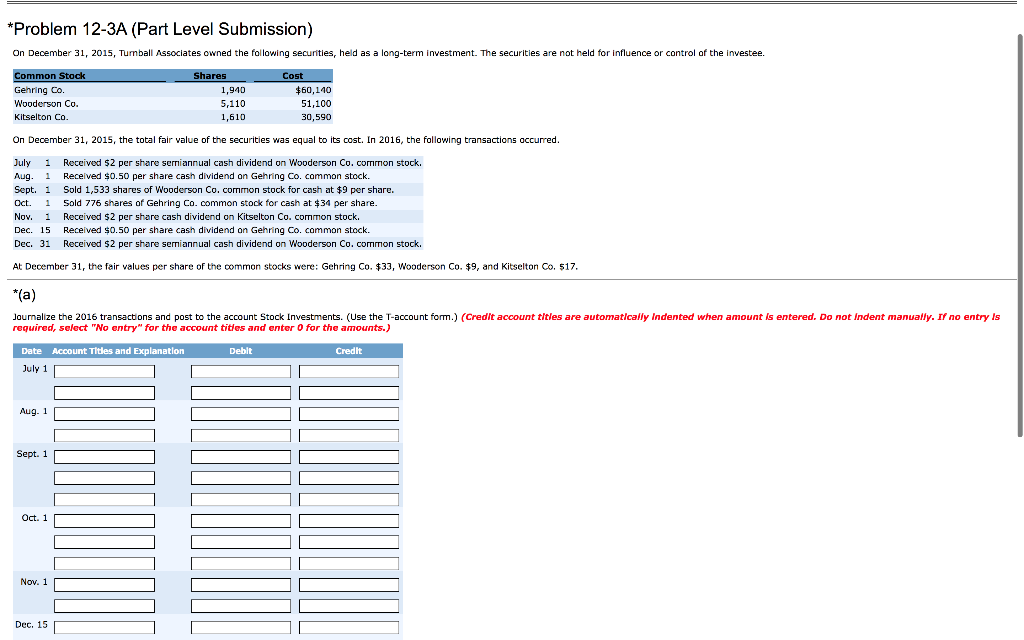

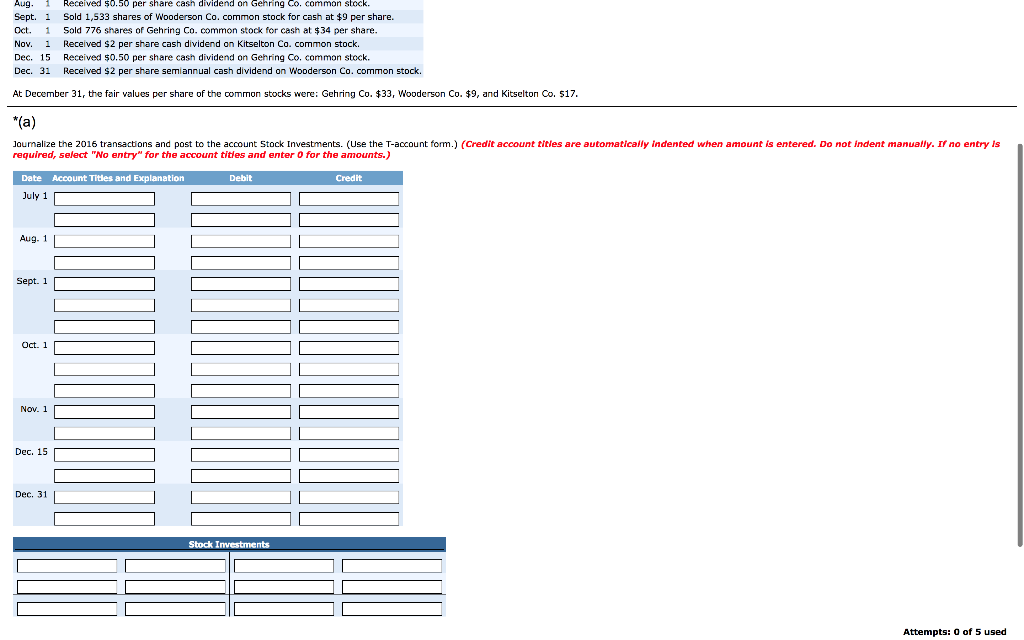

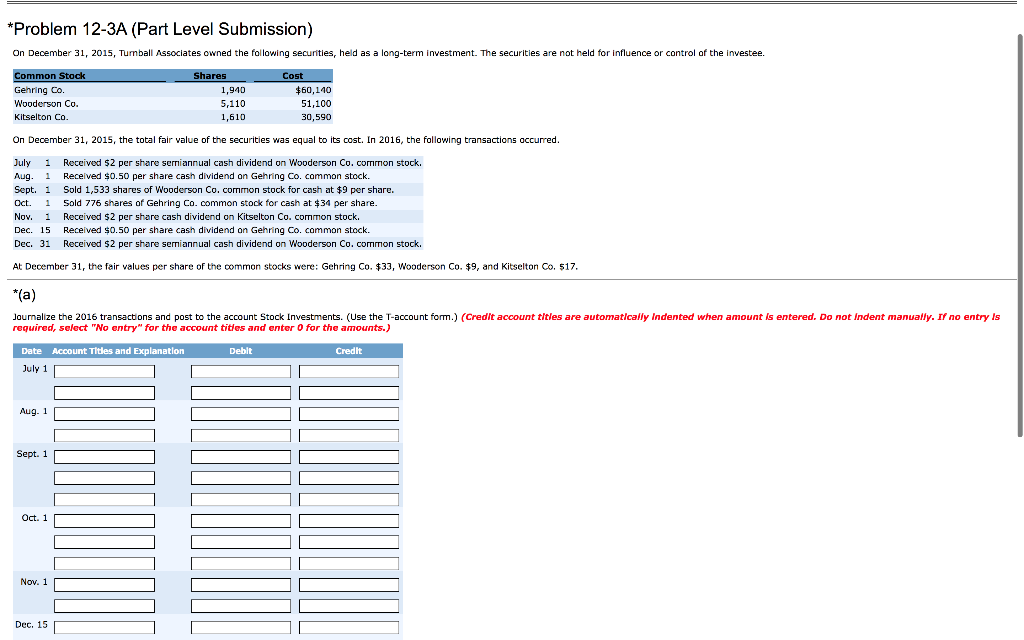

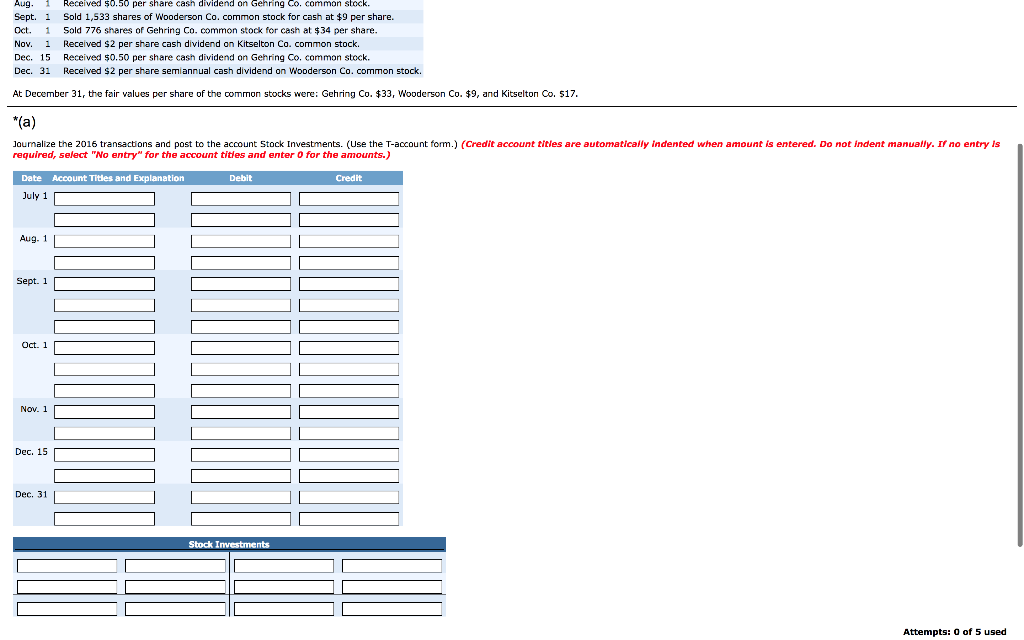

*Problem 12-3A (Part Level Submission) On December 31, 2015, Tumball Associates owned the following securities, held as a long-term investment. The securities are not held for influence or control of the investee. Shares ommon Gehring Co. Wooderson Co. Kitselton Co. ost 1,940 5,110 1,610 60,140 51,100 30,590 On December 31, 2015, the total fair value of the securities was equal to its cost. In 2016, the following transactions occurred. July 1 Received $2 per share semiannual cash dividend on Wooderson Co. common stock Aug. 1 Received $0.50 per share cash dividend on Gehring Co. cammon stock. Sept. 1 Sold 1,533 shares of Wooderson Co. common stock for cash at $9 per share. Oct. Sold 776 shares of Gehring Co. common stock for cash at $34 per share. Nov. 1 Received $2 per share cash dividend on Kitselton Co. common stock. Dec. 15 Received $0.50 per share cash dividend on Gehring Co. cammon stock. Dec. 31 Received $2 per share semiannual cash dividend on Wooderson Co. common stock At December 31, the fair values per share of the common stocks were: Gehring Co.33, wooderson Co. 9, and Kitselton