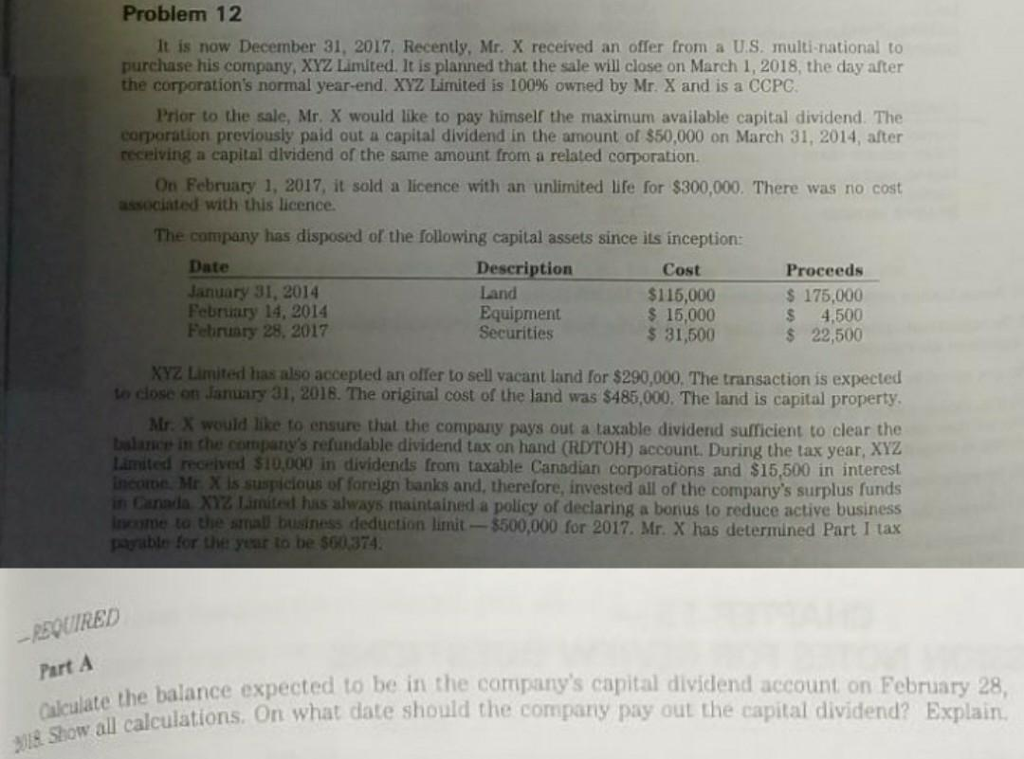

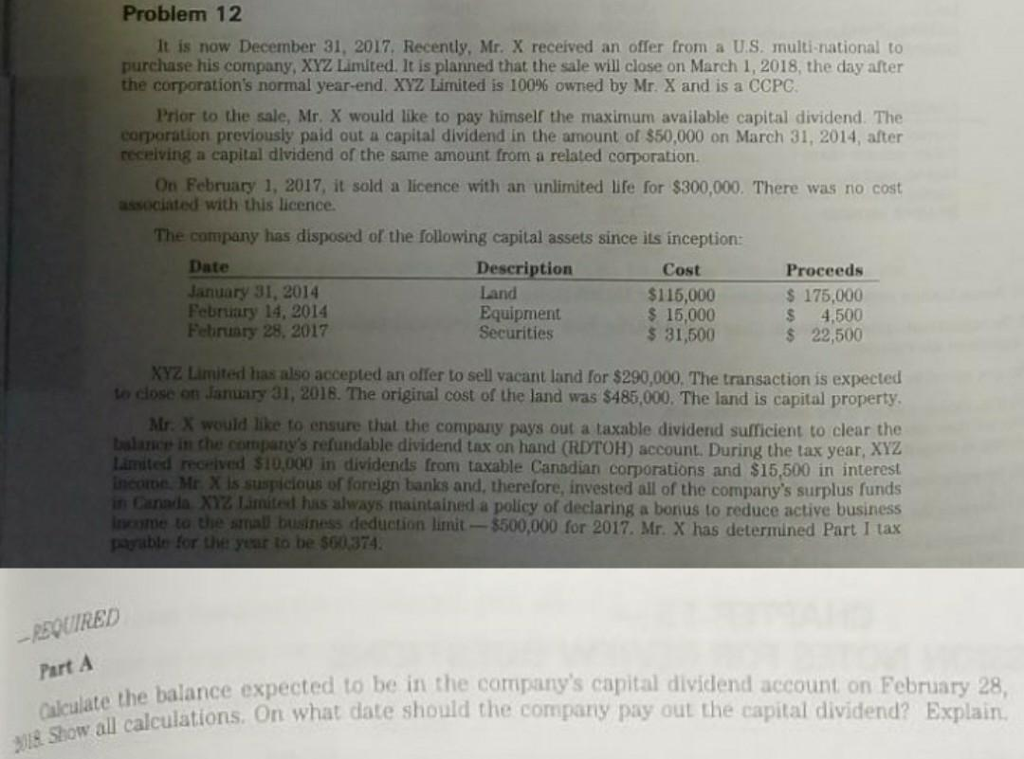

Problem 12 It is now December 31, 2017, Recently, Mr. X received an offer from a U.S. multi-national to purchase his company, XYZ Limited. It is planned that the sale will close on March 1, 2018, the day after the corporation's normal year-end. XYZ Limited is 100% owned by Mr. X and is a CCPC Prior to the sale, Mr. X would like to pay himself the maximum available capital dividend. The corporation previously paid out a capital dividend in the amount of $50,000 on March 31, 2014, after receiving a capital dividend of the same amount from a related corporation On February 1, 2017, it sold a licence with an unlimited life for $300,000. There was no cost associated with this licence The company has disposed of the following capital assets since its inception: Date January 31, 2014 February 14, 2014 February 28, 2017 Description Equipment XYZ Limited has also accepted an offer to sell vacant land for $290,000. The transaction is expected Mr. X would like to ensure that the company pays out a taxable dividend sufficient to clear the Cost $115,000 s 15,000 $ 31,500 Proceeds s 175,000 $ 4,500 $ 22,500 Land Securities o close on Jauary 31, 2018. The original cost of the land was $485,000. The land is capital property balance in che company's refundable dividend tax on hand (RDTOH) account. During the tax year, XY2 Limited received $10,000 in dividends from taxable Canadian corporations and $15,500 in interest ncoroe. Mr X is suspicious of foreign banks and, therefore, invested all of the company's surplus funds n Canala X) Limited has always maintained a policy of declaring a borius to reduce active business come to the small business deduction limit $500,000 for 2017. Mr. X has determined Part I tax REQUIRED Part A alcul the the balance expected to be in the company's capital dividend account on February 28, calculations. On what date should the company pay out the capital