Answered step by step

Verified Expert Solution

Question

1 Approved Answer

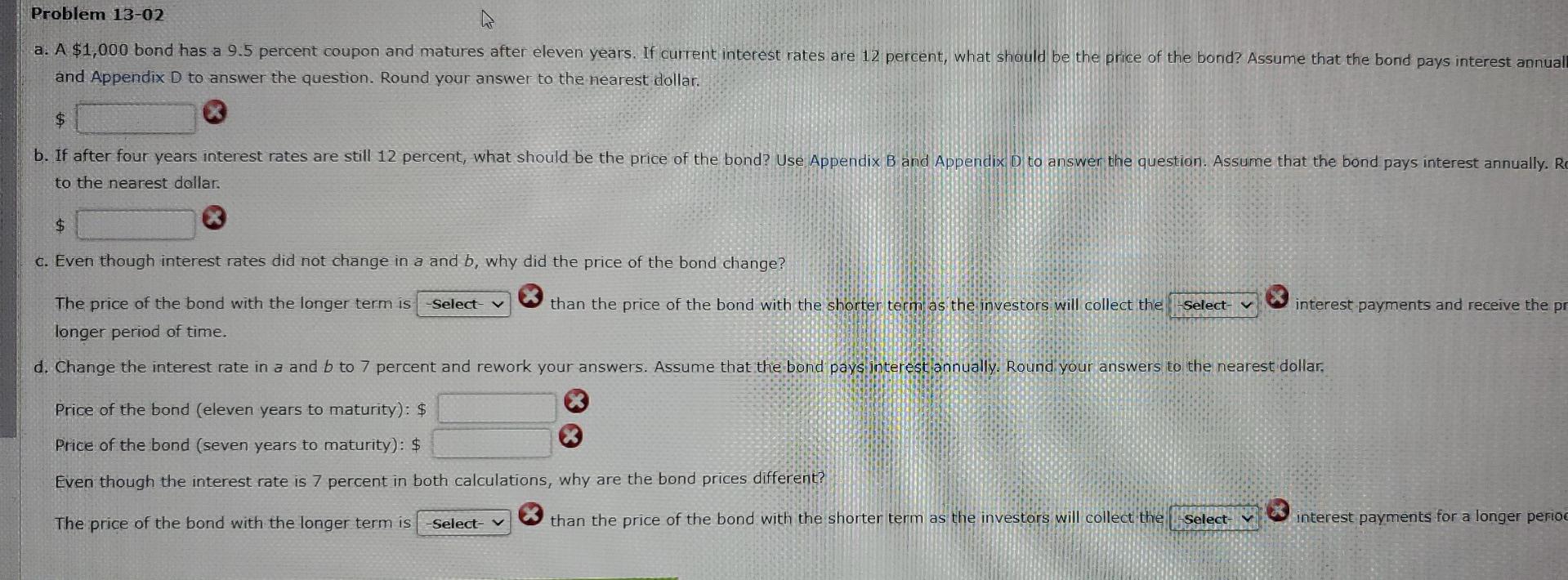

Problem 13-02 a. A $1,000 bond has a 9.5 percent coupon and matures after eleven years. If current interest rates are 12 percent, what should

