Problem 12-19A

Problem 12-21A

Check figures:

Net Cash Flow from Operating

Activities: $45,90

Net Decrease in Cash: $42,100.

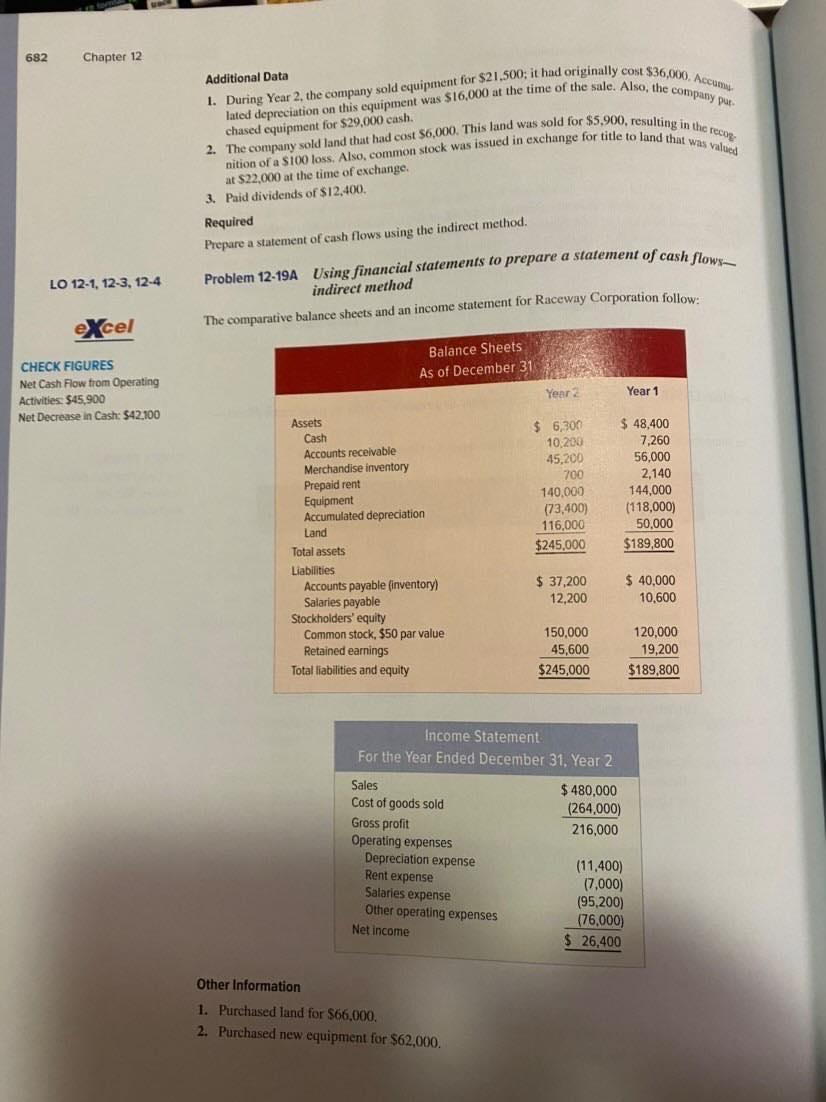

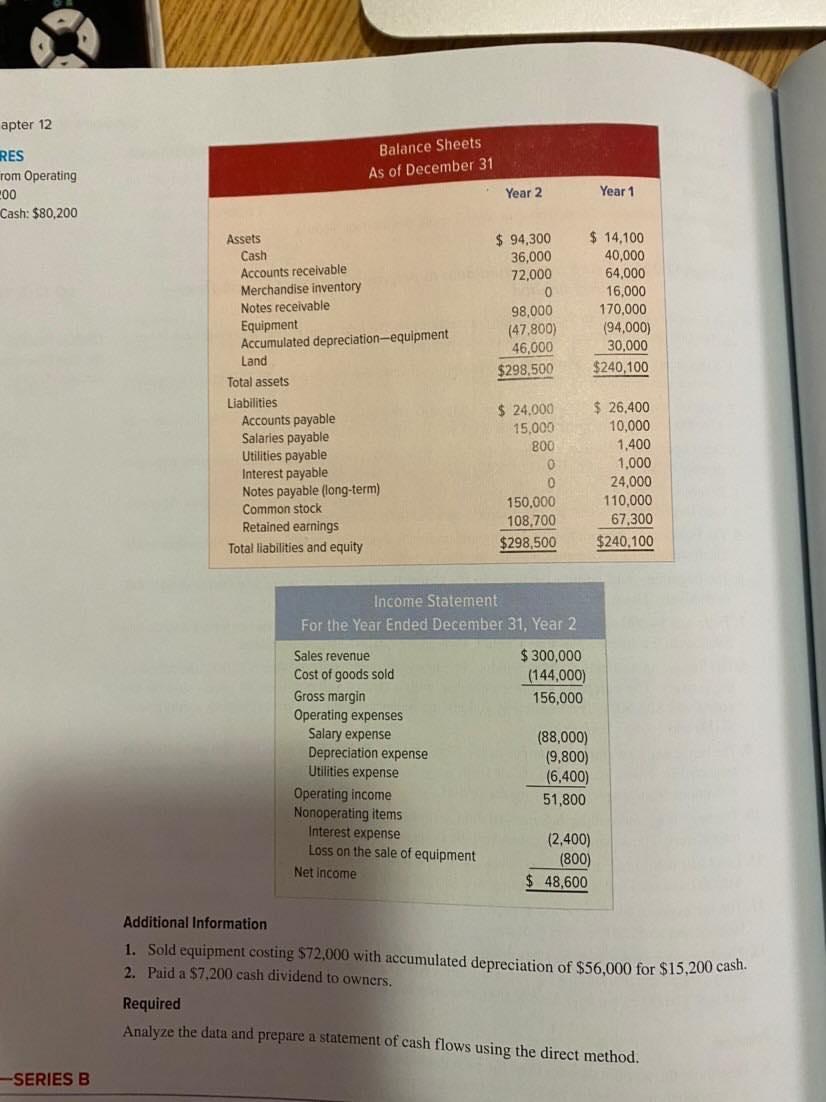

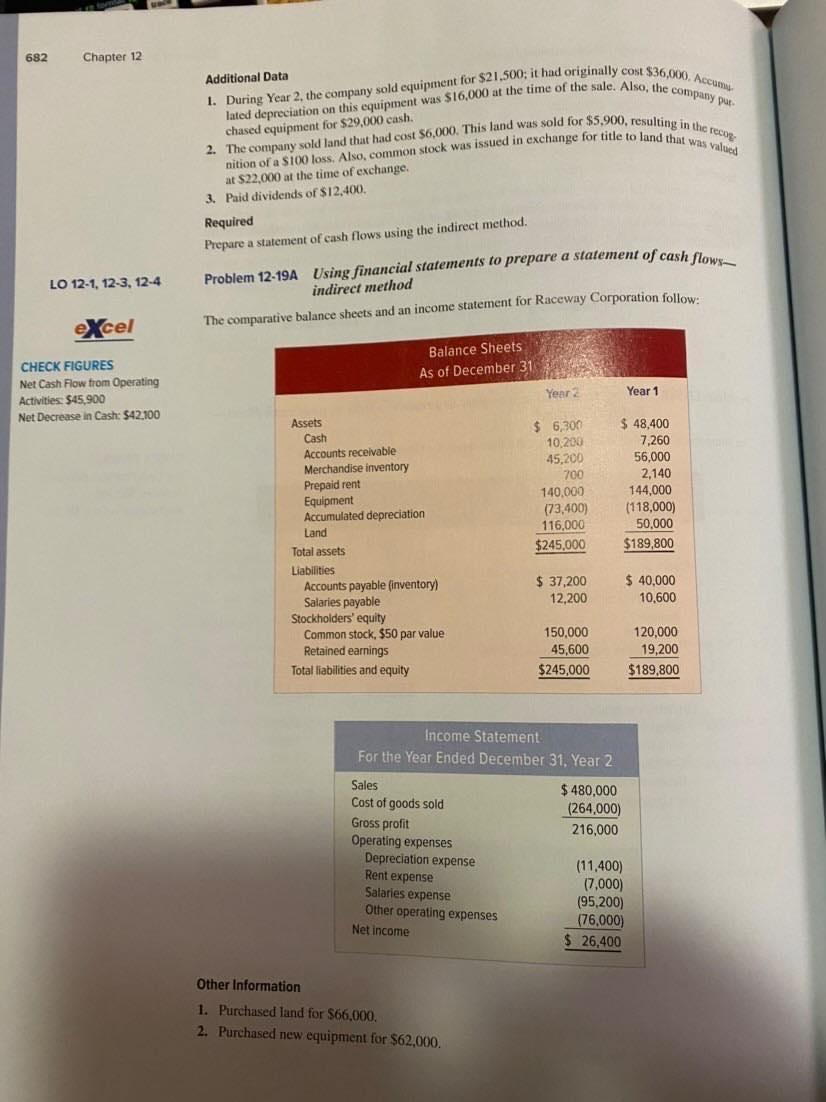

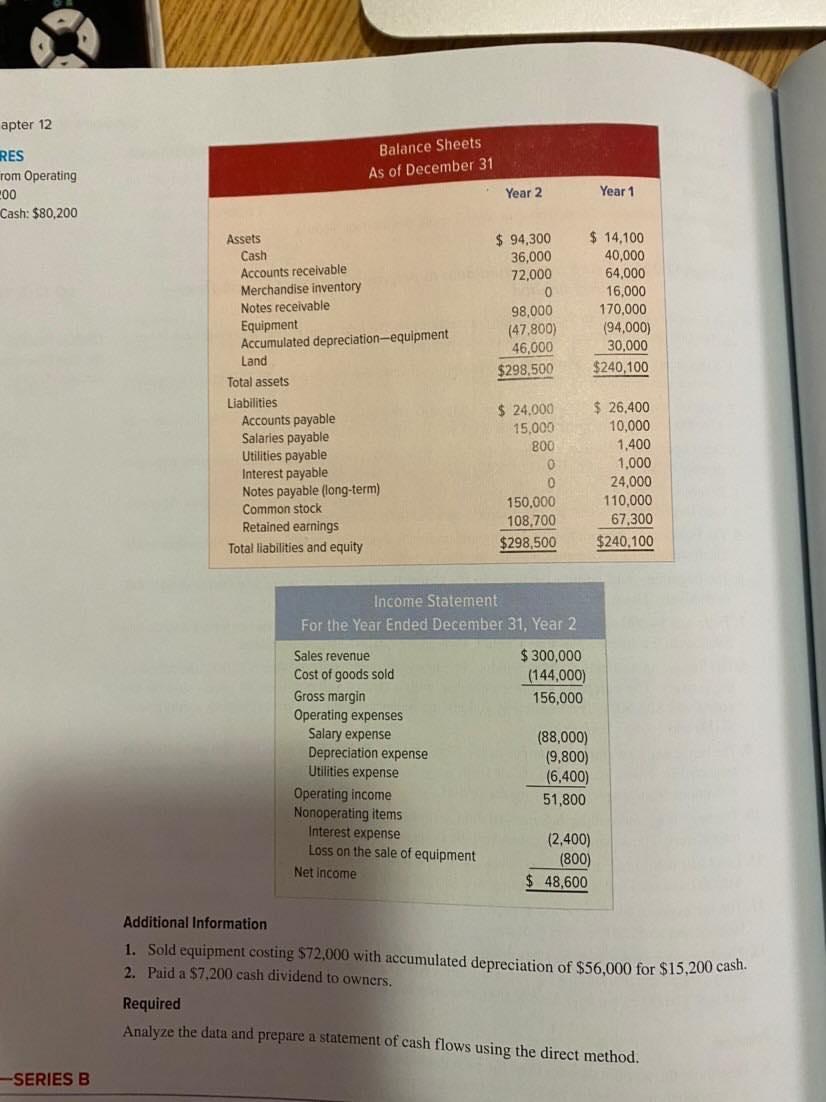

1. During Year 2, the company sold equipment for $21.500; it had originally cost $36,000. Accum lated depreciation on this equipment was $16,000 at the time of the sale. Also, the company put 2. The company sold land that had cost $6,000. This land was sold for $5.900, resulting in there nition of a $100 loss. Also, common stock was issued in exchange for title to land that was valued 682 Chapter 12 Additional Data chased equipment for $29,000 cash. r at $22,000 at the time of exchange. 