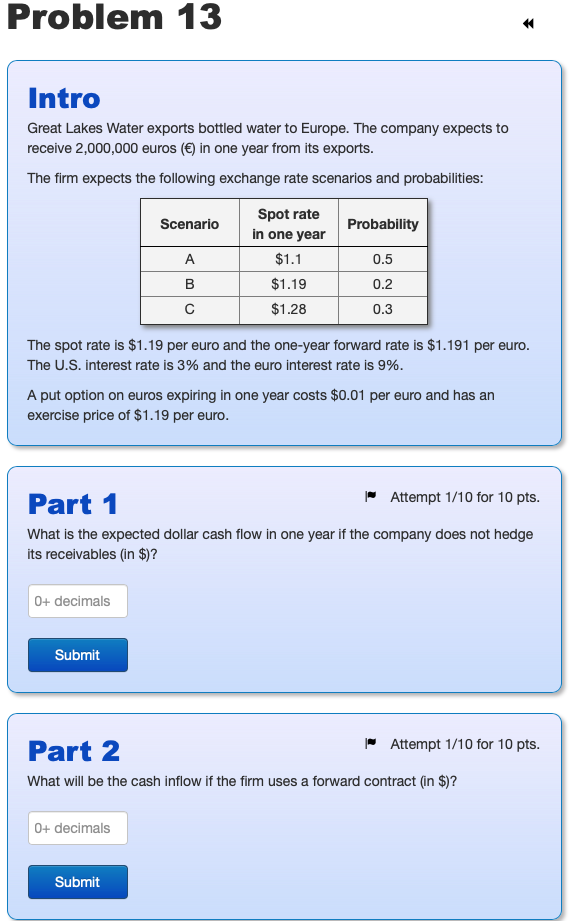

Problem 13 Intro Great Lakes Water exports bottled water to Europe. The company expects to receive 2,000,000 euros () in one year from its exports. The firm expects the following exchange rate scenarios and probabilities: Scenario Probability A Spot rate in one year $1.1 $1.19 $1.28 0.5 B 0.2 0.3 The spot rate is $1.19 per euro and the one-year forward rate is $1.191 per euro. The U.S. interest rate is 3% and the euro interest rate is 9%. A put option on euros expiring in one year costs $0.01 per euro and has an exercise price of $1.19 per euro. Part 1 | Attempt 1/10 for 10 pts. What is the expected dollar cash flow in one year if the company does not hedge its receivables (in $)? 0+ decimals Submit Part 2 Attempt 1/10 for 10 pts. What will be the cash inflow if the firm uses a forward contract (in $)? 0+ decimals Submit Part 3 | Attempt 1/10 for 10 pts. What is the value of the receivables in one year with a money market hedge (in $)? 0+ decimals Submit Part 4 | Attempt 1/10 for 10 pts. What is the expected value of the receivables in one year with the put option hedge (in $)? 0+ decimals Submit - Attempt 1/5 for 10 pts. Part 5 What is the optimal strategy for the company? Money market hedge Forward contract No hedging Put options Submit Part 6 | Attempt 1/10 for 10 pts. If the exchange rate turns out to be $1.37 per euro in one year, what was the cost of hedging (in $)? 0+ decimals Submit Problem 13 Intro Great Lakes Water exports bottled water to Europe. The company expects to receive 2,000,000 euros () in one year from its exports. The firm expects the following exchange rate scenarios and probabilities: Scenario Probability A Spot rate in one year $1.1 $1.19 $1.28 0.5 B 0.2 0.3 The spot rate is $1.19 per euro and the one-year forward rate is $1.191 per euro. The U.S. interest rate is 3% and the euro interest rate is 9%. A put option on euros expiring in one year costs $0.01 per euro and has an exercise price of $1.19 per euro. Part 1 | Attempt 1/10 for 10 pts. What is the expected dollar cash flow in one year if the company does not hedge its receivables (in $)? 0+ decimals Submit Part 2 Attempt 1/10 for 10 pts. What will be the cash inflow if the firm uses a forward contract (in $)? 0+ decimals Submit Part 3 | Attempt 1/10 for 10 pts. What is the value of the receivables in one year with a money market hedge (in $)? 0+ decimals Submit Part 4 | Attempt 1/10 for 10 pts. What is the expected value of the receivables in one year with the put option hedge (in $)? 0+ decimals Submit - Attempt 1/5 for 10 pts. Part 5 What is the optimal strategy for the company? Money market hedge Forward contract No hedging Put options Submit Part 6 | Attempt 1/10 for 10 pts. If the exchange rate turns out to be $1.37 per euro in one year, what was the cost of hedging (in $)? 0+ decimals Submit