dividend? E:xplain. ate si8 Show al alculation osd Problem 12 It is now December 31, 2017, Recently, Mr. X received an offer from a U.S. multi-national to purchase his company, XYZ Limited. It is planned that the sale will close on March 1, 2018, the day after the corporation's normal year-end. XYZ Limited is 100% owned by Mr. X and is a CCPC Prior to the sale, Mr. X would like to pay himself the maximum available capital dividend. The corporation previously paid out a capital dividend in the amount of $50,000 on March 31, 2014, after receiving a capital dividend of the same amount from a related corporation On February 1, 2017, it sold a licence with an unlimited life for $300,000. There was no cost associated with this licence The company has disposed of the following capital assets since its inception: Date January 31, 2014 February 14, 2014 February 28, 2017 Description Equipment XYZ Limited has also accepted an offer to sell vacant land for $290,000. The transaction is expected Mr. X would like to ensure that the company pays out a taxable dividend sufficient to clear the Cost $115,000 s 15,000 $ 31,500 Proceeds s 175,000 $ 4,500 $ 22,500 Land Securities o close on Jauary 31, 2018. The original cost of the land was $485,000. The land is capital property balance in che company's refundable dividend tax on hand (RDTOH) account. During the tax year, XY2 Limited received $10,000 in dividends from taxable Canadian corporations and $15,500 in interest ncoroe. Mr X is suspicious of foreign banks and, therefore, invested all of the company's surplus funds n Canala X) Limited has always maintained a policy of declaring a borius to reduce active business come to the small business deduction limit $500,000 for 2017. Mr. X has determined Part I tax REQUIRED Part A alcul the the balance expected to be in the company's capital dividend account on February 28, calculations. On what date should the company pay out the capital dividend? E:xplain. ate si8 Show al alculation osd