Question

Problem 12-18 (Algo) Net present value and internal rate of return methods [LO12-4] The Pan American Bottling Company is considering the purchase of a new

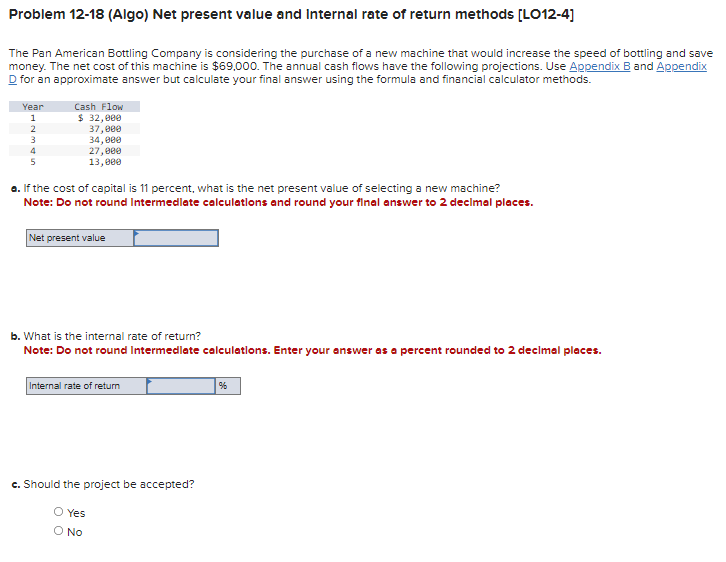

Problem 12-18 (Algo) Net present value and internal rate of return methods [LO12-4] The Pan American Bottling Company is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $69,000. The annual cash flows have the following projections. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year Cash Flow 1 $ 32,000 2 37,000 3 34,000 4 27,000 5 13,000 If the cost of capital is 11 percent, what is the net present value of selecting a new machine? Note: Do not round intermediate calculations and round your final answer to 2 decimal places. What is the internal rate of return? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Should the project be accepted? multiple choice Yes No

Problem 12-18 (Algo) Net present value and Internal rate of return methods [L012-4] The Pan American Bottling Company is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $69,000. The annual cash flows have the following projections. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. 0. If the cost of capital is 11 percent, what is the net present value of selecting a new machine? Note: Do not round Intermedlate colculations and round your flnal answer to 2 declmal places. b. What is the internal rate of return? Note: Do not round Intermedlate colculations. Enter your answer as a percent rounded to 2 declmal places. c. Should the project be accepted? Yes No

Problem 12-18 (Algo) Net present value and Internal rate of return methods [L012-4] The Pan American Bottling Company is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $69,000. The annual cash flows have the following projections. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. 0. If the cost of capital is 11 percent, what is the net present value of selecting a new machine? Note: Do not round Intermedlate colculations and round your flnal answer to 2 declmal places. b. What is the internal rate of return? Note: Do not round Intermedlate colculations. Enter your answer as a percent rounded to 2 declmal places. c. Should the project be accepted? Yes No Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started