Answered step by step

Verified Expert Solution

Question

1 Approved Answer

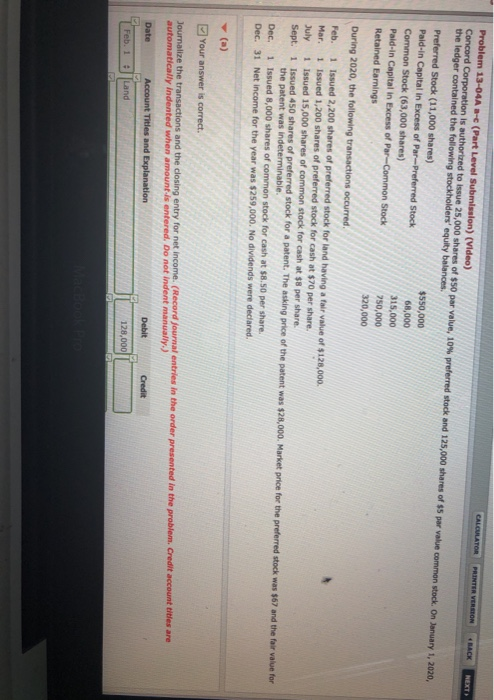

Problem 13-04A a-c (Part Level Submisslon) (Video) to issue 25,000 shares of $50 par value, 10% preferred stock and 12 5,000 shares of $5 par

