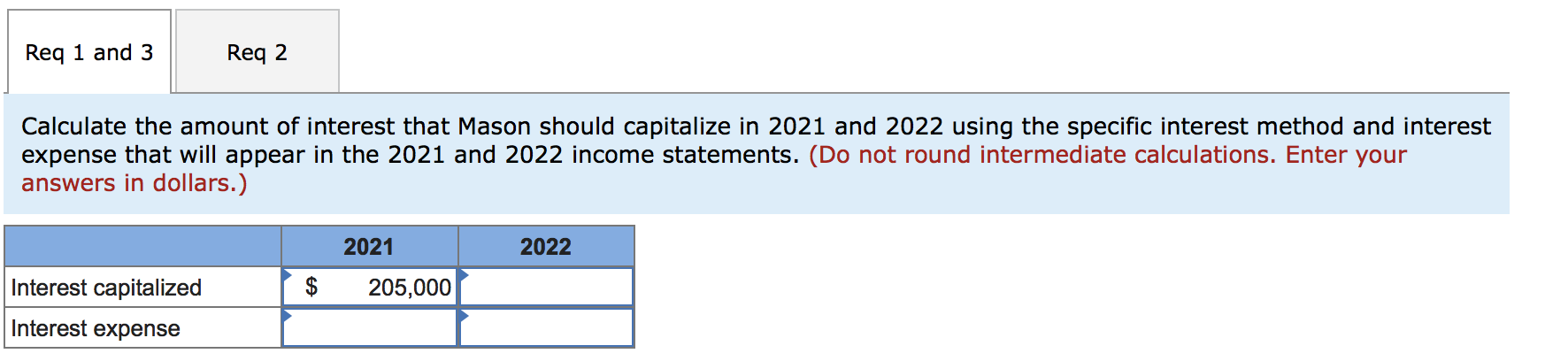

- Calculate the amount of interest that Mason should capitalize in 2021 and 2022 using the specific interest method.

- What is the total cost of the building?

- Calculate the amount of interest expense that will appear in the 2021 and 2022 income statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started