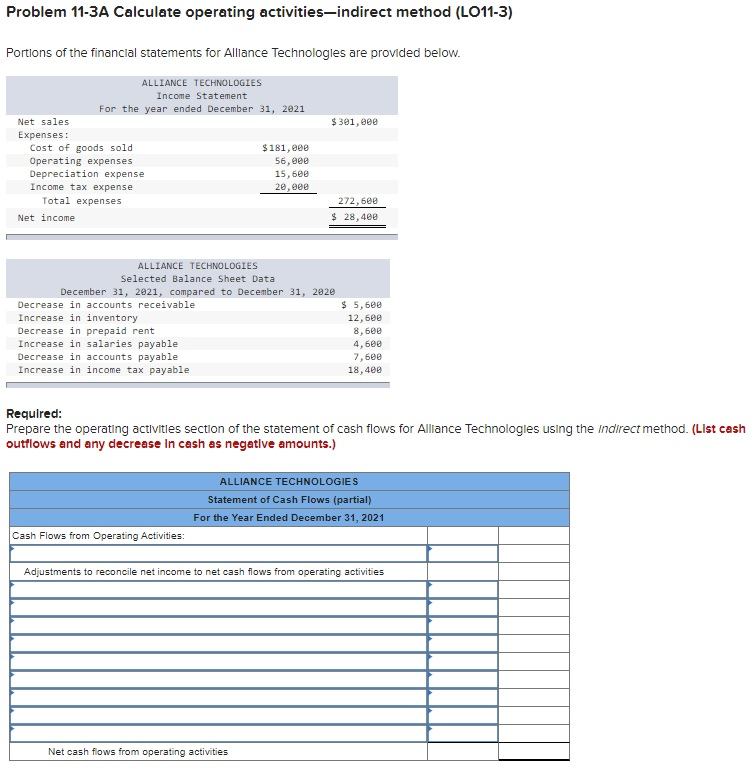

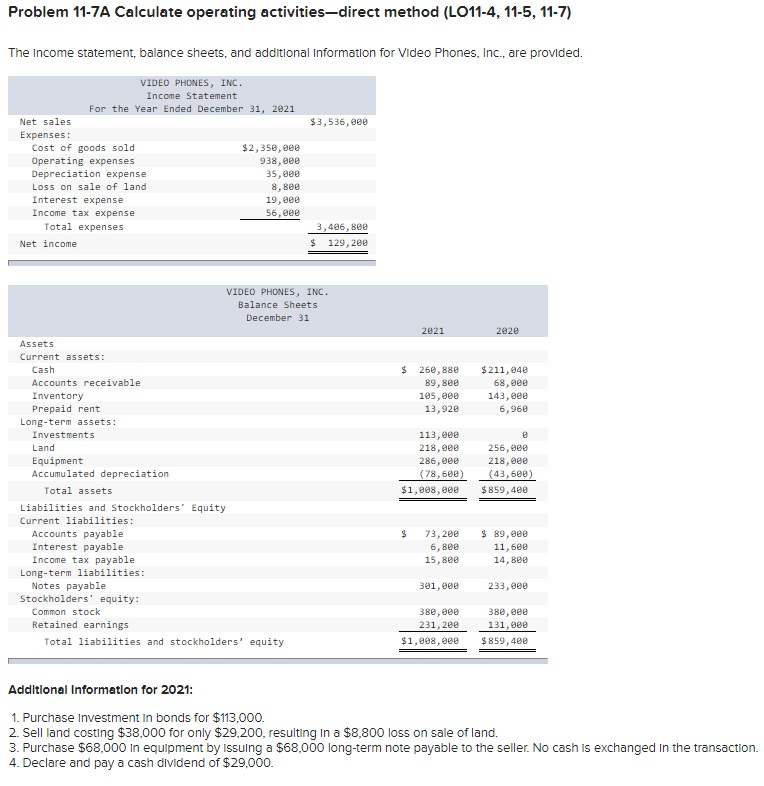

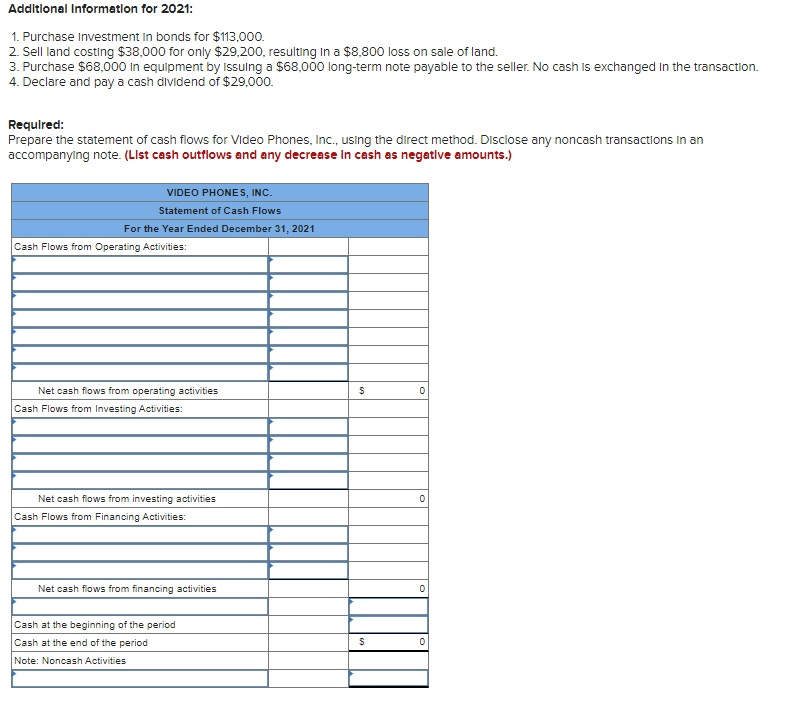

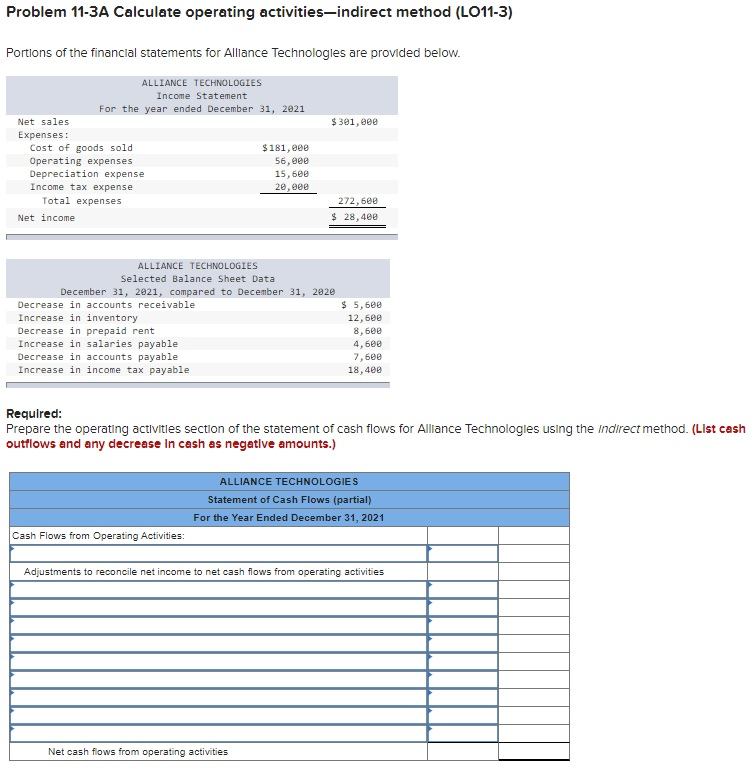

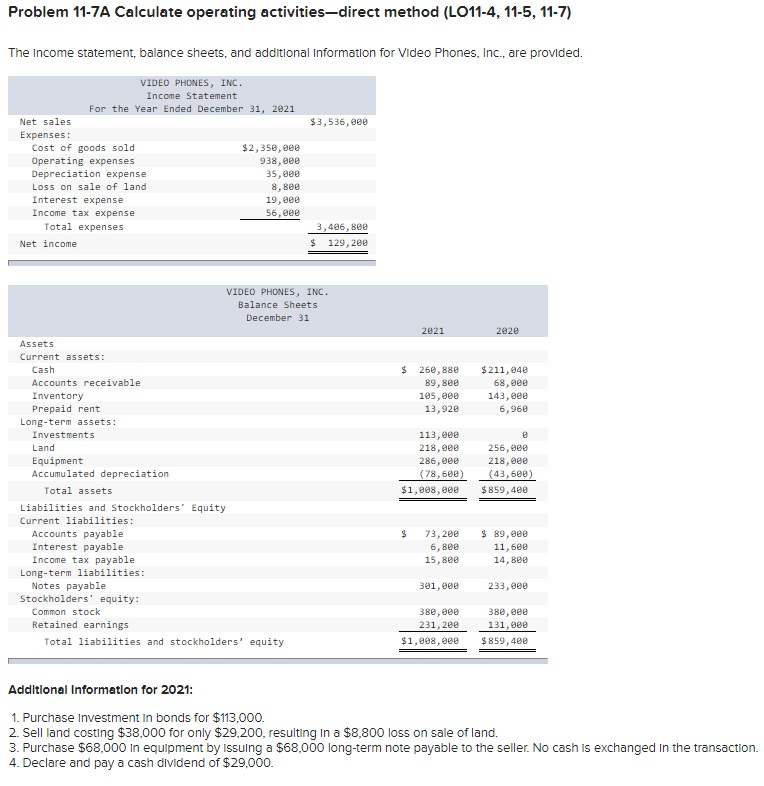

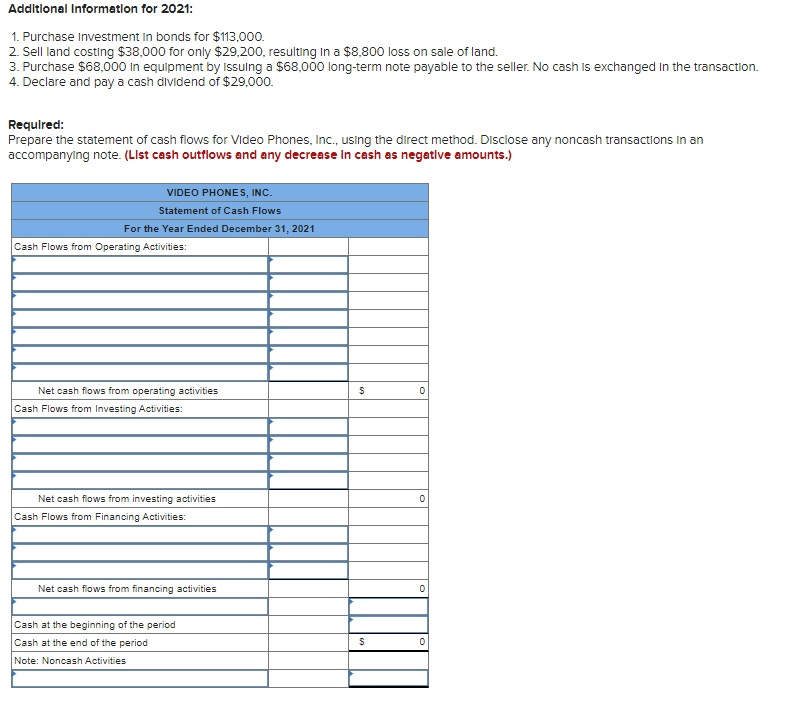

Problem 11-3A Calculate operating activities-indirect method (LO11-3) Portions of the financial statements for Alliance Technologles are provided below. $301, eee ALLIANCE TECHNOLOGIES Income Statement For the year ended December 31, 2021 Net sales Expenses: Cost of goods sold $181,000 Operating expenses 56, eee Depreciation expense 15,6ee Income tax expense 20,000 Total expenses Net income 272,600 $ 28,400 ALLIANCE TECHNOLOGIES Selected Balance Sheet Data December 31, 2021, compared to December 31, 2020 Decrease in accounts receivable Increase in inventory Decrease in prepaid rent Increase in salaries payable Decrease in accounts payable Increase in income tax payable $ 5,600 12,600 8,600 4,600 7,600 18,400 Required: Prepare the operating activities section of the statement of cash flows for Alliance Technologies using the Indirect method. (List cash outflows and any decrease in cash as negative amounts.) ALLIANCE TECHNOLOGIES Statement of Cash Flows (partial) For the