Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 12-34 (Algorithmic) (LO. 3) In 2021, Reya exercised an incentive stock option that had been granted to her in 2019 by her employer,

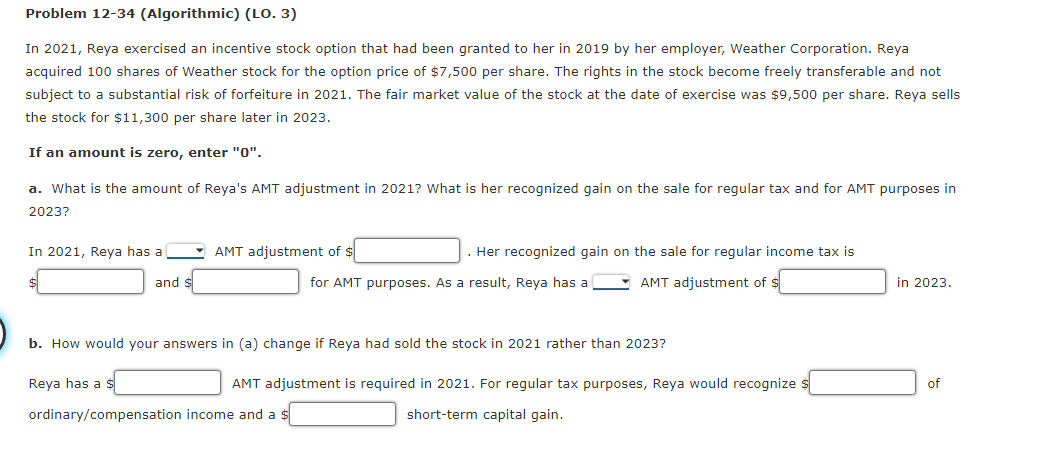

Problem 12-34 (Algorithmic) (LO. 3) In 2021, Reya exercised an incentive stock option that had been granted to her in 2019 by her employer, Weather Corporation. Reya acquired 100 shares of Weather stock for the option price of $7,500 per share. The rights in the stock become freely transferable and not subject to a substantial risk of forfeiture in 2021. The fair market value of the stock at the date of exercise was $9,500 per share. Reya sells the stock for $11,300 per share later in 2023. If an amount is zero, enter "0". a. What is the amount of Reya's AMT adjustment in 2021? What is her recognized gain on the sale for regular tax and for AMT purposes in 2023? In 2021, Reya has a AMT adjustment of $ . and Her recognized gain on the sale for regular income tax is for AMT purposes. As a result, Reya has a AMT adjustment of $ in 2023. b. How would your answers in (a) change if Reya had sold the stock in 2021 rather than 2023? Reya has a $ AMT adjustment is required in 2021. For regular tax purposes, Reya would recognize ordinary/compensation income and a $ short-term capital gain. of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started