Co. 517 Journalize the 2016 transact ons and post to the account Stock Investments. (Use the T-account form.) (Credit account titles are automatically Indented when amount is entered. Do not Indent manually. If no entry Is required, select "No entry" for the account titdes and enter 0 for the amounts.) Date Account Titles and Explanation July 1 Debit Credit Aug. 1 Sept. 1 Oct. 1 Nov. 1 Dec. 15 Aug. 1 Received so.50 per share casn dividend on Gehring Co. common stock Sept. 1 Sold 1,533 shares of Wooderson Co. common stock for cash at $9 per share. Oct. 1 Sold 776 shares of Gehring Co. common stock for cash at $34 per share Nov. 1 Received $2 per share cash dividend on Kitselton Ca. common stock. Dec. 15 Received $0.50 per share cash dividend on Gehring Co. common steck. Dec. 31 Received $2 per share semiannual cash dividend on Wooderson Co. common stock. At December 31, the fair values per share ofthe oommon stocks were: Gehring Co-$33, Wooderson Co.9, and Kitselton Co. S17 Journalize the 2016 transactions and post to the account Stock Investments. (Use the T-account form.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titdes and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit July 1 Aug. 1 Sept. 1 oct. 1 Nov. 1 Dec. 15 Dec. 31 Attempts: of 5 used