Answered step by step

Verified Expert Solution

Question

1 Approved Answer

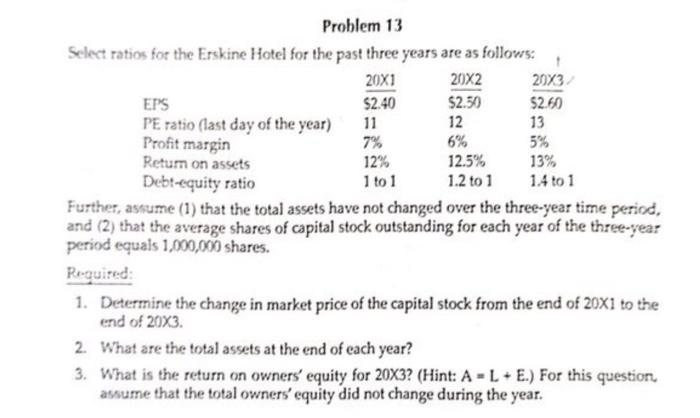

Problem 13 Select ratios for the Erskine Hotel for the past three years are as follows: 20X1 20X2 $2.40 $2.50 11 12 7% 6% 12.5%

Problem 13 Select ratios for the Erskine Hotel for the past three years are as follows: 20X1 20X2 $2.40 $2.50 11 12 7% 6% 12.5% 1.2 to 1 EPS PE ratio (last day of the year) Profit margin Return on assets 12% 1 to 1 20X3/ $2.60 13 5% 13% 1.4 to 1 Debt-equity ratio Further, assume (1) that the total assets have not changed over the three-year time period, and (2) that the average shares of capital stock outstanding for each year of the three-year period equals 1,000,000 shares. Required: 1. Determine the change in market price of the capital stock from the end of 20X1 to the end of 20X3. 2. What are the total assets at the end of each year? 3. What is the return on owners' equity for 20X3? (Hint: A = L + E.) For this question, assume that the total owners' equity did not change during the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started