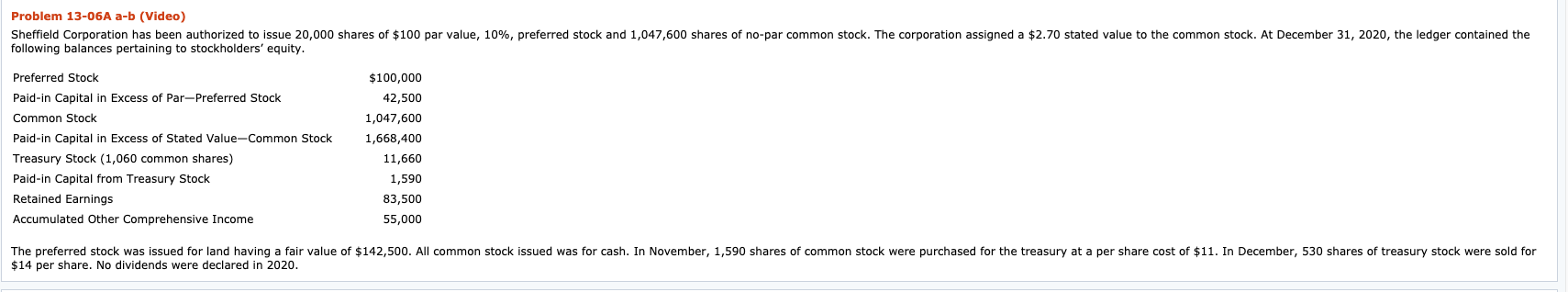

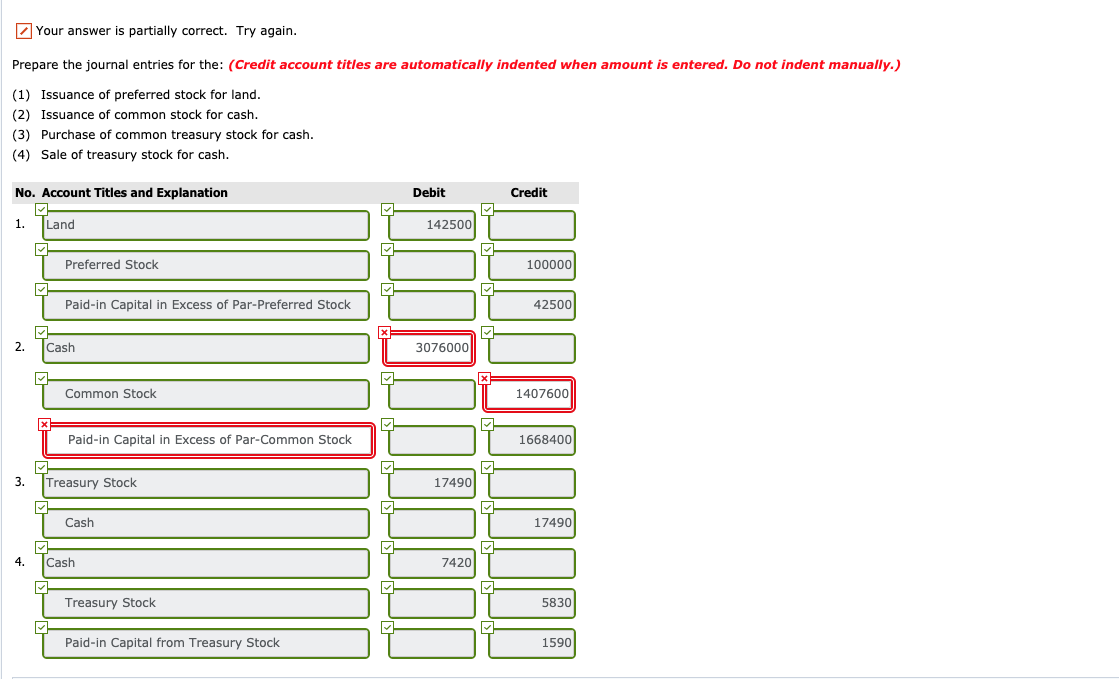

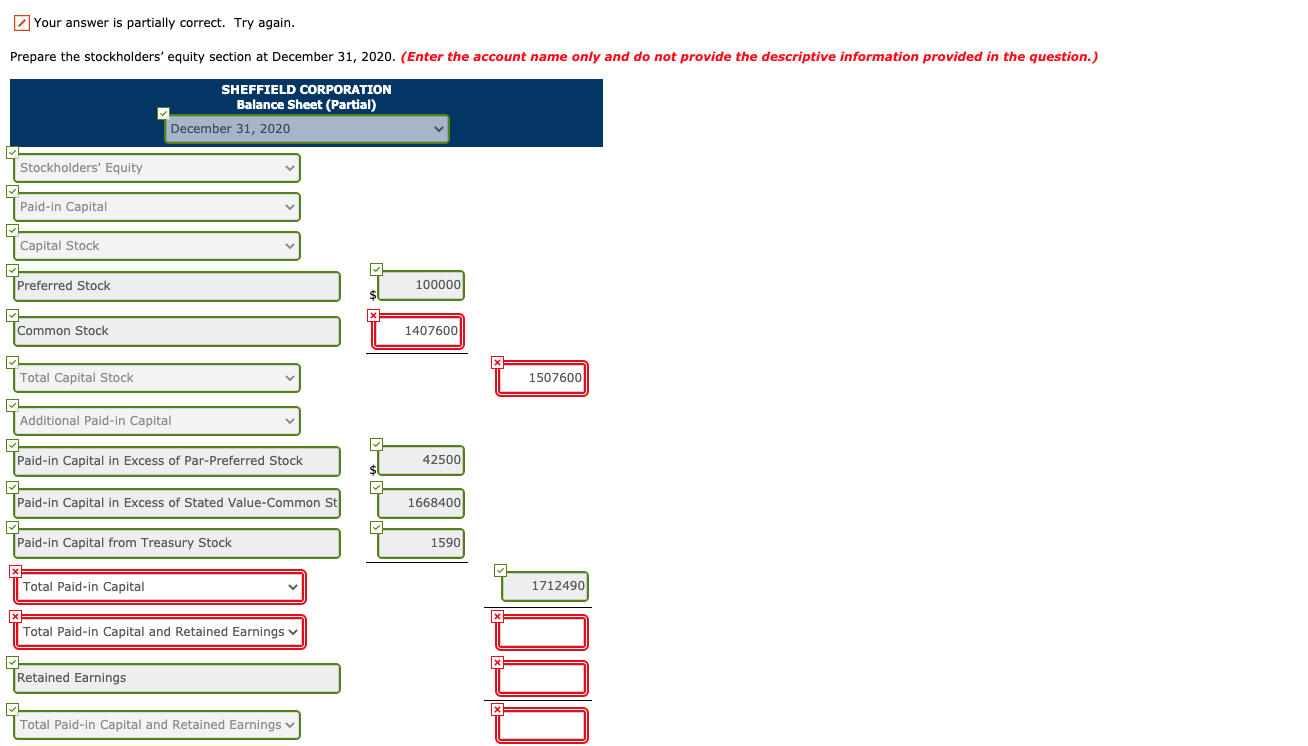

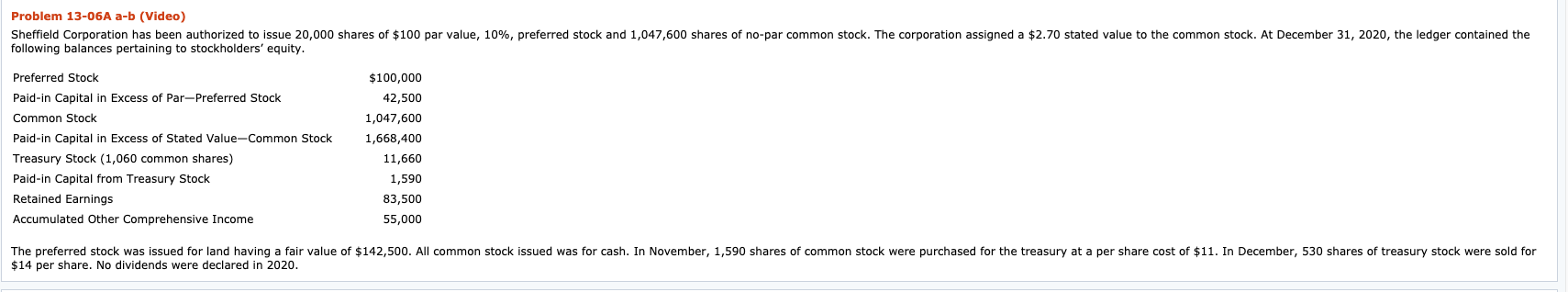

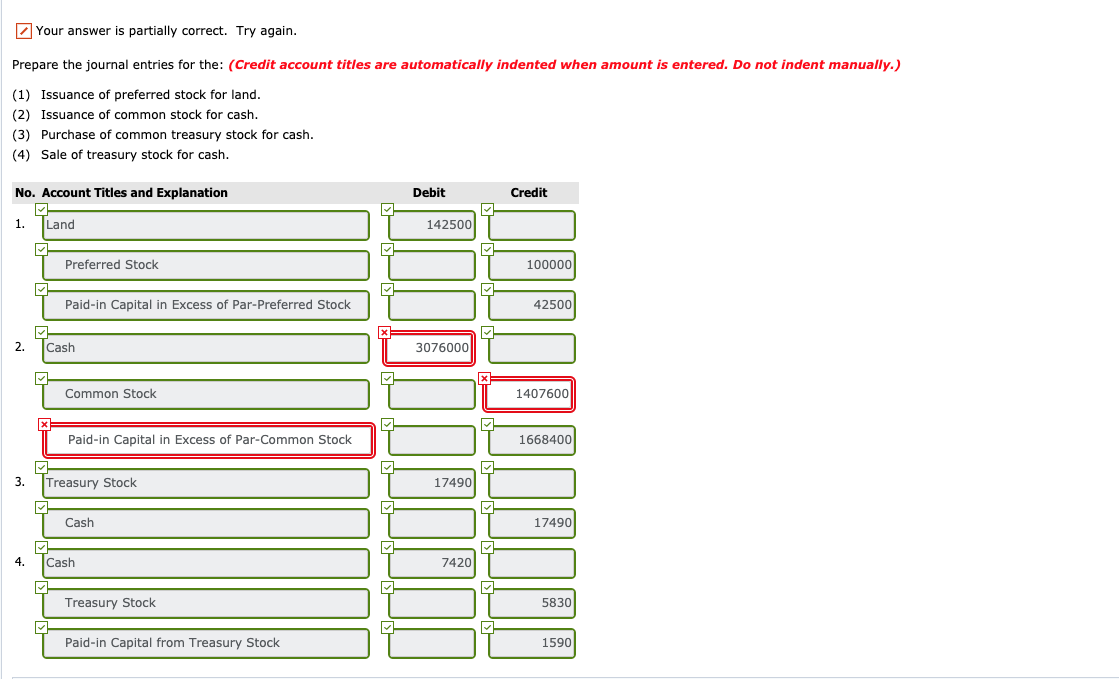

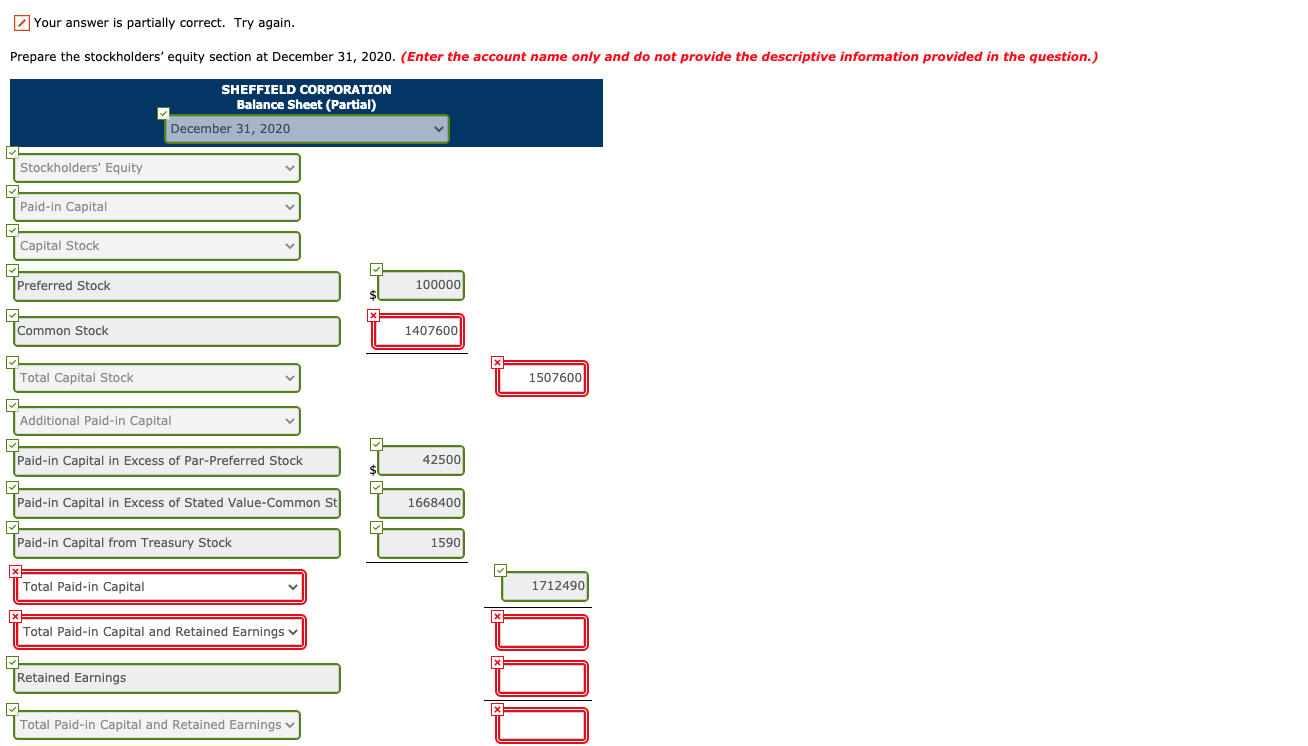

Problem 13-06A a-b (Video) Sheffield Corporation has been authorized to issue 20,000 shares of $100 par value, 10%, preferred stock and 1,047,600 shares of no-par common stock. The corporation assigned a $2.70 stated value to the common stock. At December 31, 2020, the ledger contained the following balances pertaining to stockholders' equity. Preferred Stock Paid-in Capital in Excess of Par-Preferred Stock Common Stock Paid-in Capital in