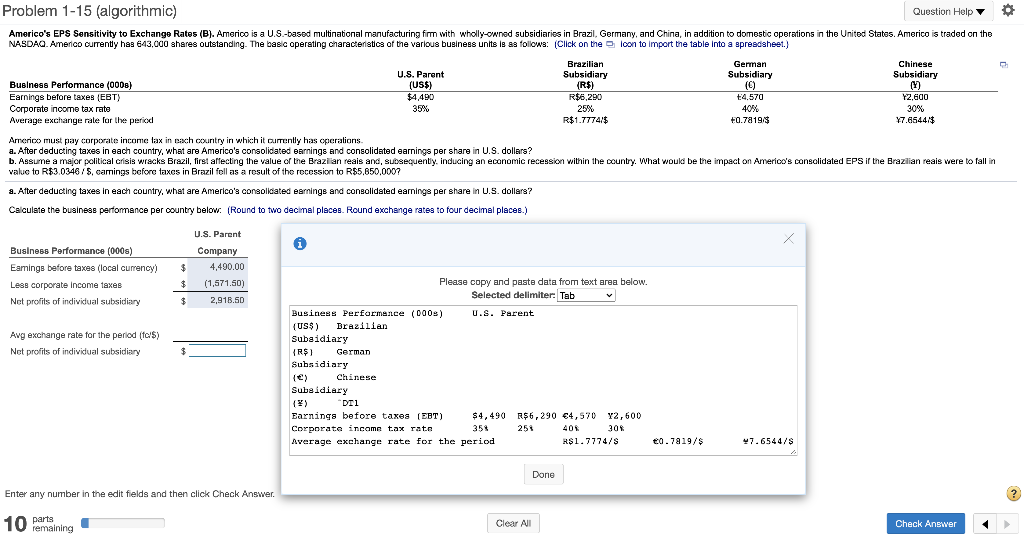

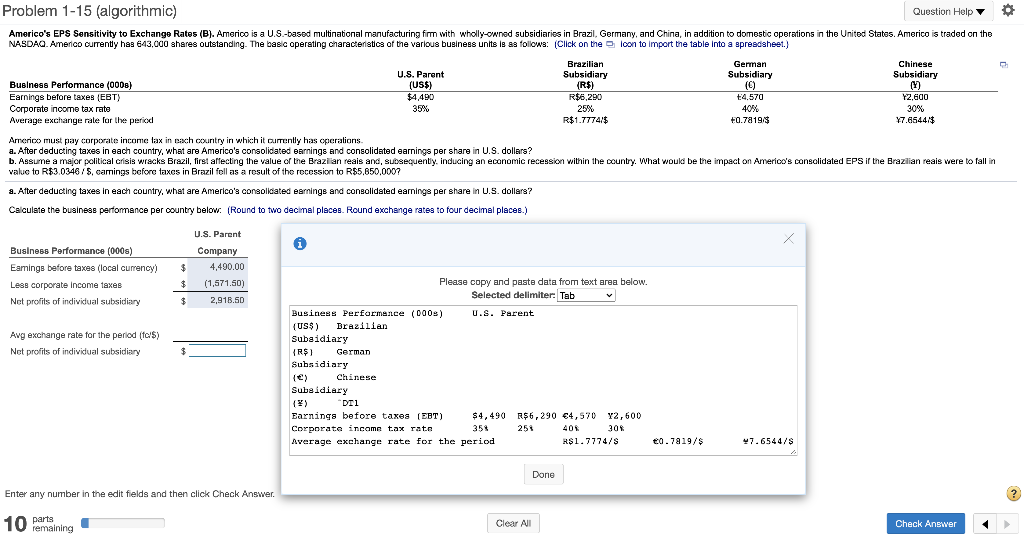

Problem 1-15 (algorithmic) Question Help Americo's EPS Sensitivity to Exchange Rates (B). Americo is a U.S.-based multinational manufacturing firm with wholly-owned subsidiaries in Brazil. Germany, and China, in addition to domestic operations in the United States. Americo is traded on the NASDAQ. Americo currently has 643,000 shares outstanding. The basic operating characteristics of the various business units is as follows: (Click on the loon to Import the table into a spreadsheet.) Brazilian German Chinese U.S. Parent Subsidiary Subsidiary Subsidiary Business Performance (0008) (US$) (R$) (C) (Y) Earnings before taxes (EBT) $4,490 R$6,290 14.570 Y2,600 Corporate income tax rate 35% 25% 40% 30% Average exchange rate for the period R$1.77741$ +0.78193 7.6544/4 Arnerico must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? b. Assume a major political crisis wracks Brazil, first affecting the value of the Brazilian reals and subsequently, inducing an economic recession within the country. What would be the impact on Americo's consolidated EPS ir the Brazilian reais were to fall in value to R$3.0346/5, camings before taxes in Brazil fell as a result of the recession to R$5.850.0007 a. After deducting taxes in each country, what are America's consolidated earnings and consolidated earnings per share in U.S. dollars? Calculate the business perfomance per country below. (Round to two decimal places. Round exchange rates to four decimal places.) U S. Parent Company 4,490.00 i $ Business Performance (000s) Earnings before taxes (local currency) Less corporate Income taxes Net profits of individual subsidiary $ (1,571.50) $ 2,918.50 Avg exchange rate for the period fc$) ( Net profits of individual subsidiary Please copy and paste data from text area below. Selected delimiter: Tab Business Performance (2008) U.S. Parent (US$) Brazilian Subsidiary {R$ 1 German Subsidiary () Chinese Subsidiary () "DI1 Earnings before taxes (EBT) $4,490 R$ 6,290 4,570 Y2,600 Corporate incame tax rate 35% 25 40 30% Average exchange rate for the period R$ 1.7774/8 0.78 19/$ 7.6544/9 Done Enter any number in the edit fields and then click Check Answer. ? 10 parts remaining Clear All Check