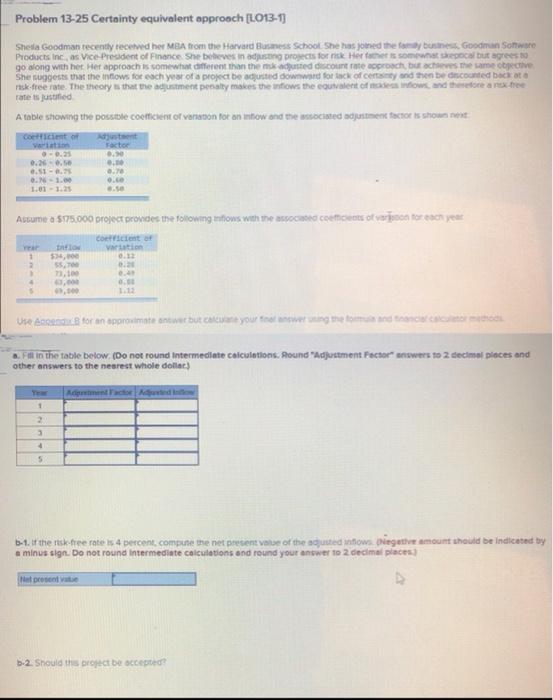

Problem 13-25 Certainty equivalent approach [LO13-1] Shella Goodman recently received her MBA from the Harvard Business School. She has joined the family business, Goodman Software Products Inc., as Vice-President of Finance. She believes in adjusting projects for risk Her father is somewhat skepocal but agrees to go along with her Her approach is somewhat different than the msk adjusted discount rate approach, but achieves the same objective She suggests that the inflows for each year of a project be adjusted downward for lack of certainty and then be discounted back at a risk-free rate. The theory is that the adjustment penalty makes the inflows the equivalent of skless inflows, and therefore a nsx-free rate is justified. A table showing the possible coefficient of variation for an inflow and the associated adjustment factor is shown next Coefficient of Adjustment variation Factor -0.25 0.0 0.26-6.50 0.00 0.51-0.75 0.70 0.16-1.00 0.co 1.01 -1.25 Assume a $175.000 project provides the following inflows with the associated coefficients of varison for each year Coefficient of Year Diflow variation 1 0.12 $34,000 55,700 2 0.20 1 73,100 0.49 4 43,000 0.00 5 49,000 1.12 Use Angendu for an approximate antwer but calculate your finer answer using the formula and financial calculator methods a. Fill in the table below. (Do not round Intermediate calculations. Round "Adjustment Factor" answers to 2 decimal places and other answers to the nearest whole dollar) Adprtment Factor Adjusted Infow 1 2 3 4 5 b-1. If the risk-free rate is 4 percent, compute the net present value of the adjusted inflows (Negative amount should be indicated by a minus sign. Do not round Intermediate calculations and round your answer to 2 decimal places) Net present vate b-2. Should this project be accepted? Problem 13-25 Certainty equivalent approach [LO13-1] Shella Goodman recently received her MBA from the Harvard Business School. She has joined the family business, Goodman Software Products Inc., as Vice-President of Finance. She believes in adjusting projects for risk Her father is somewhat skepocal but agrees to go along with her Her approach is somewhat different than the msk adjusted discount rate approach, but achieves the same objective She suggests that the inflows for each year of a project be adjusted downward for lack of certainty and then be discounted back at a risk-free rate. The theory is that the adjustment penalty makes the inflows the equivalent of skless inflows, and therefore a nsx-free rate is justified. A table showing the possible coefficient of variation for an inflow and the associated adjustment factor is shown next Coefficient of Adjustment variation Factor -0.25 0.0 0.26-6.50 0.00 0.51-0.75 0.70 0.16-1.00 0.co 1.01 -1.25 Assume a $175.000 project provides the following inflows with the associated coefficients of varison for each year Coefficient of Year Diflow variation 1 0.12 $34,000 55,700 2 0.20 1 73,100 0.49 4 43,000 0.00 5 49,000 1.12 Use Angendu for an approximate antwer but calculate your finer answer using the formula and financial calculator methods a. Fill in the table below. (Do not round Intermediate calculations. Round "Adjustment Factor" answers to 2 decimal places and other answers to the nearest whole dollar) Adprtment Factor Adjusted Infow 1 2 3 4 5 b-1. If the risk-free rate is 4 percent, compute the net present value of the adjusted inflows (Negative amount should be indicated by a minus sign. Do not round Intermediate calculations and round your answer to 2 decimal places) Net present vate b-2. Should this project be accepted