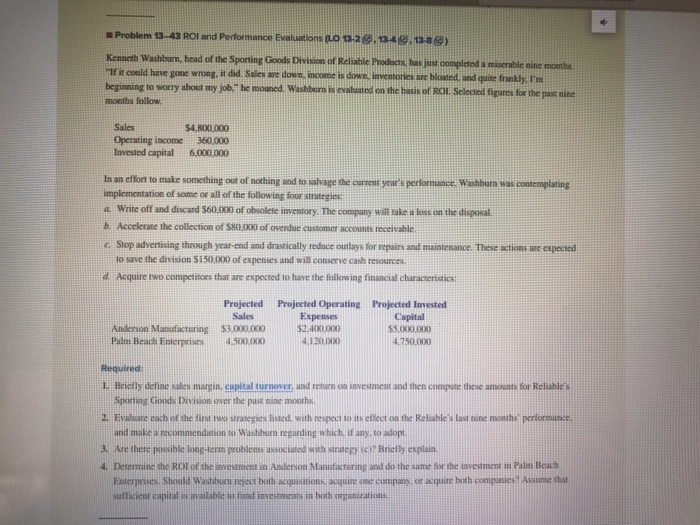

Problem 13-43 ROI and Performance Evaluations ao oa @,4@ t34@) Kenneth Washburn, head of the Sporting Goods Division of Reliable Prodos ha just Products, has just completedmiserable nine months. f it could have gone wrong, it did. Sales are down, income is down inventories are bloated, and quite beginning to worry about my job" he mouned. Washborn s cvaluated on the basis of ROI Selected figures for the past nine months follow e fnmkly, I'm Sales $4,800,000 Operating income 360.000 Invested capital 6.000,000 In an efifort to make something out of nothing and to salvage the curzent year's perlormance Washburn was contemplating mplementation of some or all of the following four strategies a. Write off and discard 560.000 of obsolete inventory. The company wilt take a loss on the disposal b. Accelerate the collection of $80.000 of overdue customer accounts receivable c Stop advertising through year-end and drastically reduce outlays for repairs and maintenance These actions are expected to save the division 5150.000 of expenses and will conserse cash resources Acquire two competitors that are expected to have the following financial characteristic ProjectedProjected Operating Projected Invested Capital Sales Expenses Anderson Manufacturing $3,000000$2-400.000 Pilm Beach Enterpriss4.500.0O 4.120.000 750,000 Required 1 Briefly define sales margin, capital turnower and return on invesment and then compute these amounts for Reliables 2. Evaluate each of the first two strategies listed, with respect to its effiect on the Reliable's last nine months performance 3. Are there posible long-Herm prohlems associated with strancgy ic Brictly cxplain Sporting Goods Division over the past nine months and make a recommendation to Washburn regarding which, if any, to adopt 4. Determinc the ROl of the investmicnt in Anderson Manufacturing and do the same for the investment in Palm Beach Enterprises. Should Wasbbun reject both acquisitions acquire one company, or acquire both compnies Assume that to fund investments in both Problem 13-43 ROI and Performance Evaluations ao oa @,4@ t34@) Kenneth Washburn, head of the Sporting Goods Division of Reliable Prodos ha just Products, has just completedmiserable nine months. f it could have gone wrong, it did. Sales are down, income is down inventories are bloated, and quite beginning to worry about my job" he mouned. Washborn s cvaluated on the basis of ROI Selected figures for the past nine months follow e fnmkly, I'm Sales $4,800,000 Operating income 360.000 Invested capital 6.000,000 In an efifort to make something out of nothing and to salvage the curzent year's perlormance Washburn was contemplating mplementation of some or all of the following four strategies a. Write off and discard 560.000 of obsolete inventory. The company wilt take a loss on the disposal b. Accelerate the collection of $80.000 of overdue customer accounts receivable c Stop advertising through year-end and drastically reduce outlays for repairs and maintenance These actions are expected to save the division 5150.000 of expenses and will conserse cash resources Acquire two competitors that are expected to have the following financial characteristic ProjectedProjected Operating Projected Invested Capital Sales Expenses Anderson Manufacturing $3,000000$2-400.000 Pilm Beach Enterpriss4.500.0O 4.120.000 750,000 Required 1 Briefly define sales margin, capital turnower and return on invesment and then compute these amounts for Reliables 2. Evaluate each of the first two strategies listed, with respect to its effiect on the Reliable's last nine months performance 3. Are there posible long-Herm prohlems associated with strancgy ic Brictly cxplain Sporting Goods Division over the past nine months and make a recommendation to Washburn regarding which, if any, to adopt 4. Determinc the ROl of the investmicnt in Anderson Manufacturing and do the same for the investment in Palm Beach Enterprises. Should Wasbbun reject both acquisitions acquire one company, or acquire both compnies Assume that to fund investments in both