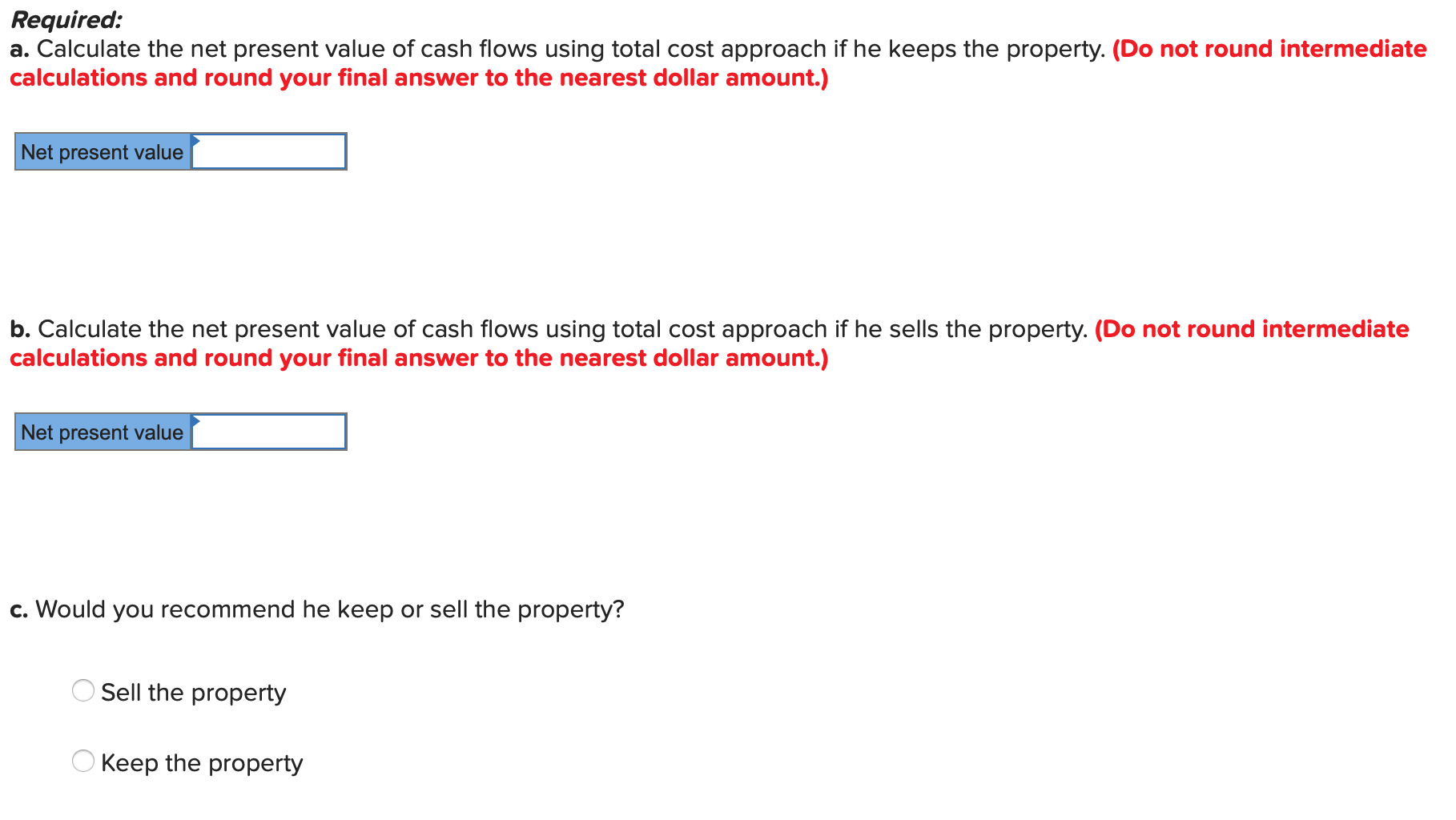

Problem 13-21 Keep or Sell a Property (LO1] Ben Ryatt, a professor of languages at a university in western Canada, owns a small office building adjacent to the university campus. He acquired the property 12 years ago at a total cost of $560,000: $52,000 for the land and $508,000 for the building. He has just received an offer from a real estate company that wants to purchase the property. However, the property has been a good source of income over the years, so Ryatt is unsure whether he should keep it or sell it. His alternatives are as follows: 20 points Keep the property. Ryatt's accountant has kept careful records of the income realized from the property over the past 10 years. These records indicate the following annual revenues and expenses: eBook $ 150,000 Rental receipts Less building expenses : Utilities Depreciation of building Property taxes and insurance Repairs and maintenance Custodial help and supplies References $28,600 17,800 19,500 10,500 43,500 119,900 Operating income $ 30,100 Ryatt makes a $12,600 mortgage payment each year on the property. The mortgage will be paid off in 10 more years. He has been depreciating the building by the straight-line method, assuming a salvage value of $9,600 for the building, which he still thinks is an appropriate figure. He feels sure that the building can be rented for another 16 years. He also feels sure that 16 years from now the land will be worth 2.5 times what he paid for it. Sell the property. A real estate company has offered to purchase the property by paying $150,000 immediately and $23,000 per year for the next 16 years. Control of the property would go to the real estate company immediately. To sell the property, Ryatt would need to pay the mortgage off, which could be done by making a lump-sum payment of $71,000. Ryatt requires a 14% rate of return. (Ignore income taxes.) (Hint: Use Microsoft Excel to calculate the discount factor(s).) Required: a. Calculate the net present value of cash flows using total cost approach if he keeps the property. (Do not round intermediate calculations and round your final answer to the nearest dollar amount.) Net present value b. Calculate the net present value of cash flows using total cost approach if he sells the property. (Do not round intermediate calculations and round your final answer to the nearest dollar amount.) Net present value c. Would you recommend he keep or sell the property? Sell the property O Keep the property