Answered step by step

Verified Expert Solution

Question

1 Approved Answer

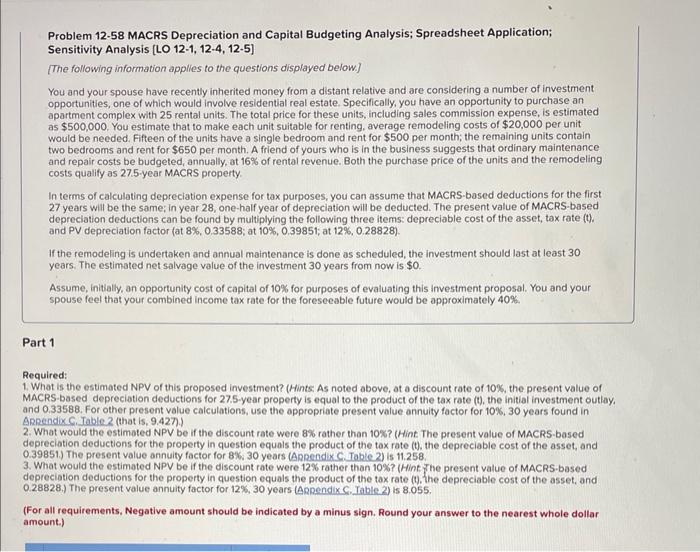

Problem 12-58 MACRS Depreciation and Capital Budgeting Analysis; Spreadsheet Application; Sensitivity Analysis (LO 12-1, 12-4, 12-5] [The following information applies to the questions displayed

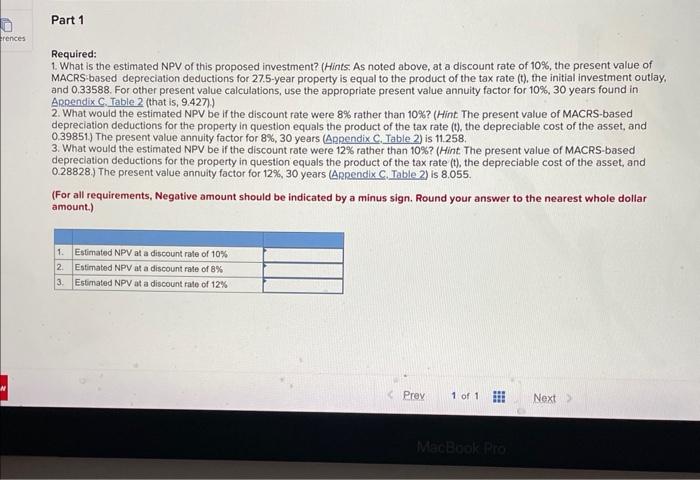

Problem 12-58 MACRS Depreciation and Capital Budgeting Analysis; Spreadsheet Application; Sensitivity Analysis (LO 12-1, 12-4, 12-5] [The following information applies to the questions displayed below.] You and your spouse have recently inherited money from a distant relative and are considering a number of investment opportunities, one of which would involve residential real estate. Specifically, you have an opportunity to purchase an apartment complex with 25 rental units. The total price for these units, including sales commission expense, is estimated as $500,000. You estimate that to make each unit suitable for renting, average remodeling costs of $20,000 per unit would be needed. Fifteen of the units have a single bedroom and rent for $500 per month; the remaining units contain two bedrooms and rent for $650 per month. A friend of yours who is in the business suggests that ordinary maintenance and repair costs be budgeted, annually, at 16% of rental revenue. Both the purchase price of the units and the remodeling costs qualify as 27.5-year MACRS property. In terms of calculating depreciation expense for tax purposes, you can assume that MACRS-based deductions for the first 27 years will be the same; in year 28, one-half year of depreciation will be deducted. The present value of MACRS-based depreciation deductions can be found by multiplying the following three items: depreciable cost of the asset, tax rate (t). and PV depreciation factor (at 8%, 0.33588; at 10%, 0.39851; at 12%, 0.28828). If the remodeling is undertaken and annual maintenance is done as scheduled, the investment should last at least 30 years. The estimated net salvage value of the investment 30 years from now is $0. Assume, initially, an opportunity cost of capital of 10% for purposes of evaluating this investment proposal. You and your spouse feel that your combined income tax rate for the foreseeable future would be approximately 40%. Part 1 Required: 1. What is the estimated NPV of this proposed investment? (Hints: As noted above, at a discount rate of 10%, the present value of MACRS-based depreciation deductions for 27.5-year property is equal to the product of the tax rate (t), the initial investment outlay, and 0.33588. For other present value calculations, use the appropriate present value annuity factor for 10%, 30 years found in ARRendix C. Table 2 (that is, 9.427).) 2. What would the estimated NPV be if the discount rate were 8% rather than 10%? (Hint. The present value of MACRS-based depreciation deductions for the property in question equals the product of the tax rate (t), the depreciable cost of the asset, and 0.39851.) The present value annuity factor for 8%, 30 years (Appendix C. Table 2) is 11.258. 3. What would the estimated NPV be if the discount rate were 12% rather than 10% ? (Hint The present value of MACRS-based depreciation deductions for the property in question equals the product of the tax rate (t), the depreciable cost of the asset, and 0.28828.) The present value annuity factor for 12%, 30 years (Appendix C. Table 2) is 8.055. (For all requirements, Negative amount should be indicated by a minus sign. Round your answer to the nearest whole dollar amount.) erences Part 1 Required: 1. What is the estimated NPV of this proposed investment? (Hints. As noted above, at a discount rate of 10%, the present value of MACRS-based depreciation deductions for 27.5-year property is equal to the product of the tax rate (t), the initial investment outlay, and 0.33588. For other present value calculations, use the appropriate present value annuity factor for 10%, 30 years found in Appendix C. Table 2 (that is, 9.427).) 2. What would the estimated NPV be if the discount rate were 8% rather than 10% ? (Hint. The present value of MACRS-based depreciation deductions for the property in question equals the product of the tax rate (t), the depreciable cost of the asset, and 0.39851.) The present value annuity factor for 8%, 30 years (Appendix C. Table 2) is 11.258. 3. What would the estimated NPV be if the discount rate were 12% rather than 10% ? (Hint. The present value of MACRS-based depreciation deductions for the property in question equals the product of the tax rate (t), the depreciable cost of the asset, and 0.28828.) The present value annuity factor for 12%, 30 years (Appendix C. Table 2) is 8.055. (For all requirements, Negative amount should be indicated by a minus sign. Round your answer to the nearest whole dollar amount.) 1. Estimated NPV at a discount rate of 10% 2. Estimated NPV at a discount rate of 8% 3. Estimated NPV at a discount rate of 12% MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started