3. Paid dividends of $12,400. Required Prepare a statement of cash flows using the indirect method. LO 12-1, 12-3, 12-4 Problem 12-19A Using financial statements to prepare a statement of cash flows indirect method The comparative balance sheets and an income statement for Raceway Corporation follow: excel Balance Sheets As of December 31 CHECK FIGURES Net Cash Flow from Operating Activities: $45,900 Net Decrease in Cash: $42.100 Year 2 Year 1 Assets Cash Accounts receivable Merchandise inventory Prepaid rent Equipment Accumulated depreciation Land Total assets Liabilities Accounts payable (inventory) Salaries payable Stockholders' equity Common stock. $50 par value Retained earnings Total liabilities and equity $ 6,300 10,200 45.200 700 140,000 (73,400) 116.000 $245,000 $ 48,400 7,260 56,000 2,140 144,000 (118,000) 50,000 $189,800 $ 37,200 12,200 $ 40,000 10,600 150,000 45,600 $245,000 120,000 19,200 $189,800 Income Statement For the Year Ended December 31. Year 2 $ 480,000 (264,000) 216,000 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense Rent expense Salaries expense Other operating expenses Net income (11,400) (7,000) (95,200) (76,000) $ 26,400 Other Information 1. Purchased land for $66,000. 2. Purchased new equipment for $62,000. Statement of Cash Flows 683 3. Sold old equipment that cost $66,000 with accumulated depreciation of $56,000 for $10,000 cash. 4. Issued common stock for $30,000. Required Prepare the statement of cash flows for Year 2 using the indirect method. LO 12-2, 12 Problem 12-21A Using financial statements to prepare a statement of cash flows- direct method The following financial statements were drawn from the records of Matrix Shoes: apter 12 Balance Sheets As of December 31 RES rom Operating 200 Cash: $80,200 Year 2 Year 1 $ 94,300 36,000 72,000 0 98,000 (47,800) 46,000 $298,500 $ 14,100 40,000 64,000 16,000 170,000 194,000) 30,000 $240,100 Assets Cash Accounts receivable Merchandise inventory Notes receivable Equipment Accumulated depreciation-equipment Land Total assets Liabilities Accounts payable Salaries payable Utilities payable Interest payable Notes payable (long-term) Common stock Retained earnings Total liabilities and equity $ 24.000 15,000 800 0 0 150.000 108,700 $298,500 $ 26,400 10,000 1,400 1,000 24,000 110,000 67,300 $240,100 Income Statement For the Year Ended December 31, Year 2 $ 300,000 (144,000) 156,000 Sales revenue Cost of goods sold Gross margin Operating expenses Salary expense Depreciation expense Utilities expense Operating income Nonoperating items Interest expense Loss on the sale of equipment Net Income (88,000) (9,800) (6,400) 51,800 (2,400) (800) $ 48,600 Additional Information 1. Sold equipment costing $72,000 with accumulated depreciation of $56,000 for $15,200 cash. 2. Paid a $7,200 cash dividend to owners. Required Analyze the data and prepare a statement of cash flows using the direct method. -SERIES B