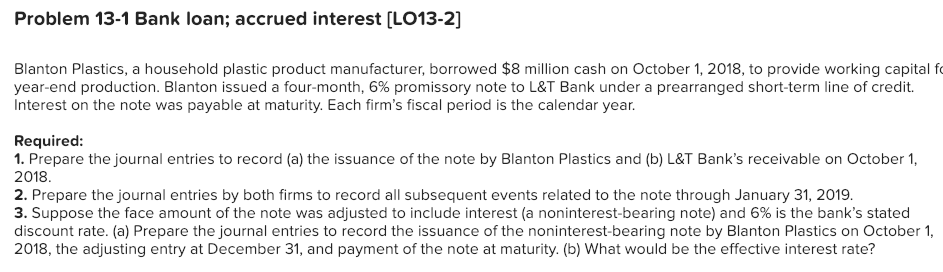

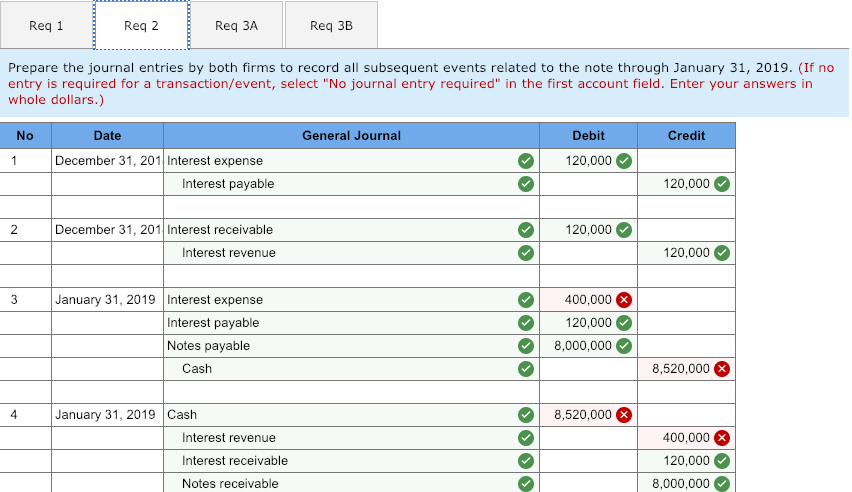

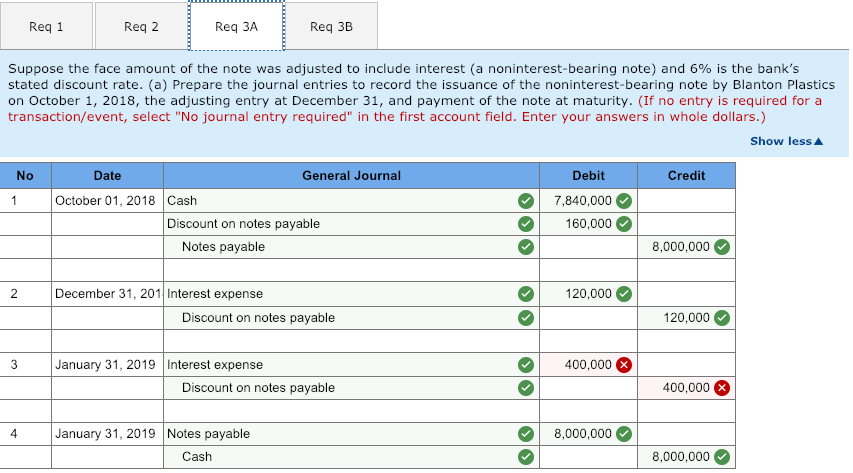

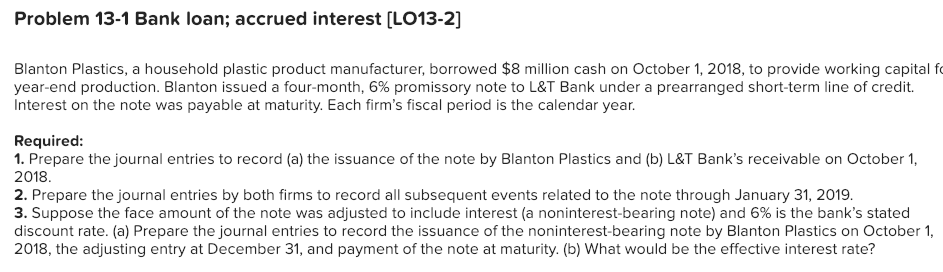

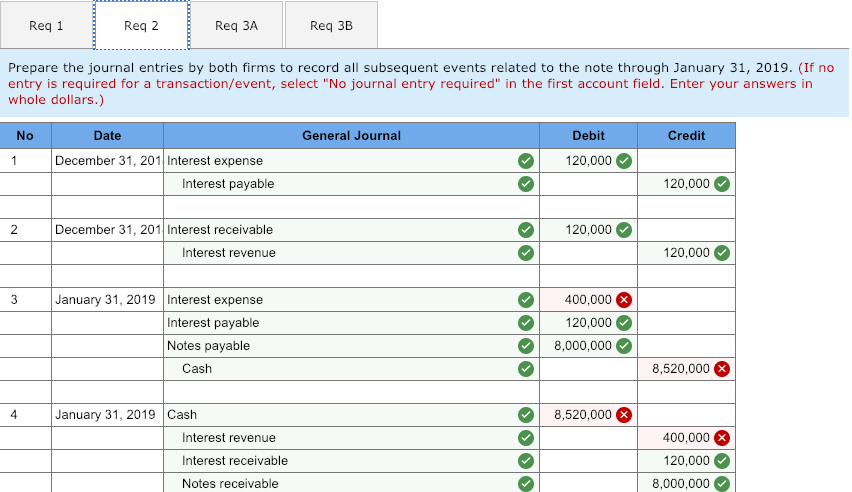

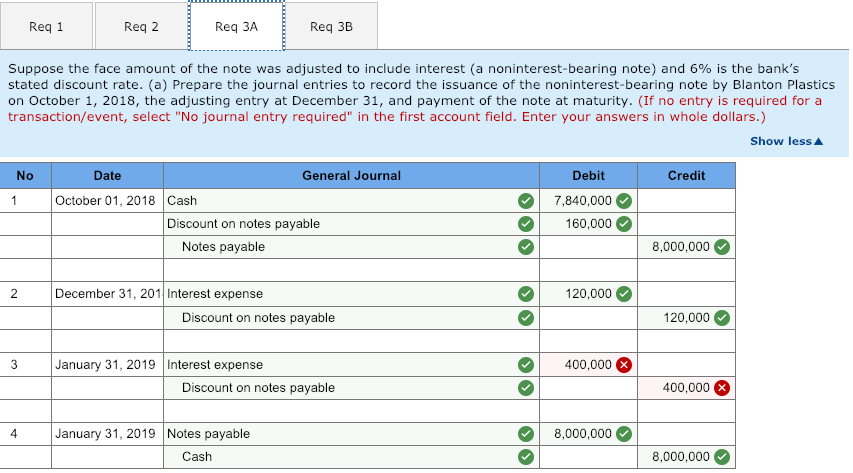

Problem 13-1 Bank loan; accrued interest L013-2] Blanton Plastics, a household plastic product manufacturer, borrowed $8 million cash on October 1, 2018, to provide working capital f year-end production. Blanton issued a four-month, 6% promissory note to L&T Bank under a prearranged short-term line of credit. Interest on the note was payable at maturity. Each firm's fiscal period is the calendar year. Required 1. Prepare the journal entries to record (a) the issuance of the note by Blanton Plastics and (b) L&T Bank's receivable on October 1, 2018 2. Prepare the journal entries by both firms to record all subsequent events related to the note through January 31, 2019. 3. Suppose the face amount of the note was adjusted to include interest (a noninterest-bearing note) and 6% is the bank's stated discount rate. (a) Prepare the journal entries to record the issuance of the noninterest-bearing note by Blanton Plastics on October 1, 2018, the adjusting entry at December 31, and payment of the note at maturity. (b) What would be the effective interest rate? Req 1 Req 2 Req 3A Req 3B Prepare the journal entries by both firms to record all subsequent events related to the note through January 31, 2019. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) Date General Journal Debit Credit December 31, 201 Interest expense 120,000 Interest payable 120,000 December 31, 201 Interest receivable 120,000 Interest revenue 20,000 400,000 120,000 8,000,00001 January 31, 2019 Interest expense Interest payable Notes payable Cash 8,520,000 4 January 31, 2019Cash 8,520,000 Interest revenue Interest receivable Notes receivable 400,000 20,000 8,000,000 Req 1 Req 2 Req 3A Req 3B Suppose the face amount of the note was adjusted to include interest (a noninterest-bearing note) and 6% is the bank's stated discount rate. (a) Prepare the journal entries to record the issuance of the noninterest-bearing note by Blanton Plastics on October 1, 2018, the adjusting entry at December 31, and payment of the note at maturity. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) Show lessA Date General Journal Credit Debit 7,840,000 160,000 October 01, 2018 Cash Discount on notes payable Notes payable 8,000,000 December 31, 201 Interest expense 120,000 Discount on notes payable 20,000 January 31, 2019 Interest expense 400,000 Discount on notes payable 400,000 4 January 31, 2019 Notes payable 8,000,000 Cash 8,000,000