Excess of Stated Value-Common Stock Treasury Stock (1,060 common shares) Paid-in Capital from Treasury Stock Retained Earnings Accumulated Other Comprehensive Income $100,000 42,500 1,047,600 1,668,400 11,660 1,590 83,500 55,000 The preferred stock was issued for land having a fair value of $142,500. All common stock issued was for cash. In November, 1,590 shares of common stock were purchased for the treasury at a per share cost of $11. In December, 530 shares of treasury stock were sold for $14 per share. No dividends were declared in 2020. Your answer is partially correct. Try again. Prepare the journal entries for the: (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (1) Issuance of preferred stock for land. (2) Issuance of common stock for cash. (3) Purchase of common treasury stock for cash. (4) Sale of treasury stock for cash. No. Account Titles and Explanation Debit Credit 1. Land 142500 Preferred Stock 100000 Paid-in Capital in Excess of Par-Preferred Stock 42500 x 2. Cash 3076000 Common Stock 1407600 Paid-in Capital in Excess of Par-Common Stock 1668400 3. Treasury Stock 17490 Cash 17490 4. Cash 7420 Treasury Stock 5830 Paid-in Capital from Treasury Stock 1590 Your answer is partially correct. Try again. Prepare the stockholders' equity section at December 31, 2020. (Enter the account name only and do not provide the descriptive information provided in the question.) SHEFFIELD CORPORATION Balance Sheet (Partial) December 31, 2020 Stockholders' Equity Paid-in Capital Capital Stock Preferred Stock 100000 Common Stock 1407600 x Total Capital Stock 1507600 Additional Paid-in Capital Paid-in Capital in Excess of Par-Preferred Stock 42500 Paid-in Capital in Excess of Stated Value-Common St 1668400 Paid-in Capital from Treasury Stock 15901 x Total Paid-in Capital 1712490 X X Total Paid-in Capital and Retained Earnings Retained Earnings Total Paid-in Capital and Retained Earnings Accumulated Other Comprehensive Income Less 5830 Treasury Stock Total Stockholders' Equity Click if you would like to Show Work for this question: Open Show Work