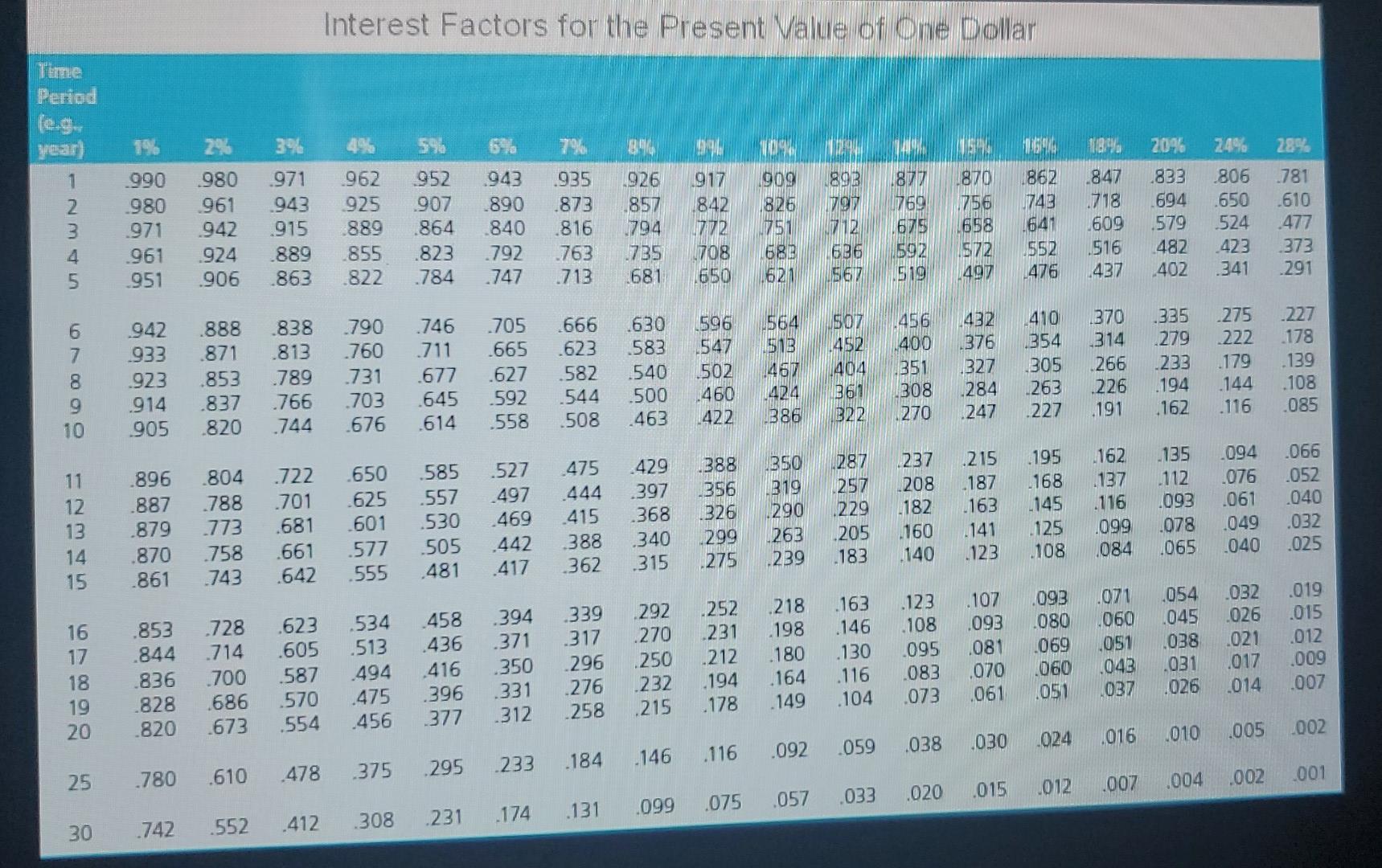

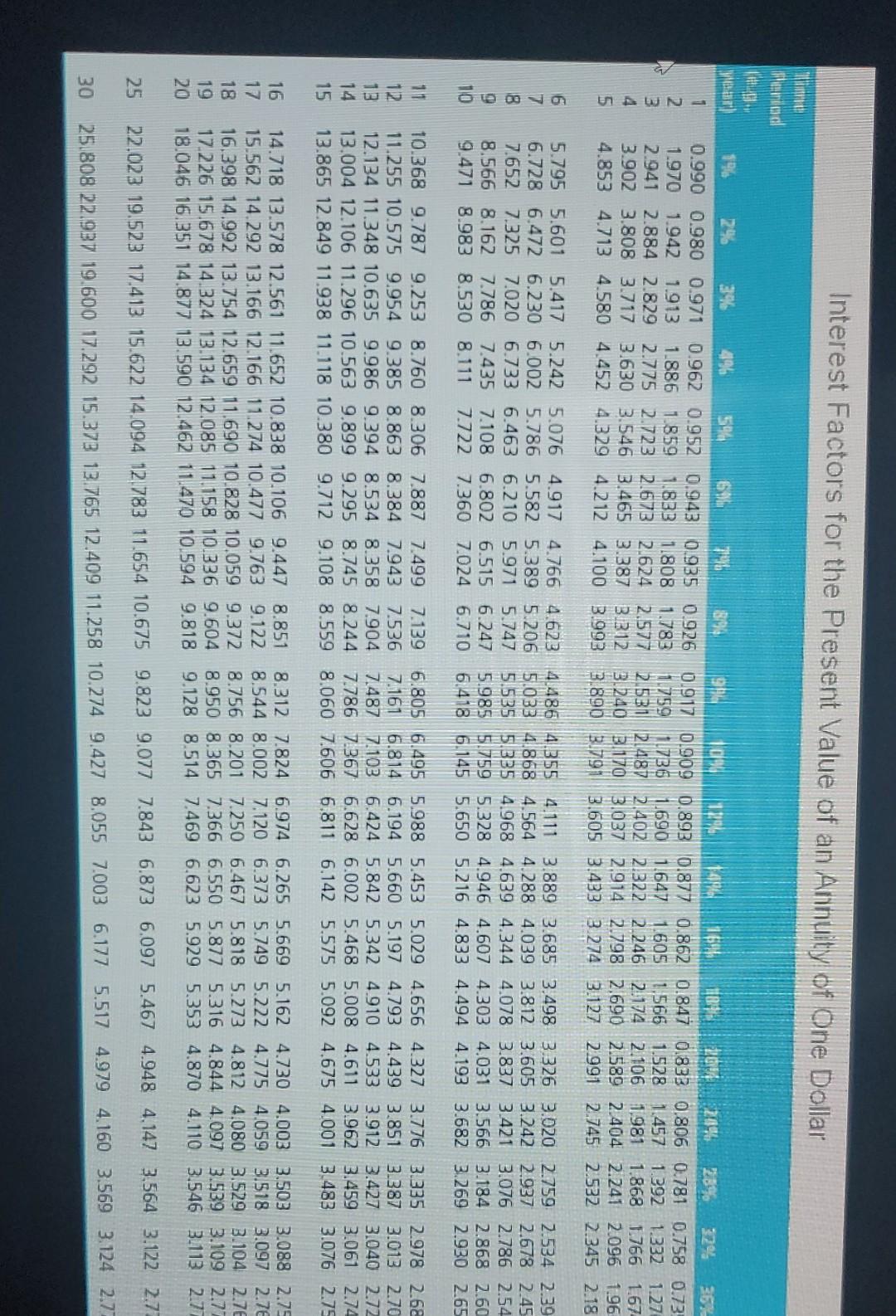

Problem 13-02 a. A $1,000 bond has a 9.5 percent coupon and matures after eleven years. If current interest rates are 12 percent, what should be the price of the bond? Assume that the bond pays interest annual and Appendix D to answer the question. Round your answer to the nearest dollar. $ b. If after four years interest rates are still 12 percent, what should be the price of the bond? Use Appendix B and Appendix D to answer the question. Assume that the bond pays interest annually. Re to the nearest dollar. $ C. Even though interest rates did not change in a and b, why did the price of the bond change? -Select- than the price of the bond with the shorter term as the investors will collect the Select- interest payments and receive the pr The price of the bond with the longer term is longer period of time. d. Change the interest rate in a and b to 7 percent and rework your answers. Assume that the bond pays interest annually. Round your answers to the nearest dollar, Price of the bond (eleven years to maturity): $ Price of the bond (seven years to maturity): $ Even though the interest rate is 7 percent in both calculations, why are the bond prices different? The price of the bond with the longer term is -Select- than the price of the bond with the shorter term as the investors will collect the Select- interest payments for a longer period Interest Factors for the Present Value of an Annuity of One Dollar Beriod . Wear) 1 2 3 4 5 WN 1936 2%. 3% 4% 59 6% B9% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 9 10% 120 14 16% 2014 2044 28% 32% 363 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.73 1.759 1736 1.690 1.647 1.605 1.566 1.528 1.457 1292 1.332 1.27 2.531 21487 2.402 2.322 2.246 2.174 2.106 1981 1.868 1766 167 3.240 31170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1.96 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.18 ma 6 7 8 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.39 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.45 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.54 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.60 9.471 8.983 8.530 8.111 7.722 7.360 7024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.65 10 11 12 13 14 15 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.62 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.70 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.72 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.74 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 275 16 17 18 19 20 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.75 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4.059 3.518 3.097 2.70 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 27 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.097 3.539 3.109 2.77 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 277 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.73 30 25.808 22.987 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started