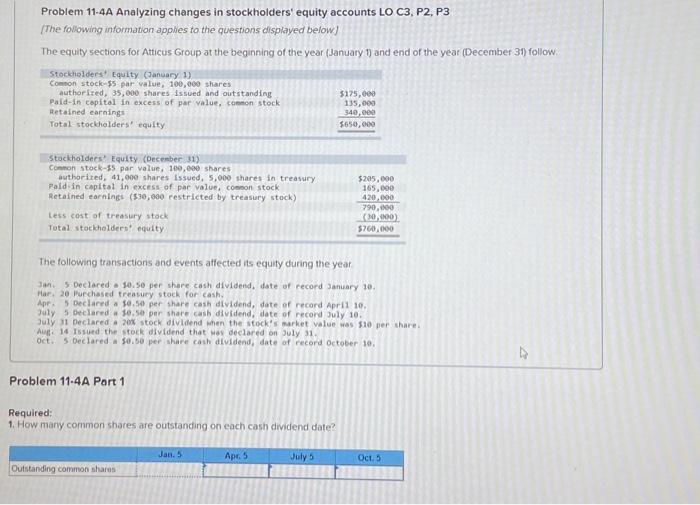

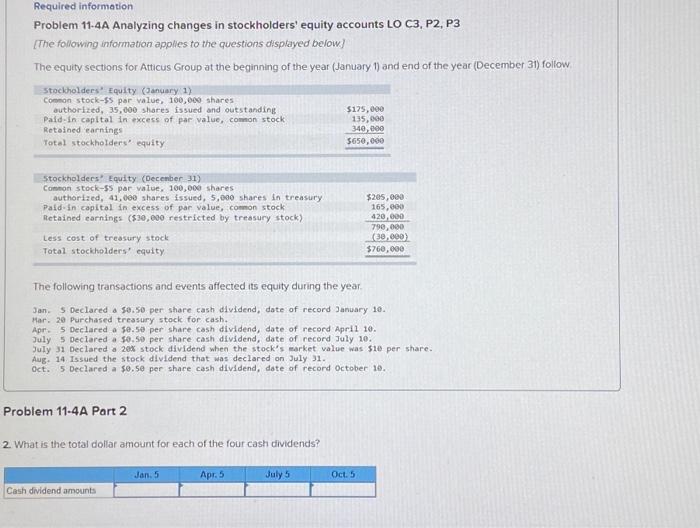

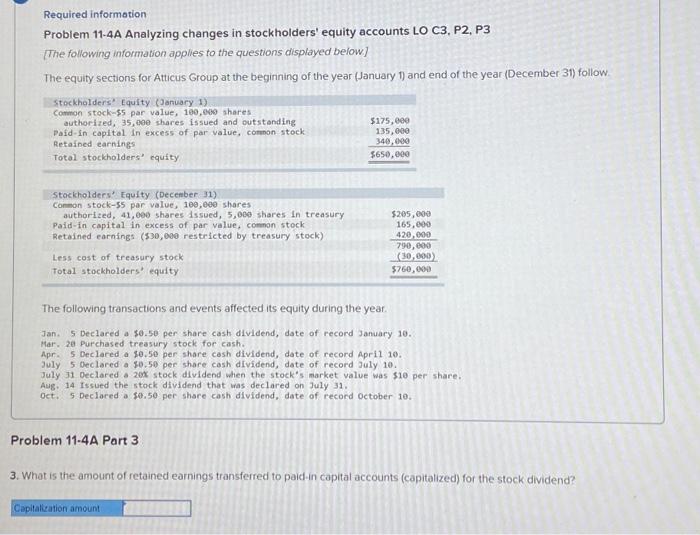

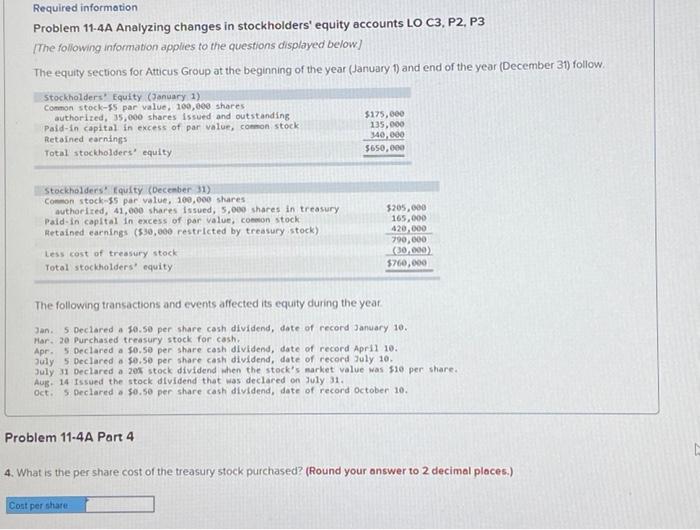

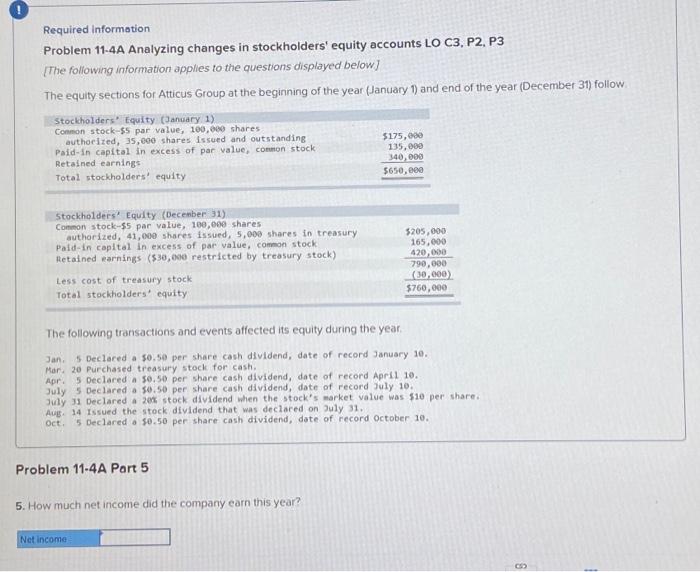

Problem 11-4A Analyzing changes in stockholders equity accounts LO C3, P2, P3 [The following information applies ta the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31 ) follow. The following transactions and events affected its equity during the year 3an. 5 Declared = 30.50 per share cash dividend, date of record January 10 . Har, 20 Durchased treasury stock for cash. Apre 5 Declared a ge.50 per thare cash dividend, date of record apri1 10. July 5 beclared a 10.50 per share cash dividend, date of record july 10. July 31 Declared a 200 stock dividend inen the itock's market value was sto per share. Aue. 14 issued the stock dividend that was dectared on July 31. oct. 5 beclared a so.se per share cash dividend, date of record october 10. Problem 11.4A Part 1 Required: 1. How many common shares are outstanding on each cash dwidend date? Problem 11-4A Analyzing changes in stockholders' equity accounts LO C3, P2, P3 [The following information applies to the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. The following transactions and events affected its equity during the year. Jan. S Declared a 50.50 per share cash dividend, date of record January 10. Mar. 20 Purchased tressury stock for cash. Apr. 5 Declared a se.50 per share cash dividend, date of record Apri1 10. July 5 peclared a 50.50 per share cash dividend, date of record Jaly 10. July 31 Declared a 20K stock dividend when the stock's earket value was sie per share. Aug. 14. Issued the stock divldend that was declared on. July 31. oct. 5 Declared a 50.50 per share cash dividend, dote of record october 10. Problem 11.4A Part 2 2. What is the total dollar amount for each of the four cash dividends? Required informotion Problem 11-4A Analyzing changes in stockholders' equity accounts LO C3, P2, P3 [The following information applies to the questions displayed below. The equity sections for Atticus Group at the beginning of the year (January 1 ) and end of the year (December 31) follow The following transactions and events affected its equity during the year. Jan. 5 Declared a 30.50 per share cash dividend, date of record