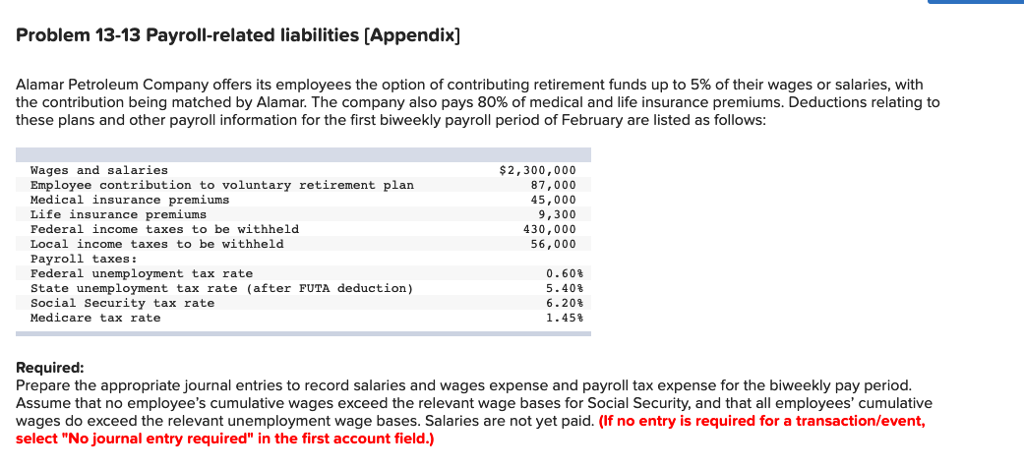

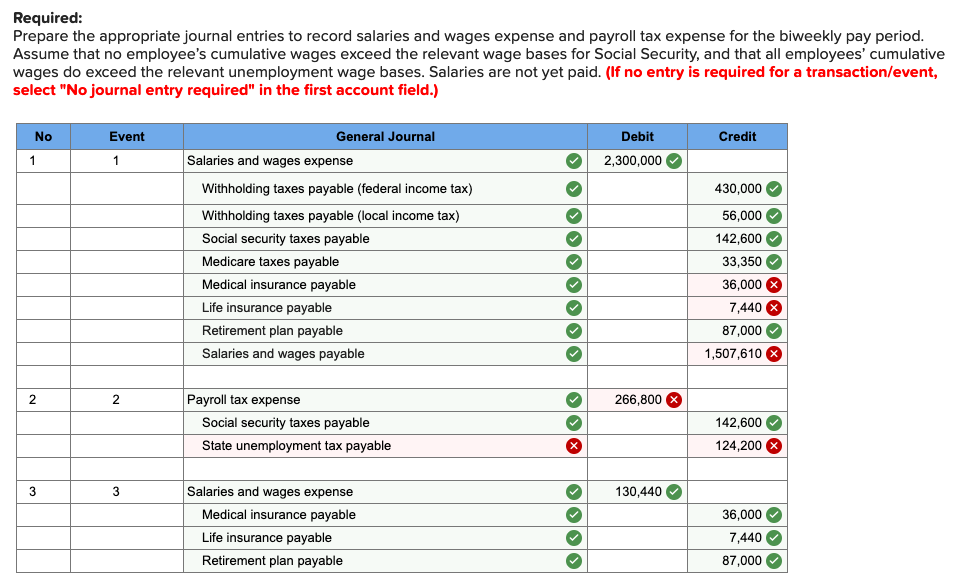

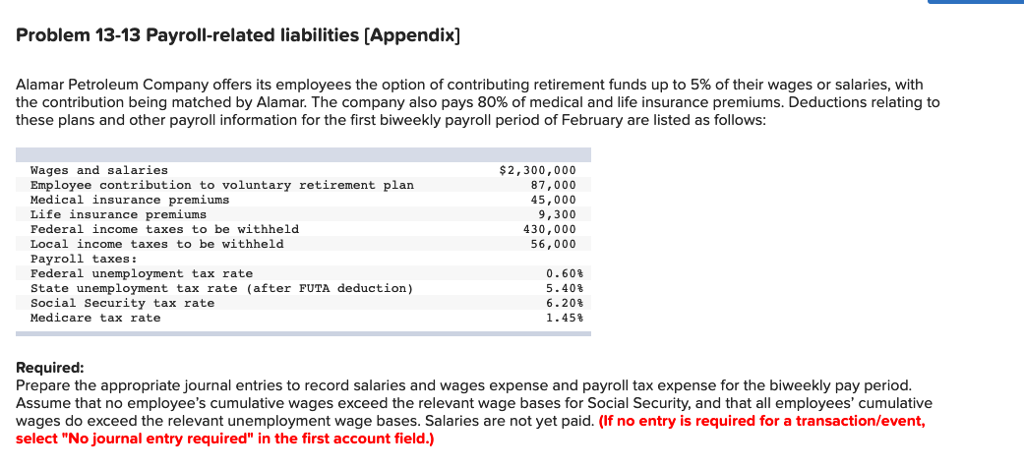

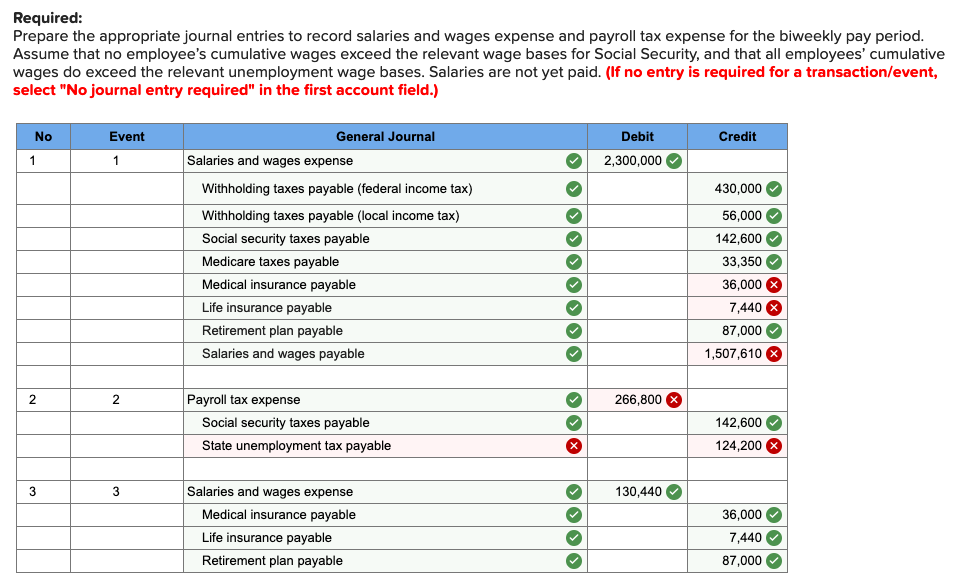

Problem 13-13 Payroll-related liabilities [Appendix] Alamar Petroleum Company offers its employees the option of contributing retirement funds up to 5% of their wages or salaries, with the contribution being matched by Alamar. The company also pays 80% of medical and life insurance premiums. Deductions relating to these plans and other payroll information for the first biweekly payroll period of February are listed as follows Wages and salaries Employee contribution to voluntary retirement plan Medical insurance premiums Life insurance premiums Federal income taxes to be withheld Local income taxes to be withheld Payroll taxes: Federal unemployment tax rate State unemployment tax rate (after FUTA deduction) Social Security tax rate Medicare tax rate $2,300,000 87,000 45,000 9,300 430,000 56,000 060% 5. 40% 620% 1 . 45% Required: Prepare the appropriate journal entries to record salaries and wages expense and payroll tax expense for the biweekly pay period Assume that no employee's cumulative wages exceed the relevant wage bases for Social Security, and that all employees' cumulative wages do exceed the relevant unemployment wage bases. Salaries are not yet paid. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Required Prepare the appropriate journal entries to record salaries and wages expense and payroll tax expense for the biweekly pay period Assume that no employee's cumulative wages exceed the relevant wage bases for Social Security, and that all employees' cumulative wages do exceed the relevant unemployment wage bases. Salaries are not yet paid. (f no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Event General Journal Debit Credit Salaries and wages expense 2,300,000 Withholding taxes payable (federal income tax) Withholding taxes payable (local income tax) Social security taxes payable Medicare taxes pay Medical insurance payable Life insurance payable Retirement plan payable Salaries and wages payable 430,000 56,000 42,600 33,350 36,000 7,440 87,000 1,507,610 able Payroll tax expense 266,800 Social security taxes payable State unemployment tax payable 42,600 124,200 130,440 Salaries and wages expense Medical insurance payable Life insurance payable Retirement plan payable 36,000 7,440 87,000