Answered step by step

Verified Expert Solution

Question

1 Approved Answer

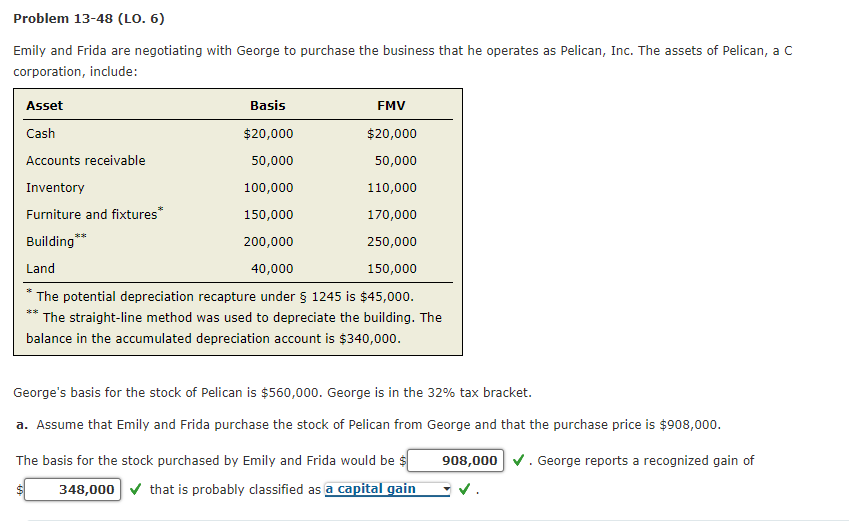

Problem 13-48 (LO. 6) Emily and Frida are negotiating with George to purchase the business that he operates as Pelican, Inc. The assets of

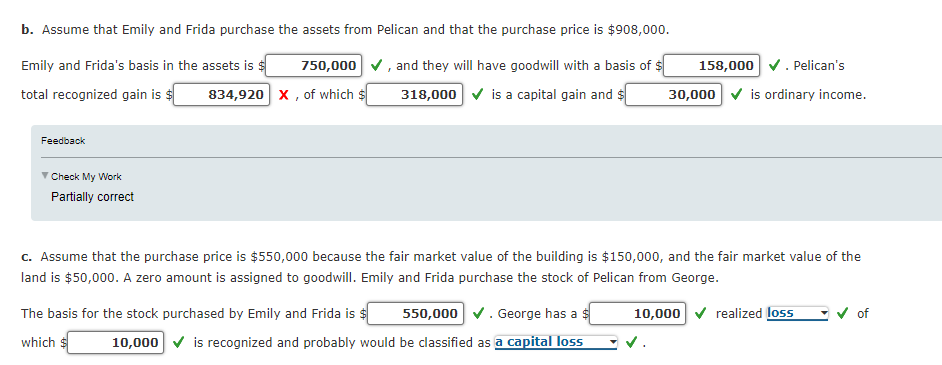

Problem 13-48 (LO. 6) Emily and Frida are negotiating with George to purchase the business that he operates as Pelican, Inc. The assets of Pelican, a C corporation, include: Asset Basis FMV Cash $20,000 $20,000 Accounts receivable 50,000 50,000 Inventory 100,000 110,000 Furniture and fixtures* 150,000 170,000 Building** 200,000 250,000 Land 40,000 150,000 *The potential depreciation recapture under 1245 is $45,000. ** *The straight-line method was used to depreciate the building. The balance in the accumulated depreciation account is $340,000. George's basis for the stock of Pelican is $560,000. George is in the 32% tax bracket. a. Assume that Emily and Frida purchase the stock of Pelican from George and that the purchase price is $908,000. The basis for the stock purchased by Emily and Frida would be $ $ 908,000 . George reports a recognized gain of 348,000 that is probably classified as a capital gain . b. Assume that Emily and Frida purchase the assets from Pelican and that the purchase price is $908,000. 750,000, and they will have goodwill with a basis of $ 318,000 is a capital gain and $ Emily and Frida's basis in the assets is $ total recognized gain is $ 834,920 X, of which $ 158,000 Pelican's 30,000 is ordinary income. Feedback Check My Work Partially correct c. Assume that the purchase price is $550,000 because the fair market value of the building is $150,000, and the fair market value of the land is $50,000. A zero amount is assigned to goodwill. Emily and Frida purchase the stock of Pelican from George. The basis for the stock purchased by Emily and Frida is $ which $ 550,000 George has a $ 10,000 10,000 is recognized and probably would be classified as a capital loss realized loss of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets examine each part of the problem separately Part a Emily and Frida are purchasing the stock of Pelican from George for 908000 1 Basis for the Sto...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started