Year Ended December 31, 2021 Cash Flows from Operating Activities: Adjustments to reconcile net income to net cash flows from operating activities Net cash flows from operating activities Problem 11-7A Calculate operating activities-direct method (LO11-4, 11-5, 11-7) The Income statement, balance sheets, and additional Information for Video Phones, Inc., are provided. $3,536,000 VIDEO PHONES, INC. Income Statement For the Year Ended December 31, 2021 Net sales Expenses: Cost of goods sold $2,350,000 Operating expenses 938, eee Depreciation expense 35,eee Loss on sale of land 8,800 Interest expense 19, eee Income tax expense 56,000 Total expenses Net income 3,406,800 $ 129, 2ee VIDEO PHONES, INC. Balance Sheets December 31 2021 2020 $ 260,880 89, Bee 185, eee 13,920 $ 211,040 68,eee 143,000 6,960 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investments Land Equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity 113, see 218,000 286, see (78,600) $1,808, eee 256,000 218,000 (43,60e) $859,400 $ 73,200 6, 8ee 15, Bee $ 89,00 11,600 14,800 301, eee 233, eee 380, eee 231, 2ee $1,898, eee 380,000 131, eee $859,400 Additional Information for 2021: 1. Purchase Investment in bonds for $113,000. 2. Sell land costing $38,000 for only $29,200, resulting in a $8,800 loss on sale of land. 3. Purchase $68,000 in equipment by Issuing a $68,000 long-term note payable to the seller. No cash is exchanged in the transaction. 4. Declare and pay a cash dividend of $29,000. Additional Information for 2021: 1. Purchase Investment in bonds for $113,000. 2. Sell land costing $38,000 for only $29,200, resulting in a $8,800 loss on sale of land. 3. Purchase $68,000 in equipment by Issuing a $68,000 long-term note payable to the seller. No cash is exchanged in the transaction. 4. Declare and pay a cash dividend of $29,000. Required: Prepare the statement of cash flows for Video Phones, Inc., using the direct method. Disclose any noncash transactions in an accompanying note. (List cash outflows and any decrease in cash as negative amounts.) VIDEO PHONES, INC. Statement of Cash Flows For the Year Ended December 31, 2021 Cash Flows from Operating Activities: s 0 Net cash flows from operating activities Cash Flows from Investing Activities: 0 Net cash flows from investing activities Cash Flows from Financing Activities: Net cash flows from financing activities 0 Cash at the beginning of the period Cash the end of the period Note: Noncash Activities S 0