Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tecniquip Limited is a public corporation whose head office is located in Toronto, Ontario. The activities of the corporation are carried on through permanent

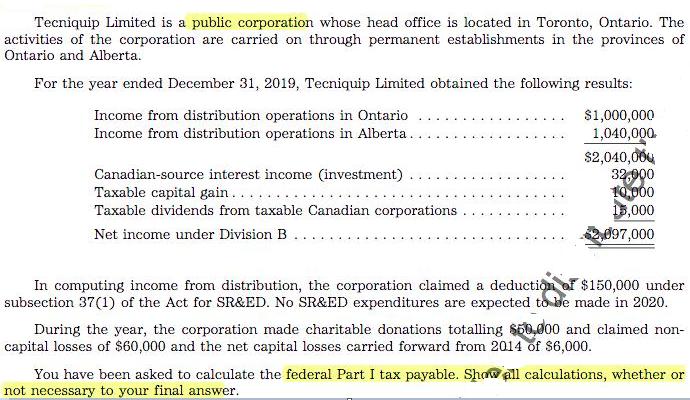

Tecniquip Limited is a public corporation whose head office is located in Toronto, Ontario. The activities of the corporation are carried on through permanent establishments in the provinces of Ontario and Alberta. For the year ended December 31, 2019, Tecniquip Limited obtained the following results: Income from distribution operations in Ontario $1,000,000 1,040,000. $2,040,004 32,000 10,000 15,000 097,000 Income from distribution operations in Alberta.. Canadian-source interest income (investment) ..... Taxable capital gain... Taxable dividends from taxable Canadian corporations Net income under Division B In computing income from distribution, the corporation claimed a deduction of $150,000 under subsection 37(1) of the Act for SR&ED. No SR&ED expenditures are expected to be made in 2020. During the year, the corporation made charitable donations totalling S50,000 and claimed non- capital losses of $60,000 and the net capital losses carried forward from 2014 of S6,000. You have been asked to calculate the federal Part I tax payable. Show all calculations, whether or not necessary to your final answer.

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

STEP 1a Income from distribution operations 2040000 Canadian source interest income from investments ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started