Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 12 For many years Tinor Company has used a manufacturing overhead rate based on direct labor hours. A new plant accountant has suggested

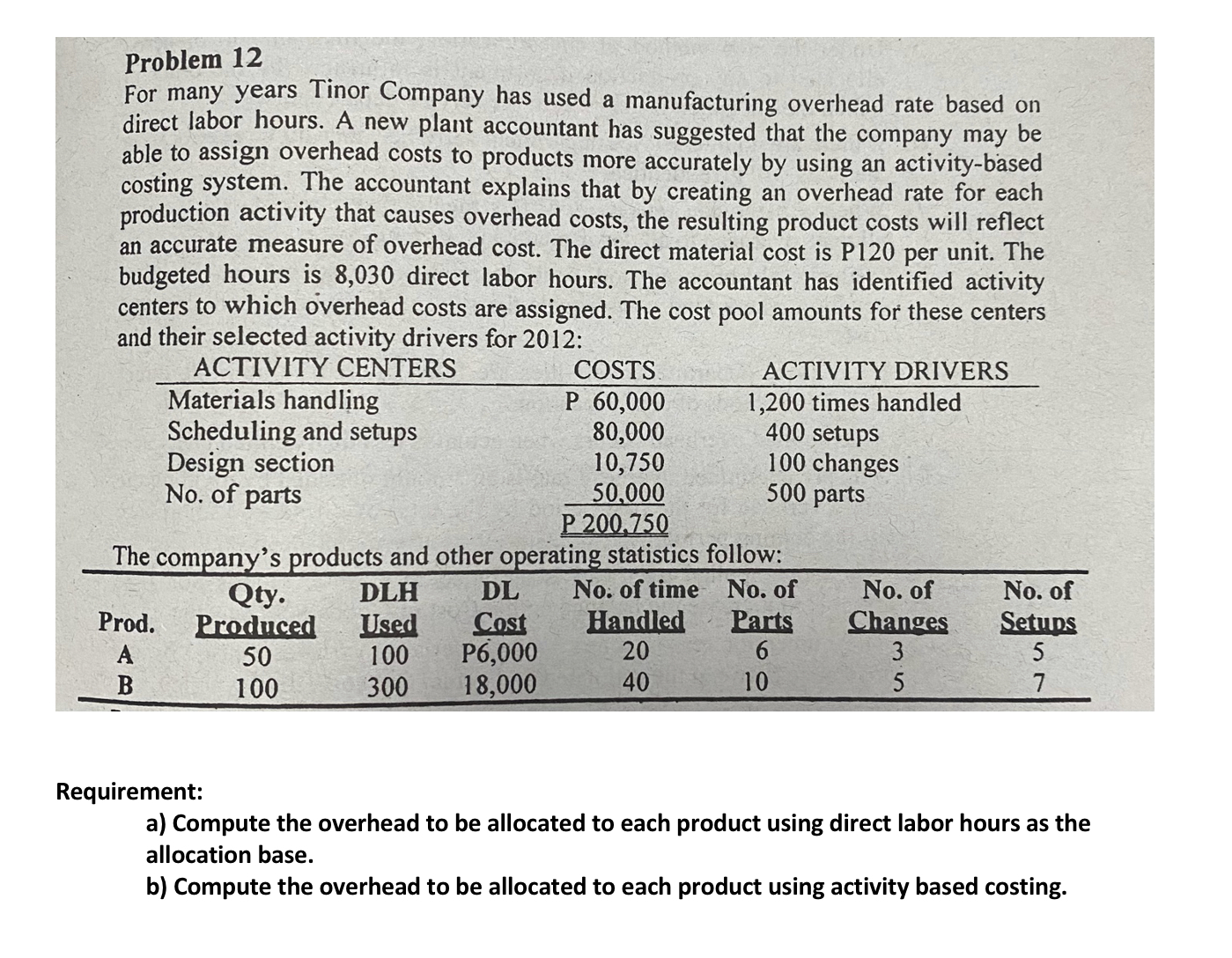

Problem 12 For many years Tinor Company has used a manufacturing overhead rate based on direct labor hours. A new plant accountant has suggested that the company may be able to assign overhead costs to products more accurately by using an activity-based costing system. The accountant explains that by creating an overhead rate for each production activity that causes overhead costs, the resulting product costs will reflect an accurate measure of overhead cost. The direct material cost is P120 per unit. The budgeted hours is 8,030 direct labor hours. The accountant has identified activity centers to which overhead costs are assigned. The cost pool amounts for these centers and their selected activity drivers for 2012: ACTIVITY CENTERS Materials handling Scheduling and setups Design section No. of parts ACTIVITY DRIVERS 1,200 times handled 400 setups COSTS P 60,000 80,000 10,750 100 changes 50,000 500 parts P 200,750 The company's products and other operating statistics follow: Qty. DLH DL No. of time No. of Prod. Produced Used Cost Handled Parts No. of Changes No. of Setups A 50 100 P6,000 20 6 3 5 B 100 300 18,000 40 10 5 7 Requirement: a) Compute the overhead to be allocated to each product using direct labor hours as the allocation base. b) Compute the overhead to be allocated to each product using activity based costing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To compute the overhead to be allocated to each product using direct labor hours as the allocation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started