Answered step by step

Verified Expert Solution

Question

1 Approved Answer

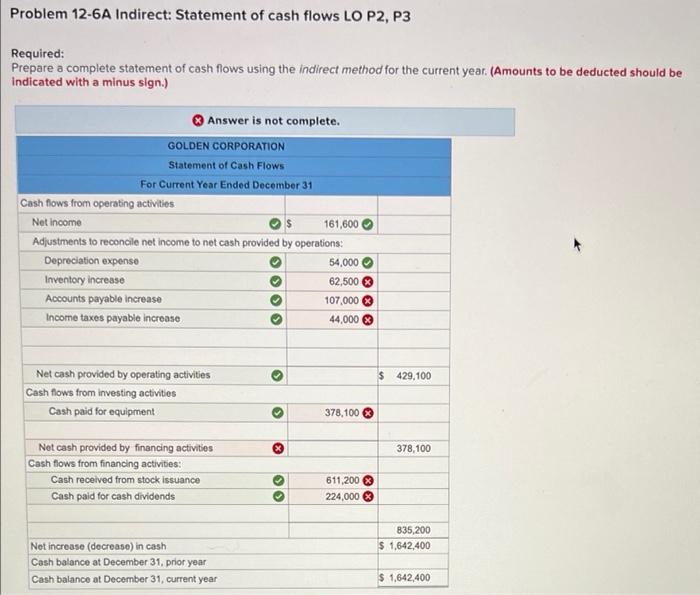

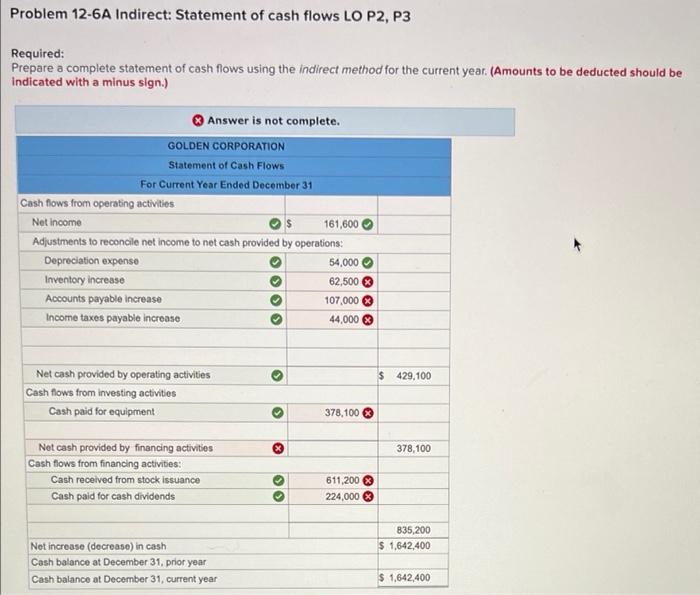

Problem 12-6A Indirect: Statement of cash flows LO P2, P3 Required information Use the following information for the Problems below. [The following information applies to

