Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 12-8A 2014 Jun. 10 Adam Buckner and Amber Kwan have agreed to pool their assets and form a partnership to be called B&K Consulting.

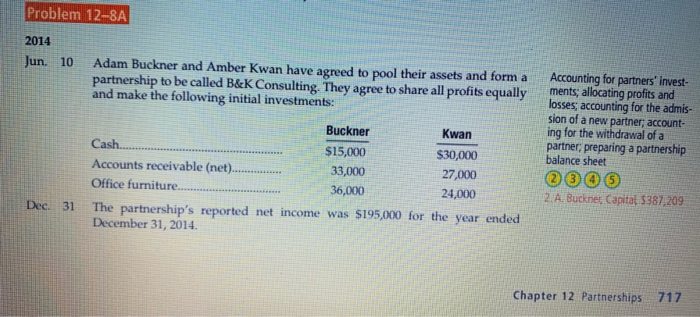

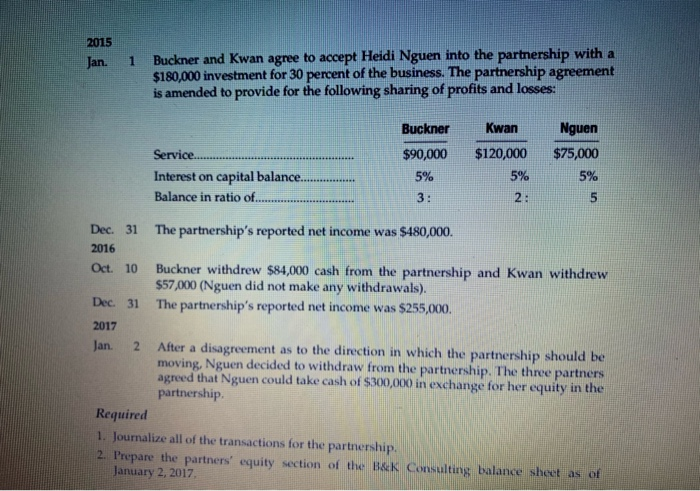

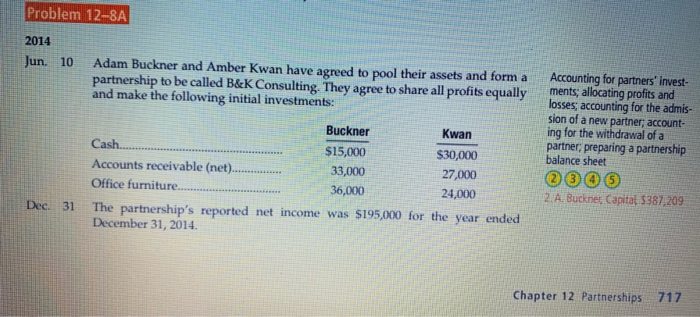

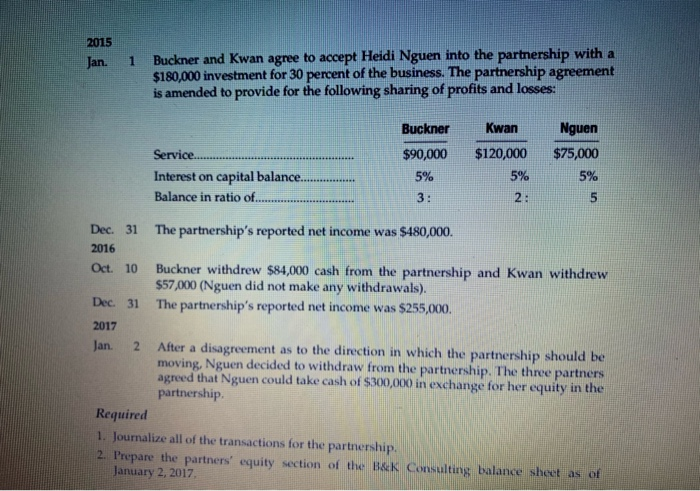

Problem 12-8A 2014 Jun. 10 Adam Buckner and Amber Kwan have agreed to pool their assets and form a partnership to be called B&K Consulting. They agree to share all profits equally and make the following initial investments: Buckner Kwan Cash $15,000 $30,000 Accounts receivable (net)... 33,000 27,000 Office furniture.... 36,000 24,000 The partnership's reported net income was $195,000 for the year ended December 31, 2014 Accounting for partners' invest- ments, allocating profits and losses; accounting for the admis- sion of a new partner, account- ing for the withdrawal of a partner, preparing a partnership balance sheet 2305 2. A Bucknet Capital $387,209 Dec. 31 Chapter 12 Partnerships 717 2015 Jan 1 Buckner and Kwan agree to accept Heidi Nguen into the partnership with a $180,000 investment for 30 percent of the business. The partnership agreement is amended to provide for the following sharing of profits and losses: Buckner $90,000 Kwan $120,000 Service Interest on capital balance............. Balance in ratio of.......... Nguen $75,000 5% 5% 3: Dec. 31 The partnership's reported net income was $480,000. 2016 Oct. 10 Buckner withdrew $84,000 cash from the partnership and Kwan withdrew $57,000 (Nguen did not make any withdrawals). Dec. 31 The partnership's reported net income was $255,000. 2017 Jan. 2 After a disagreement as to the direction in which the partnership should be moving, Nguen decided to withdraw from the partnership. The three partners agreed that Nguen could take cash of $300,000 in exchange for her equity in the partnership Required 1. Journalize all of the transactions for the partnership. 2. Prepare the partners' equity section of the B&K Consulting balance sheet as of January 2, 2017

Problem 12-8A 2014 Jun. 10 Adam Buckner and Amber Kwan have agreed to pool their assets and form a partnership to be called B&K Consulting. They agree to share all profits equally and make the following initial investments: Buckner Kwan Cash $15,000 $30,000 Accounts receivable (net)... 33,000 27,000 Office furniture.... 36,000 24,000 The partnership's reported net income was $195,000 for the year ended December 31, 2014 Accounting for partners' invest- ments, allocating profits and losses; accounting for the admis- sion of a new partner, account- ing for the withdrawal of a partner, preparing a partnership balance sheet 2305 2. A Bucknet Capital $387,209 Dec. 31 Chapter 12 Partnerships 717 2015 Jan 1 Buckner and Kwan agree to accept Heidi Nguen into the partnership with a $180,000 investment for 30 percent of the business. The partnership agreement is amended to provide for the following sharing of profits and losses: Buckner $90,000 Kwan $120,000 Service Interest on capital balance............. Balance in ratio of.......... Nguen $75,000 5% 5% 3: Dec. 31 The partnership's reported net income was $480,000. 2016 Oct. 10 Buckner withdrew $84,000 cash from the partnership and Kwan withdrew $57,000 (Nguen did not make any withdrawals). Dec. 31 The partnership's reported net income was $255,000. 2017 Jan. 2 After a disagreement as to the direction in which the partnership should be moving, Nguen decided to withdraw from the partnership. The three partners agreed that Nguen could take cash of $300,000 in exchange for her equity in the partnership Required 1. Journalize all of the transactions for the partnership. 2. Prepare the partners' equity section of the B&K Consulting balance sheet as of January 2, 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started