Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 11. At time t=0, you invests 2000 in a fund earning 8% convertible quarterly, but payable annually. He reinvests each interest payment in individual

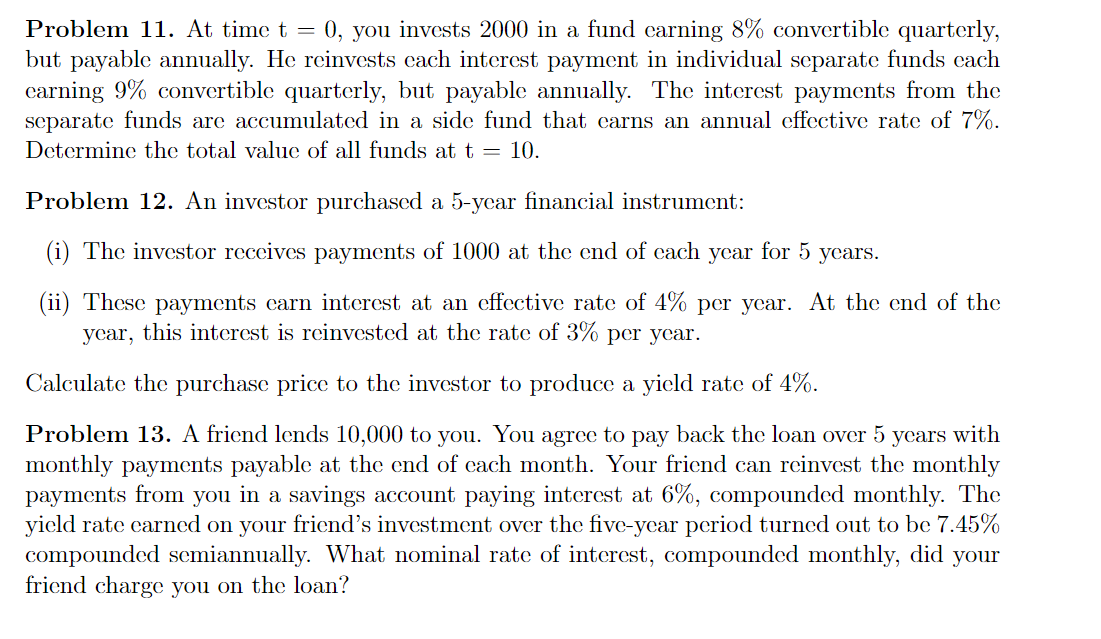

Problem 11. At time t=0, you invests 2000 in a fund earning 8% convertible quarterly, but payable annually. He reinvests each interest payment in individual separate funds each earning 9% convertible quarterly, but payable annually. The interest payments from the separate funds are accumulated in a side fund that earns an annual effective rate of 7%. Determine the total value of all funds at t=10. Problem 12. An investor purchased a 5-year financial instrument: (i) The investor receives payments of 1000 at the end of each year for 5 years. (ii) These payments earn interest at an effective rate of 4% per year. At the end of the year, this interest is reinvested at the rate of 3% per year. Calculate the purchase price to the investor to produce a yield rate of 4%. Problem 13. A friend lends 10,000 to you. You agree to pay back the loan over 5 years with monthly payments payable at the end of each month. Your friend can reinvest the monthly payments from you in a savings account paying interest at 6%, compounded monthly. The yield rate earned on your friend's investment over the five-year period turned out to be 7.45% compounded semiannually. What nominal rate of interest, compounded monthly, did your friend charge you on the loan

Problem 11. At time t=0, you invests 2000 in a fund earning 8% convertible quarterly, but payable annually. He reinvests each interest payment in individual separate funds each earning 9% convertible quarterly, but payable annually. The interest payments from the separate funds are accumulated in a side fund that earns an annual effective rate of 7%. Determine the total value of all funds at t=10. Problem 12. An investor purchased a 5-year financial instrument: (i) The investor receives payments of 1000 at the end of each year for 5 years. (ii) These payments earn interest at an effective rate of 4% per year. At the end of the year, this interest is reinvested at the rate of 3% per year. Calculate the purchase price to the investor to produce a yield rate of 4%. Problem 13. A friend lends 10,000 to you. You agree to pay back the loan over 5 years with monthly payments payable at the end of each month. Your friend can reinvest the monthly payments from you in a savings account paying interest at 6%, compounded monthly. The yield rate earned on your friend's investment over the five-year period turned out to be 7.45% compounded semiannually. What nominal rate of interest, compounded monthly, did your friend charge you on the loan Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started