Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 12-3A (Algo) Allocating partnership income LO P2 [The following information applies to the questions displayed below.] Ries, Bax, and Thomas invested $48,000, $64,000, and

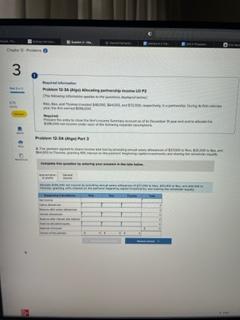

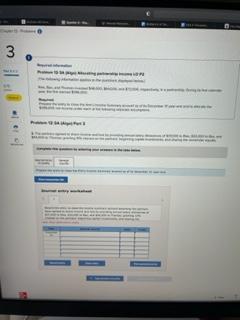

Problem 12-3A (Algo) Allocating partnership income LO P2

[The following information applies to the questions displayed below.] Ries, Bax, and Thomas invested $48,000, $64,000, and $72,000, respectively, in a partnership. During its first calendar year, the firm earned $396,000. Required: Prepare the entry to close the firms Income Summary account as of its December 31 year-end and to allocate the $396,000 net income under each of the following separate assumptions.

Acting pr 100 Pro 12:34 P Salary 107 page of w S P34 W ung 3 3 TRE P Musting pa Acting pr 100 Pro 12:34 P Salary 107 page of w S P34 W ung 3 3 TRE P Musting paStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started