Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 13-32 (LO. 4, 8) Joyce, a widow, lives in an apartment with her two minor children (ages 8 and 10), whom she supports. Joyce

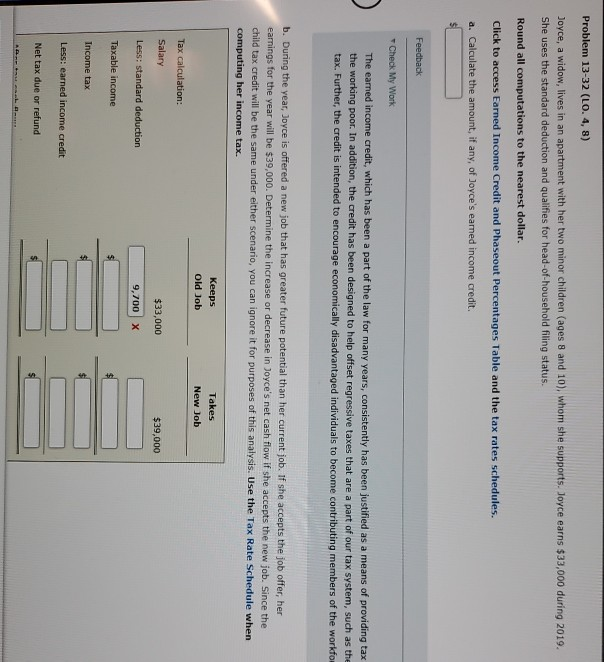

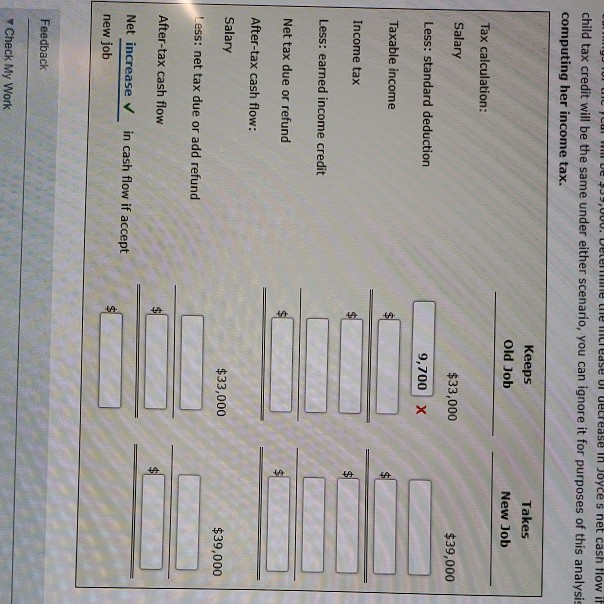

Problem 13-32 (LO. 4, 8) Joyce, a widow, lives in an apartment with her two minor children (ages 8 and 10), whom she supports. Joyce earns $33,000 during 2019. She uses the standard deduction and qualifies for head-of-household filing status. Round all computations to the nearest dollar. Click to access Earned Income Credit and Phaseout Percentages Table and the tax rates schedules. a. Calculate the amount, if any, of Joyce's eamed income credit. Feedback Check My Work The earned income credit, which has been a part of the law for many years, consistently has been justified as a means of providing tax the working poor. In addition, the credit has been designed to help offset regressive taxes that are a part of our tax system, such as the tax. Further, the credit is intended to encourage economically disadvantaged individuals to become contributing members of the workfo b. During the year, Joyce is offered a new job that has greater future potential than her current job. If she accepts the job offer, her earnings for the year will be $39,000. Determine the increase or decrease in Joyce's net cash flow if she accepts the new job. Since the child tax credit will be the same under either scenario, you can ignore it for purposes of this analysis. Use the Tax Rate Schedule when computing her income tax. keeps Old Job Takes New Job Tax calculation: Salary $39,000 $33,000 9,700 x Less: standard deduction Taxable income Income tax Less: earned income credit Net tax due or refund puuv e edse ecos child tax credit will be the same under either scenario, you can ignore it for purposes of this analysis computing her income tax. Keeps Old Job Takes New Job Tax calculation: Salary $33,000 $39,000 Less: standard deduction 9,700 Taxable income Income tax Less: earned income credit Net tax due or refund After-tax cash flow: Salary $33,000 $39,000 Less: net tax due or add refund After-tax cash flow in cash flow if accept Net increase new job Feedback Check My Work Problem 13-32 (LO. 4, 8) Joyce, a widow, lives in an apartment with her two minor children (ages 8 and 10), whom she supports. Joyce earns $33,000 during 2019. She uses the standard deduction and qualifies for head-of-household filing status. Round all computations to the nearest dollar. Click to access Earned Income Credit and Phaseout Percentages Table and the tax rates schedules. a. Calculate the amount, if any, of Joyce's eamed income credit. Feedback Check My Work The earned income credit, which has been a part of the law for many years, consistently has been justified as a means of providing tax the working poor. In addition, the credit has been designed to help offset regressive taxes that are a part of our tax system, such as the tax. Further, the credit is intended to encourage economically disadvantaged individuals to become contributing members of the workfo b. During the year, Joyce is offered a new job that has greater future potential than her current job. If she accepts the job offer, her earnings for the year will be $39,000. Determine the increase or decrease in Joyce's net cash flow if she accepts the new job. Since the child tax credit will be the same under either scenario, you can ignore it for purposes of this analysis. Use the Tax Rate Schedule when computing her income tax. keeps Old Job Takes New Job Tax calculation: Salary $39,000 $33,000 9,700 x Less: standard deduction Taxable income Income tax Less: earned income credit Net tax due or refund puuv e edse ecos child tax credit will be the same under either scenario, you can ignore it for purposes of this analysis computing her income tax. Keeps Old Job Takes New Job Tax calculation: Salary $33,000 $39,000 Less: standard deduction 9,700 Taxable income Income tax Less: earned income credit Net tax due or refund After-tax cash flow: Salary $33,000 $39,000 Less: net tax due or add refund After-tax cash flow in cash flow if accept Net increase new job Feedback Check My Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started