Answered step by step

Verified Expert Solution

Question

1 Approved Answer

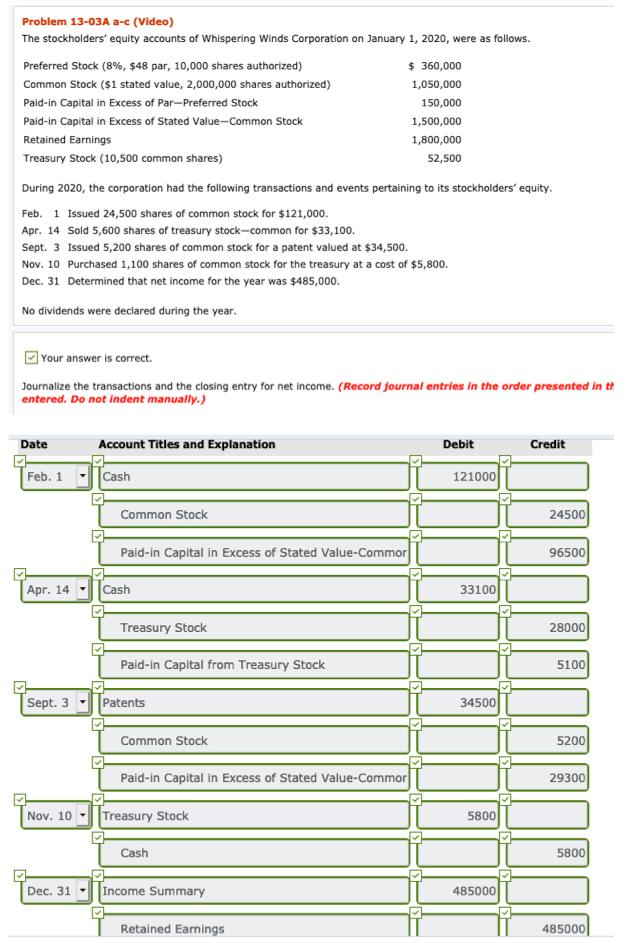

Problem 13-03A a-c (Video) The stockholders' equity accounts of Whispering Winds Corporation on January 1, 2020, were as follows. Preferred Stock (8%, $48 par,