Problem 12-6A Indirect: Statement of cash flows LO P2, P3

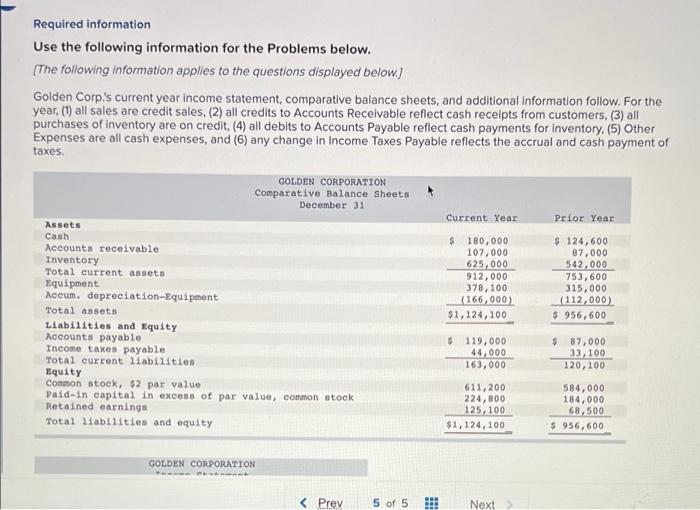

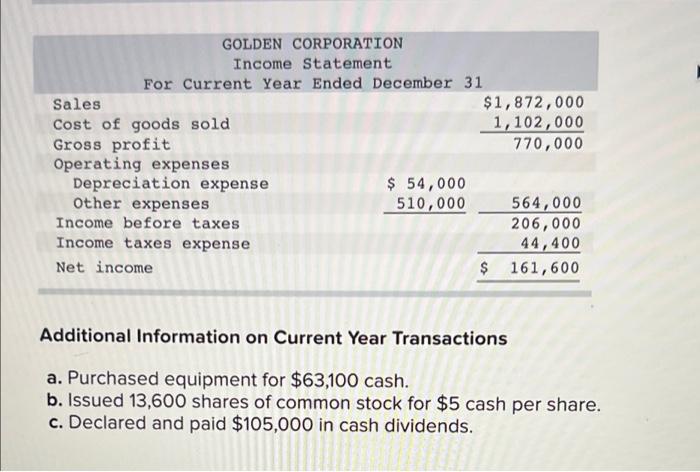

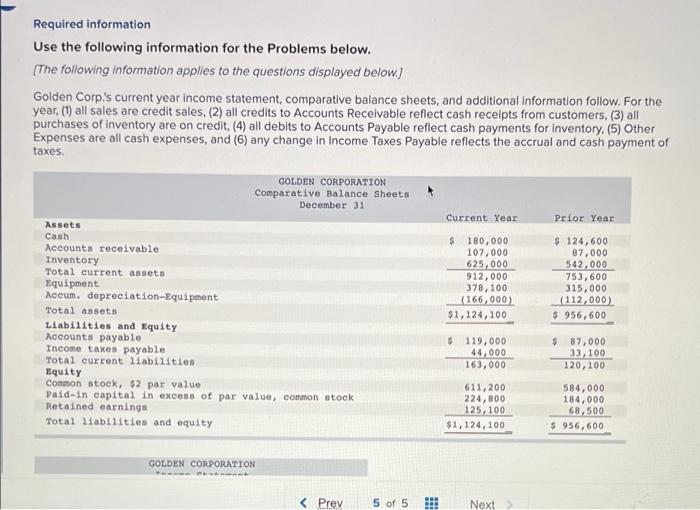

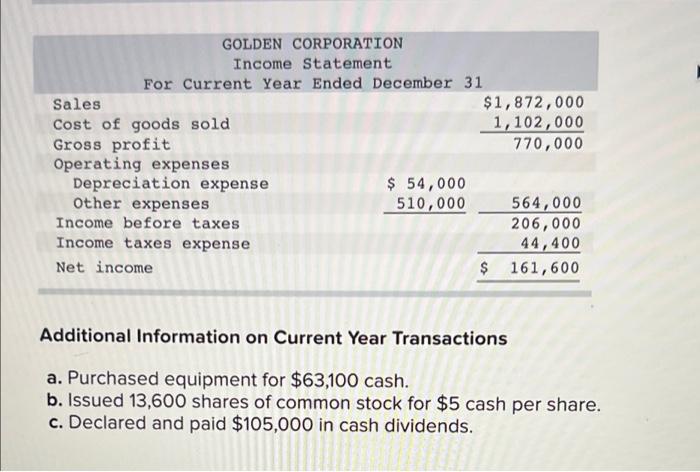

Required information Use the following information for the Problems below. [The following information applies to the questions displayed below.) Golden Corp's current year income statement, comparative balance sheets, and additional Information follow. For the year. (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory (5) Other Expenses are all cash expenses, and (6) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. GOLDEN CORPORATION Comparative Balance Sheets December 31 Current Year Prior Year $ 180,000 107.000 625,000 912,000 378,100 (166.000) $1,124,100 $ 124,600 87,000 542,000 753,600 315,000 (112,000) $ 956, 600 Assets Cash Accounts receivable Inventory Total current assets Equipment Accum. depreciation-Equipment Total assets Liabilities and Equity Accounts payable Income taxes payable Total current liabilities Equity Common stock, $2 par value Paid-in capital in excess of par value, common stock Retained earnings Total liabilities and equity $ 119,000 44,000 163,000 $ 87,000 33,100 120,100 611,200 224,800 125,100 $1,124,100 584,000 184,000 68,500 5.956,600 GOLDEN CORPORATION

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started