Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 11-23A Problem 11-23A 1. Assuming that the car wash will be open 52 weeks a year, compute the expected annual net cash receipts from

Problem 11-23A

Problem 11-23A

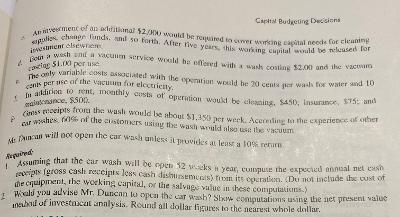

1. Assuming that the car wash will be open 52 weeks a year, compute the expected annual net cash receipts from its operation.

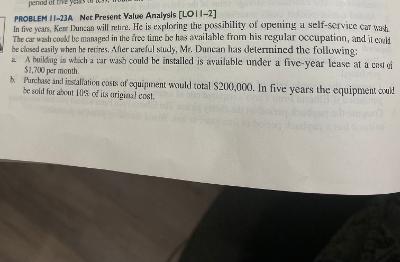

pened of the PROBLEM II 23 Net Present Value Analysis [LO11-2] In five years, Kon Iman will nehe. He is exploring the possibility of opening a self-service car wash The car waar could be managed in the free time be has available from his regular occupation, and it could be closed easily when he retires. Afler careful study, Mr. Duncan has determined the following: A building a which a car wash could be installed is available under a five-year lease at a costi $1,700 per month Purchase and installatice costs of equipment would total S200,000. In five years the equipment ovell be sold for about los dits Griginal cost Cap Budgeting Decision Avement of an churanal 5200 would be done and force polos chung und so forth. After the youth wing cald be lessed for necontent Don Vice wild ha noved with wh contine 32.and the vacuum 51.00 per The only variable costsciated with the nation would he was for water and 10 pero the actor electricity. Marcice cent, monthly costs of operation would be cleaning, $450, Insurance $15, and cors receipts for the wale would be show $1,250 per week. Acestia na the experience of other de SSO car wishes of the citons using the said Awiloot open the car wash alessi des at least a 10% Assuming that the car wash will be open 12 year, consult the expectul antal meter cripts (gross cash recints les cash dishes from its operation. Du not include the cost of de cquipment, the working capital, or the salvage value in these computations) Wald you advise Mr Duncan to open the car wash? Slx computations using the net present value be of investical analysis. Round all dollar figures to the nearest whole della pened of the PROBLEM II 23 Net Present Value Analysis [LO11-2] In five years, Kon Iman will nehe. He is exploring the possibility of opening a self-service car wash The car waar could be managed in the free time be has available from his regular occupation, and it could be closed easily when he retires. Afler careful study, Mr. Duncan has determined the following: A building a which a car wash could be installed is available under a five-year lease at a costi $1,700 per month Purchase and installatice costs of equipment would total S200,000. In five years the equipment ovell be sold for about los dits Griginal cost Cap Budgeting Decision Avement of an churanal 5200 would be done and force polos chung und so forth. After the youth wing cald be lessed for necontent Don Vice wild ha noved with wh contine 32.and the vacuum 51.00 per The only variable costsciated with the nation would he was for water and 10 pero the actor electricity. Marcice cent, monthly costs of operation would be cleaning, $450, Insurance $15, and cors receipts for the wale would be show $1,250 per week. Acestia na the experience of other de SSO car wishes of the citons using the said Awiloot open the car wash alessi des at least a 10% Assuming that the car wash will be open 12 year, consult the expectul antal meter cripts (gross cash recints les cash dishes from its operation. Du not include the cost of de cquipment, the working capital, or the salvage value in these computations) Wald you advise Mr Duncan to open the car wash? Slx computations using the net present value be of investical analysis. Round all dollar figures to the nearest whole dellaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started