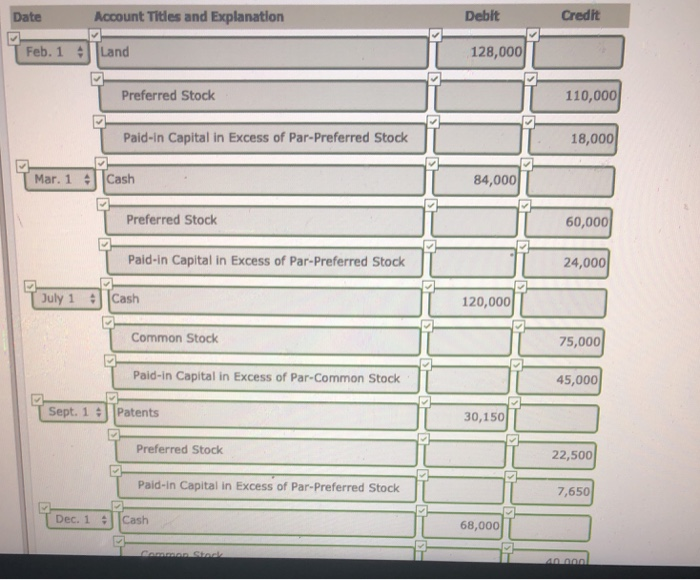

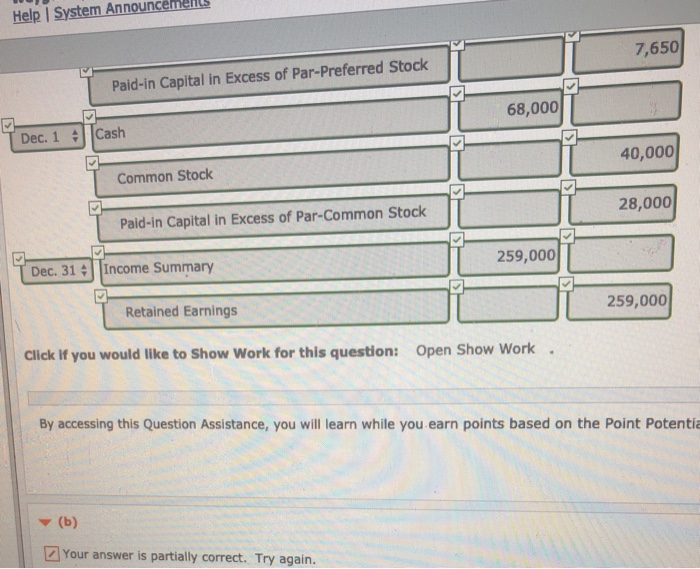

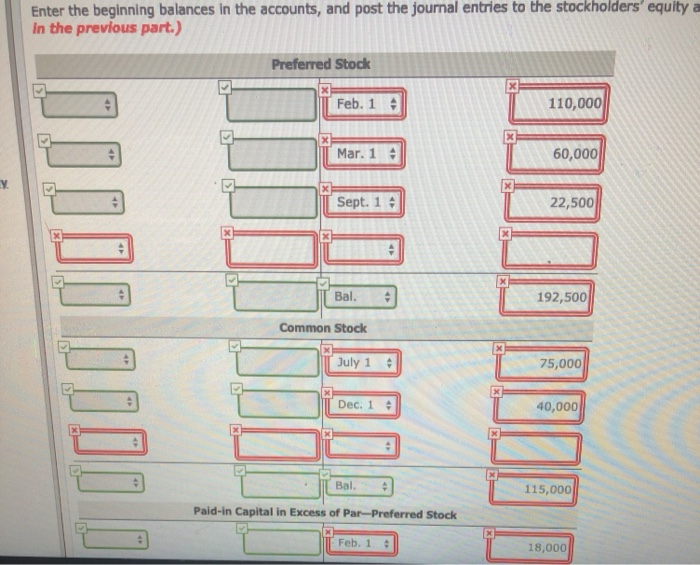

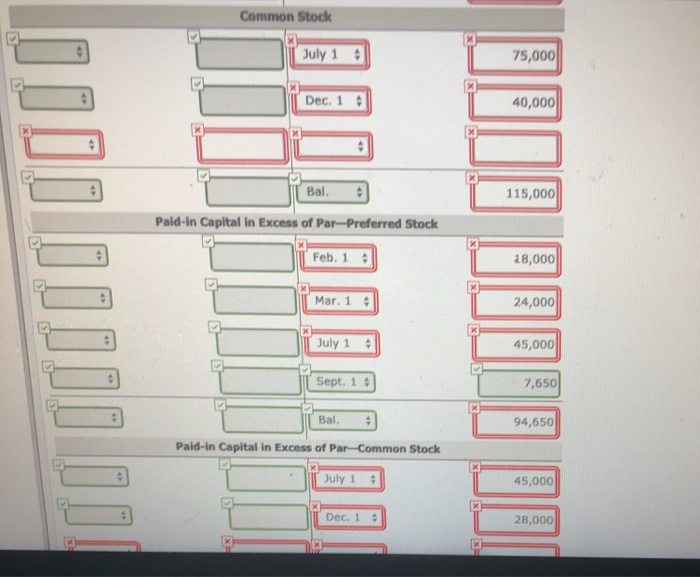

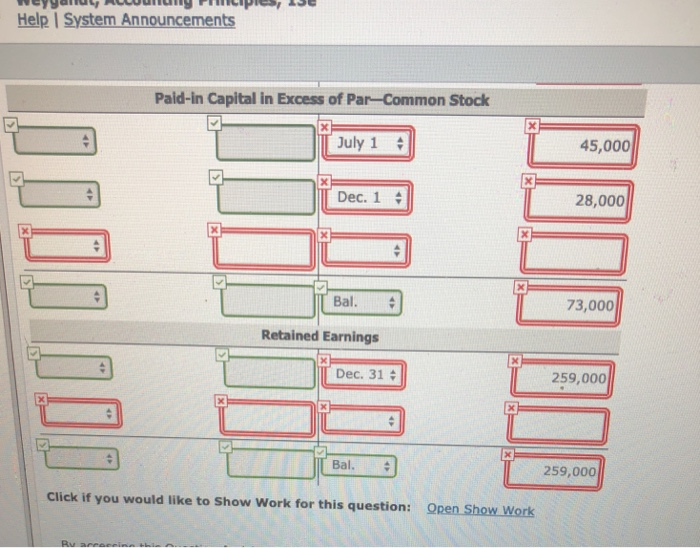

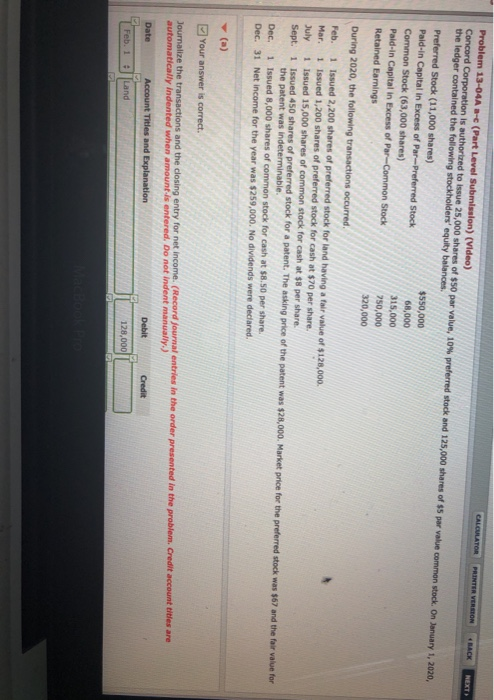

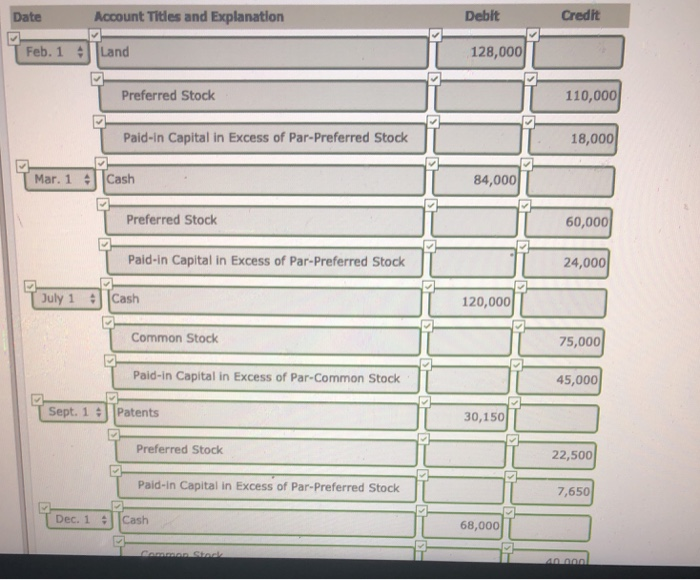

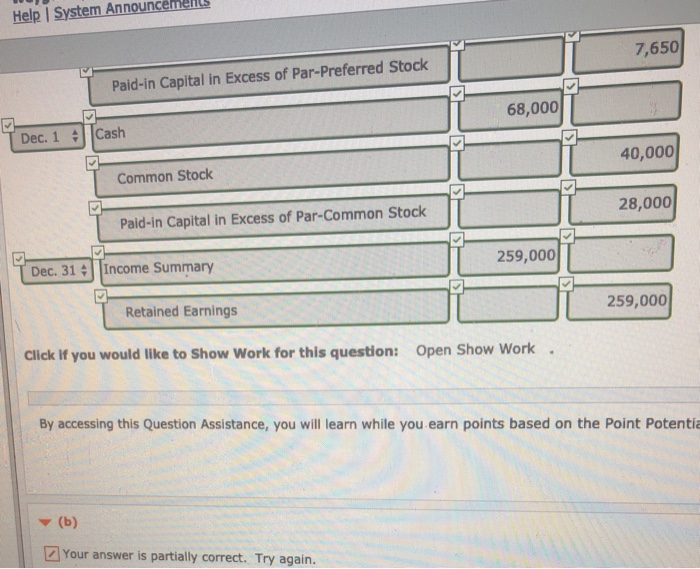

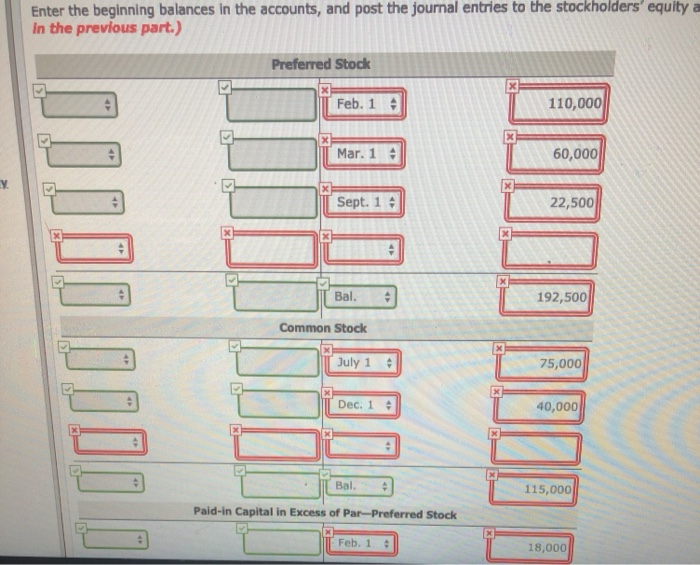

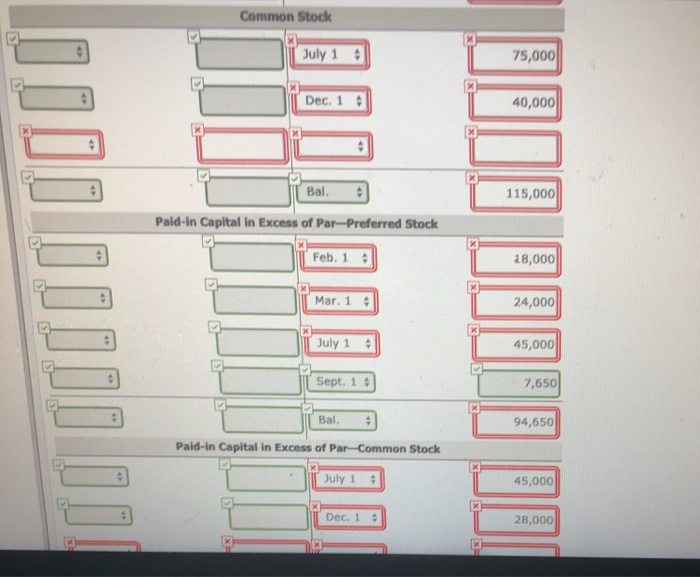

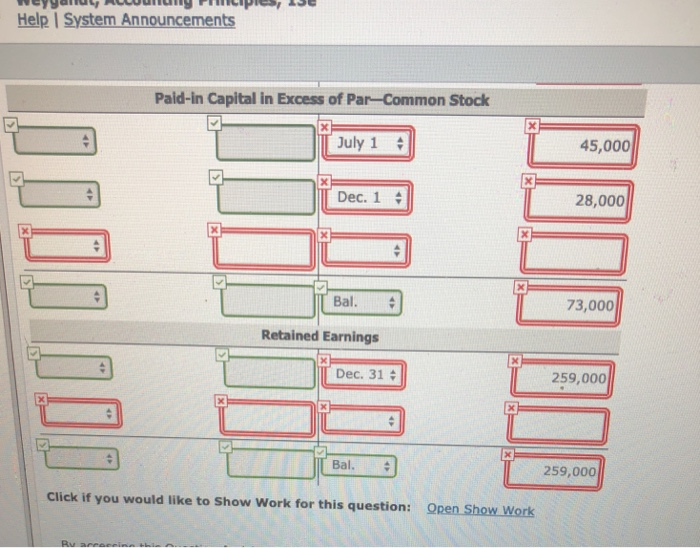

Problem 13-04A a-c (Part Level Submisslon) (Video) to issue 25,000 shares of $50 par value, 10% preferred stock and 12 5,000 shares of $5 par value o mmon stock. On January 1 2020 the ledger contained the following stockholders' equity balances. Preferred Stock (11,000 shares) Paid-in Capital in Excess of Par--pPreferred Stock Common Stock (63,000 shares) Pald-in Capital in Excess of Par-Common Stock Retained Earnings $550,000 68,000 315,000 750,000 320,000 During 2020, the following transactions occurred Feb. 1 Issued 2,200 shares of preferred stock for land having a fair value of $128,000 Mar. 1 Issued 1,200 shares of preferred stock for cash at $70 per share. July 1 Issued 15,000 shares of