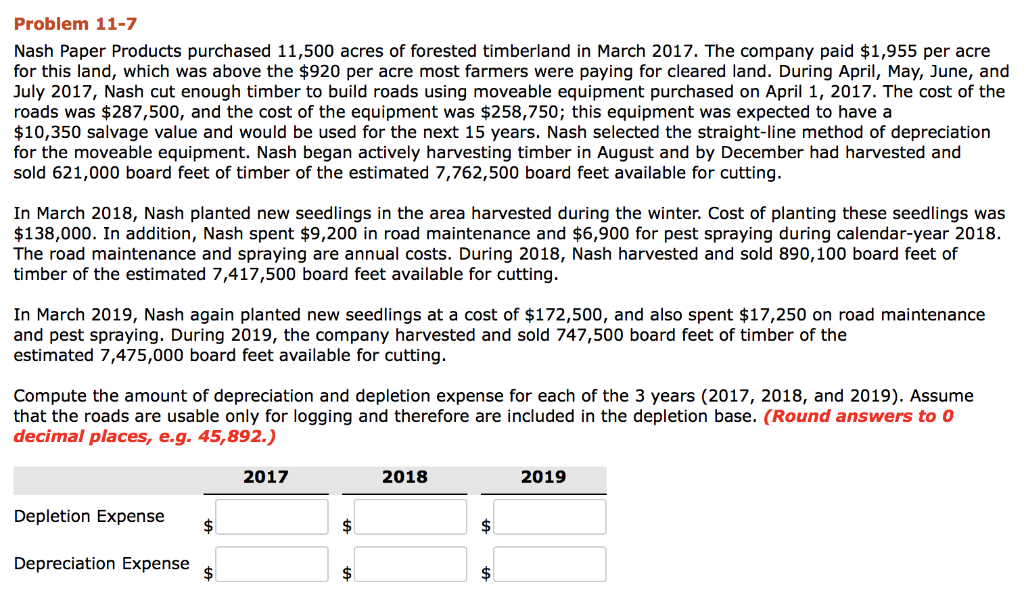

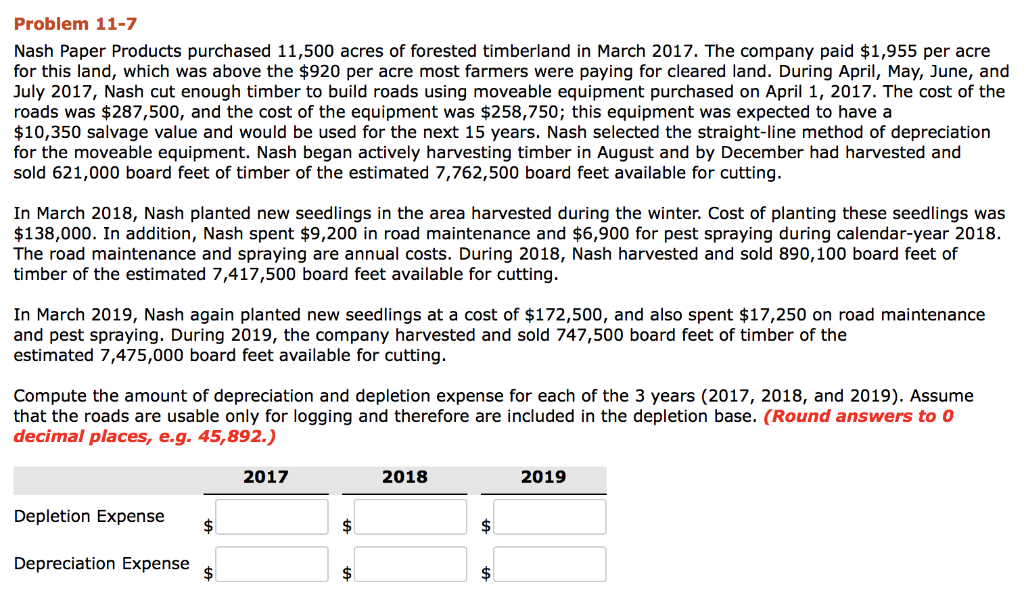

Problem 11-7 Nash Paper Products purchased 11,500 acres of forested timberland in March 2017. The company paid $1,955 per acre for this land, which was above the $920 per acre most farmers were paying for cleared land. During April, May, June, and July 2017, Nash cut enough timber to build roads using moveable equipment purchased on April 1, 2017. The cost of the roads was $287,500, and the cost of the equipment was $258,750; this equipment was expected to have a $10,350 salvage value and would be used for the next 15 years. Nash selected the straight-line method of depreciation for the moveable equipment. Nash began actively harvesting timber in August and by December had harvested and sold 621,000 board feet of timber of the estimated 7,762,500 board feet available for cutting. In March 2018, Nash planted new seedlings in the area harvested during the winter. Cost of planting these seedlings wa:s $138,000. In addition, Nash spent $9,200 in road maintenance and $6,900 for pest spraying during calendar-year 2018. The road maintenance and spraying are annual costs. During 2018, Nash harvested and sold 890,100 board feet of timber of the estimated 7,417,500 board feet available for cutting In March 2019, Nash again planted new seedlings at a cost of $172,500, and also spent $17,250 on road maintenance and pest spraying. During 2019, the company harvested and sold 747,500 board feet of timber of the estimated 7,475,000 board feet available for cutting. Compute the amount of depreciation and depletion expense for each of the 3 years (2017, 2018, and 2019). Assume that the roads are usable only for logging and therefore are included in the depletion base. (Round answers to 0 decimal places, e.g. 45,892.) 2017 2018 2019 Depletion Expense Depreciation Expense s Problem 11-7 Nash Paper Products purchased 11,500 acres of forested timberland in March 2017. The company paid $1,955 per acre for this land, which was above the $920 per acre most farmers were paying for cleared land. During April, May, June, and July 2017, Nash cut enough timber to build roads using moveable equipment purchased on April 1, 2017. The cost of the roads was $287,500, and the cost of the equipment was $258,750; this equipment was expected to have a $10,350 salvage value and would be used for the next 15 years. Nash selected the straight-line method of depreciation for the moveable equipment. Nash began actively harvesting timber in August and by December had harvested and sold 621,000 board feet of timber of the estimated 7,762,500 board feet available for cutting. In March 2018, Nash planted new seedlings in the area harvested during the winter. Cost of planting these seedlings wa:s $138,000. In addition, Nash spent $9,200 in road maintenance and $6,900 for pest spraying during calendar-year 2018. The road maintenance and spraying are annual costs. During 2018, Nash harvested and sold 890,100 board feet of timber of the estimated 7,417,500 board feet available for cutting In March 2019, Nash again planted new seedlings at a cost of $172,500, and also spent $17,250 on road maintenance and pest spraying. During 2019, the company harvested and sold 747,500 board feet of timber of the estimated 7,475,000 board feet available for cutting. Compute the amount of depreciation and depletion expense for each of the 3 years (2017, 2018, and 2019). Assume that the roads are usable only for logging and therefore are included in the depletion base. (Round answers to 0 decimal places, e.g. 45,892.) 2017 2018 2019 Depletion Expense Depreciation Expense s