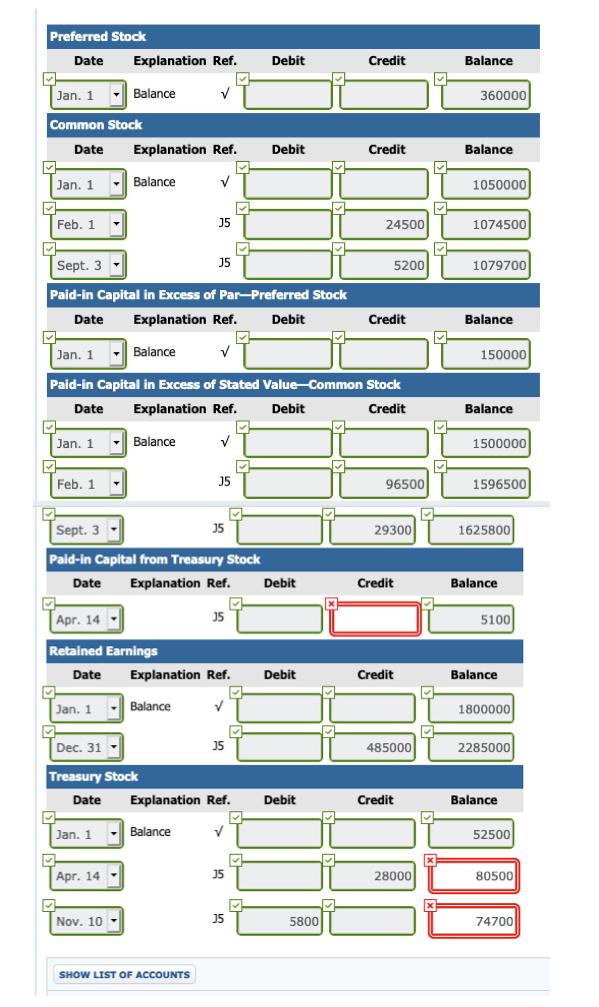

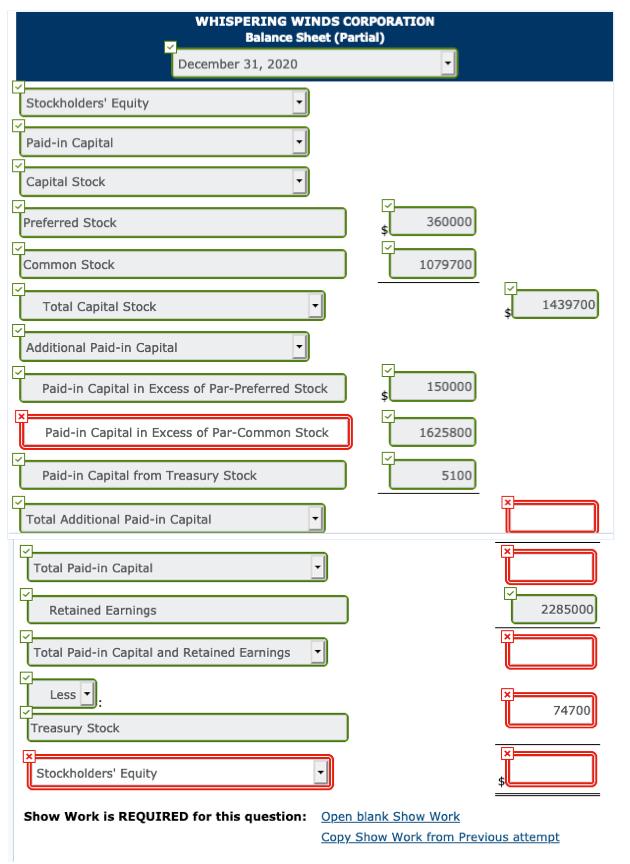

Problem 13-03A a-c (Video) The stockholders' equity accounts of Whispering Winds Corporation on January 1, 2020, were as follows. Preferred Stock (8%, $48 par, 10,000 shares authorized) Common Stock ($1 stated value, 2,000,000 shares authorized) Paid-in Capital in Excess of Par-Preferred Stock Paid-in Capital in Excess of Stated Value-Common Stock Retained Earnings Treasury Stock (10,500 common shares) During 2020, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Issued 24,500 shares of common stock for $121,000. Apr. 14 Sold 5,600 shares of treasury stock-common for $33,100. Sept. 3 Issued 5,200 shares of common stock for a patent valued at $34,500. Nov. 10 Purchased 1,100 shares of common stock for the treasury at a cost of $5,800. Dec. 31 Determined that net income for the year was $485,000. No dividends were declared during the year. Date Your answer is correct. Journalize the transactions and the closing entry for net income. (Record journal entries in the order presented in th entered. Do not indent manually.) Feb. 1 Sept. 31 Nov. 10 Account Titles and Explanation Dec. 31 Cash Apr. 14 Cash Common Stock Paid-in Capital in Excess of Stated Value-Commor Treasury Stock Paid-in Capital from Treasury Stock Patents Common Stock Paid-in Capital in Excess of Stated Value-Commor Treasury Stock Cash $360,000 1,050,000 150,000 Income Summary 1,500,000 1,800,000 52,500 Retained Earnings Debit 121000 33100 34500 5800 485000 Credit 24500 96500 28000 5100 5200 29300 5800 485000 Preferred Stock Date Jan. 1 Jan. 1 Common Stock Date Feb. 1 Date Date Jan. 1 Feb. 1 Date Explanation Ref. Balance Jan. 1 Sept. 3 Paid-in Capital in Excess of Par-Preferred Stock Explanation Ref. Debit V Jan. 1 Explanation Ref. Balance Apr. 14 - Apr. 14 Retained Earnings Date Nov. 10 Balance Dec. 31 Treasury Stock Date V Jan. 1 Balance Paid-in Capital in Excess of Stated Value-Common Stock Explanation Ref. Credit Balance V J5 Sept. 3 Paid-in Capital from Treasury Stock Explanation Ref. J5 Balance SHOW LIST OF ACCOUNTS J5 J5 Explanation Ref. 35 V J5 Explanation Ref. M V 35 35 M M Debit Debit F Debit Debit Debit Debit 5800 Credit x Credit 24500 5200 Credit 96500 29300 Credit Credit 485000 Credit 28000 P D F X= x Balance 360000 Balance 1050000 1074500 1079700 Balance 150000 Balance 1500000 1596500 1625800 Balance 5100 Balance 1800000 2285000 Balance 52500 80500 74700 Stockholders' Equity Paid-in Capital Capital Stock Preferred Stock Common Stock Total Capital Stock Additional Paid-in Capital Paid-in Capital in Excess of Par-Preferred Stock Paid-in Capital in Excess of Par-Common Stock Paid-in Capital from Treasury Stock WHISPERING WINDS CORPORATION Balance Sheet (Partial) December 31, 2020 Total Additional Paid-in Capital Total Paid-in Capital Retained Earnings Total Paid-in Capital and Retained Earnings Less Treasury Stock Stockholders' Equity | > | 360000 1079700 150000 1625800 5100 Show Work is REQUIRED for this question: Open blank Show Work 1439700 000000 2285000 74700 Copy Show Work from Previous attempt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Paidin Capital from Treasury Stock Date Explanation ref Apr 14 Treasury Stock Date Jan 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started