common stock for cash at $8 per share Sept. 1 Issued 450 shares of preferred stock for a patent. The asking price of the patent was $28,000. Market price for the preferred stock was $67 and the fair value for the patent was indeterminable Dec. 1 Issued 8,000 shares of common stock for cash at $8.50 per share. Dec. 31 Net income for the year was $259,000. No dividends were deciared Y (a) presented in the problem. Credit account titles are Journalize the transactions and the closing entry for net income. (Record journal entries in the order when amount-is entered. Do not indent manually,) Date Feb. 1 Land Account Titles and Explanation Debit Credit Feb. 1 |Land 128,000 Preferred Stock 110,000 Paid-in Capital in Excess of Par-Preferred Stock 18,000 Mar. 1 |Cash 84,000 Preferred Stock 60,000 Paid-in Capital in Excess of Par-Preferred Stock 24,000 uly 1 Cash 120,000 Common Stock 75,000 Paid-in Capital in Excess of Par-Common Stock 45,000 Sept. 1Patents 30,150 Preferred Stock 22,500 Paid-in Capital in Excess of Par-Preferred Stock 7,650 Dec. 1 Cash 68,000 Help I System Announcenells 7,650 Paid-in Capital in Excess of Par-Preferred Stock 68,000 Dec. 1 :| |Cash Common Stock 40,000 Paid-in Capital in Excess of Par-Common Stock 28,000 Dec. 31 |Income Summary 259,000 Retained Earnings 259,000 Click if you would like to Show Work for this question: Open Show Work . By accessing this Question Assistance, you will learn while you earn points based on the Point Potentia (b) Your answer is partially correct. Try again Enter the beginning balances in the accounts, and post the journal entries to the In the previous part.) stockholders' equity a Preferred Stock Feb. 1 110,000 Mar. 1 60,000 y. Sept. 1 22,500 Bal. 192,500 Common Stock July 1 75,000 Dec. 1 40,000 Bal 115,000 Paid-in Capital in Excess of Par-Preferred Stock Feb. 1 18,000 Common Stock uly 1 75,000 Dec. 1 40,000 Bal. 115,000 Pald-in Capital in Excess of Par-Preferred Stock Feb. 1 18,000 Mar. 1 24,000 45,000 7,650 94,650 July 1 Sept. 1 Bal. Paid-in Capital in Excess of Par-Common Stock uly 1 45,000 Dec. 1 28,000 Help I System Announcements Pald-in Capital in Excess of Par-Common Stock July 1 45,000 Dec. 1 ; 28,000 Ba 73,000 Retained Earnings Dec. 31 259,000 Bal. 259,000 Click if you would like to Show Work for this question: Qpen Show Work