January 10. Mar. 20 Purchased treasury stock for cash. Apr. 5. Declared a se.50 per share cash dividend, date of record April 10. July 5 0eclared a 50.50 per share cash dividend, date of record July 10. July 31 oeclared a 20x stock dividend when the stock"s market value was s10 per share. Aug. 14 Issued the stock dividend that was declared on July 31. oct. 5. Declared a 50.50 per share cash dividend, date of record october 10. Problem 11-4A Part 3 3. What is the amount of retained eamings transferred to paid-in capital accounts (capitalized) for the stock dividend? Required information Problem 11-4A Analyzing changes in stockholders' equity accounts LO C3, P2, P3 [The following information applies to the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. The following transactions and events affected its equity during the yeat Jan. 5 Declared a 10.50 per share cash dividend, date of record January 10. Har - 20 Purchased treasury stock for cash. Apr. 5 Declared a $0.50 per share cash dividend, date of record Aprl1 10. July 5 peclared a so.se per share cash dividend, date of record July 10 . July 31 Declared a 205 stock dividend when the stock's market value was s1e per share. Aus. 14 issued the stock dividend that was declared on July 31. oct. 5. Declared a so.50 per share cash dividend, date of record october 10. Problem 11-4A Part 4 1. What is the per share cost of the treasury stock purchased? (Round your onswer to 2 decimal ploces.) Required information Problem 11-4A Analyzing changes in stockholders' equity accounts LO C3, P2, P3 [The following information applies to the questions displayed below] The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow The following transactions and events affected its equity during the year. Jan. 5 Declared a 50.50 per share cash dividend, date of record January 10 . Mar. 20 Purchased treasury stock for cash. Apr. 5 peclared a 50.50 per share cash dividend, date of record April 10. July 5 Declared a 50.50 per share cash dividend, date of record July 10. July 31 Declared a 20 stock dividend when the stock's market value was \$10 per share. Aug. 14 issued the stock dividend that was declared on July 31. oct. 5 Declared a so.50 per share cash dividend, date of record October 10. Problem 11-4A Part 5 5. How much net income did the company earn this year