Problem 13-04A a-c (Part Level Submisslon) (Video) to issue 25,000 shares of $50 par value, 10% preferred stock and 12 5,000 shares of $5 par value o mmon stock. On January 1 2020 the ledger contained the following stockholders' equity balances. Preferred Stock (11,000 shares) Paid-in Capital in Excess of Par--pPreferred Stock Common Stock (63,000 shares) Pald-in Capital in Excess of Par-Common Stock Retained Earnings $550,000 68,000 315,000 750,000 320,000 During 2020, the following transactions occurred Feb. 1 Issued 2,200 shares of preferred stock for land having a fair value of $128,000 Mar. 1 Issued 1,200 shares of preferred stock for cash at $70 per share. July 1 Issued 15,000 shares of common stock for cash at $8 per share Sept. 1 Issued 450 shares of preferred stock for a patent. The asking price of the patent was $28,000. Market price for the preferred stock was $67 and the fair value for the patent was indeterminable Dec. 1 Issued 8,000 shares of common stock for cash at $8.50 per share. Dec. 31 Net income for the year was $259,000. No dividends were deciared Y (a) presented in the problem. Credit account titles are Journalize the transactions and the closing entry for net income. (Record journal entries in the order when amount-is entered. Do not indent manually,) Date Feb. 1 Land Account Titles and Explanation Debit Credit Feb. 1 |Land 128,000 Preferred Stock 110,000 Paid-in Capital in Excess of Par-Preferred Stock 18,000 Mar. 1 |Cash 84,000 Preferred Stock 60,000 Paid-in Capital in Excess of Par-Preferred Stock 24,000 uly 1 Cash 120,000 Common Stock 75,000 Paid-in Capital in Excess of Par-Common Stock 45,000 Sept. 1Patents 30,150 Preferred Stock 22,500 Paid-in Capital in Excess of Par-Preferred Stock 7,650 Dec. 1 Cash 68,000 Help I System Announcenells 7,650 Paid-in Capital in Excess of Par-Preferred Stock 68,000 Dec. 1 :| |Cash Common Stock 40,000 Paid-in Capital in Excess of Par-Common Stock 28,000 Dec. 31 |Income Summary 259,000 Retained Earnings 259,000 Click if you would like to Show Work for this question: Open Show Work . By accessing this Question Assistance, you will learn while you earn points based on the Point Potentia (b) Your answer is partially correct. Try again Enter the beginning balances in the accounts, and post the journal entries to the In the previous part.) stockholders' equity a Preferred Stock Feb. 1 110,000 Mar. 1 60,000 y. Sept. 1 22,500 Bal. 192,500 Common Stock July 1 75,000 Dec. 1 40,000 Bal 115,000 Paid-in Capital in Excess of Par-Preferred Stock Feb. 1 18,000 Common Stock uly 1 75,000 Dec. 1 40,000 Bal. 115,000 Pald-in Capital in Excess of Par-Preferred Stock Feb. 1 18,000 Mar. 1 24,000 45,000 7,650 94,650 July 1 Sept. 1 Bal. Paid-in Capital in Excess of Par-Common Stock uly 1 45,000 Dec. 1 28,000 Help I System Announcements Pald-in Capital in Excess of Par-Common Stock July 1 45,000 Dec. 1 ; 28,000 Ba 73,000 Retained Earnings Dec. 31 259,000 Bal. 259,000 Click if you would like to Show Work for this question: Qpen Show Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started