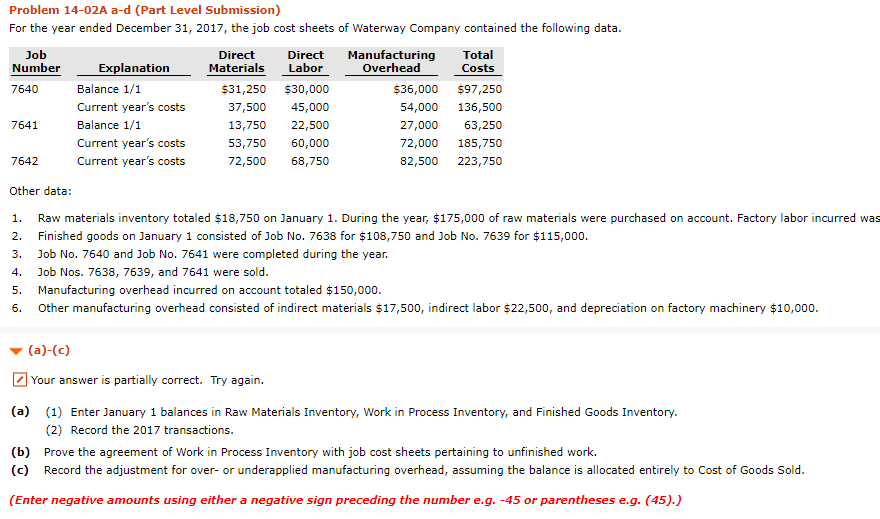

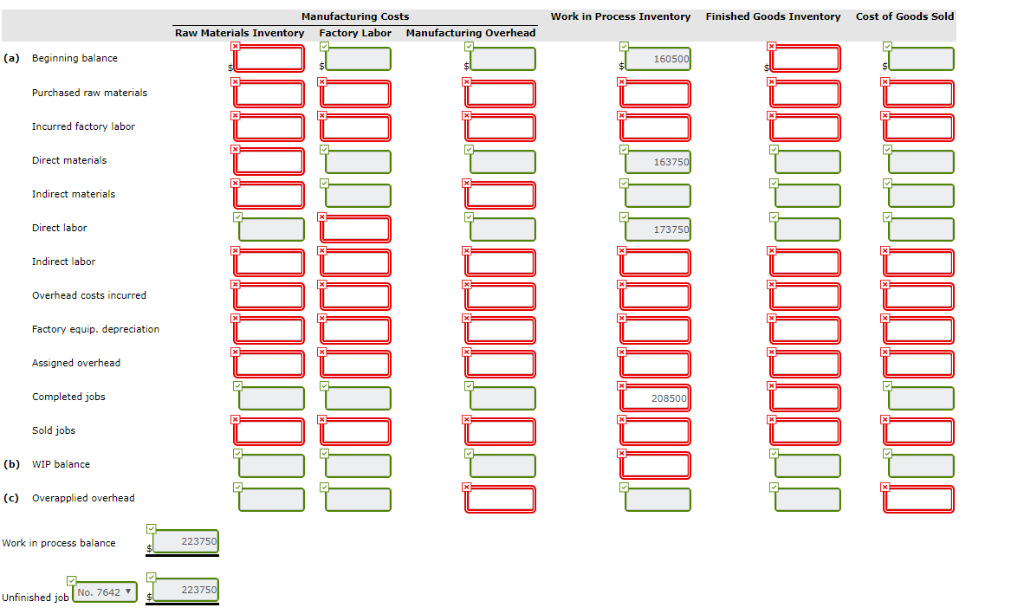

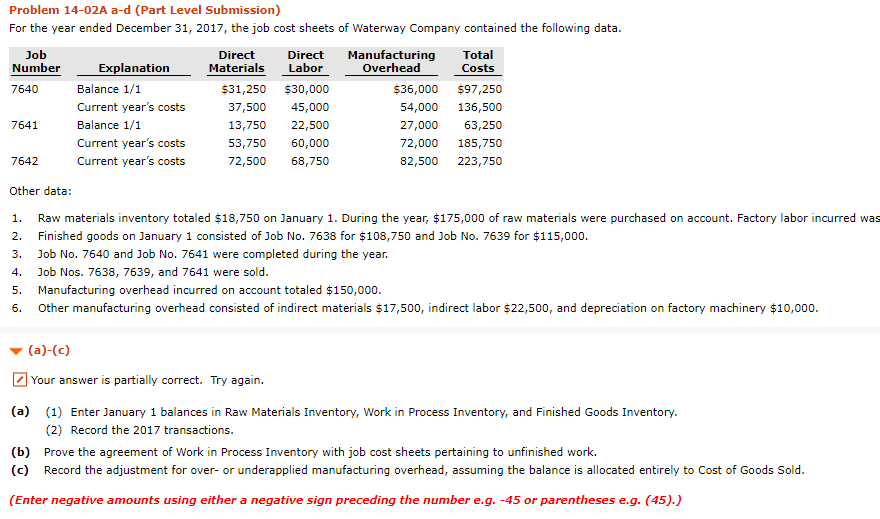

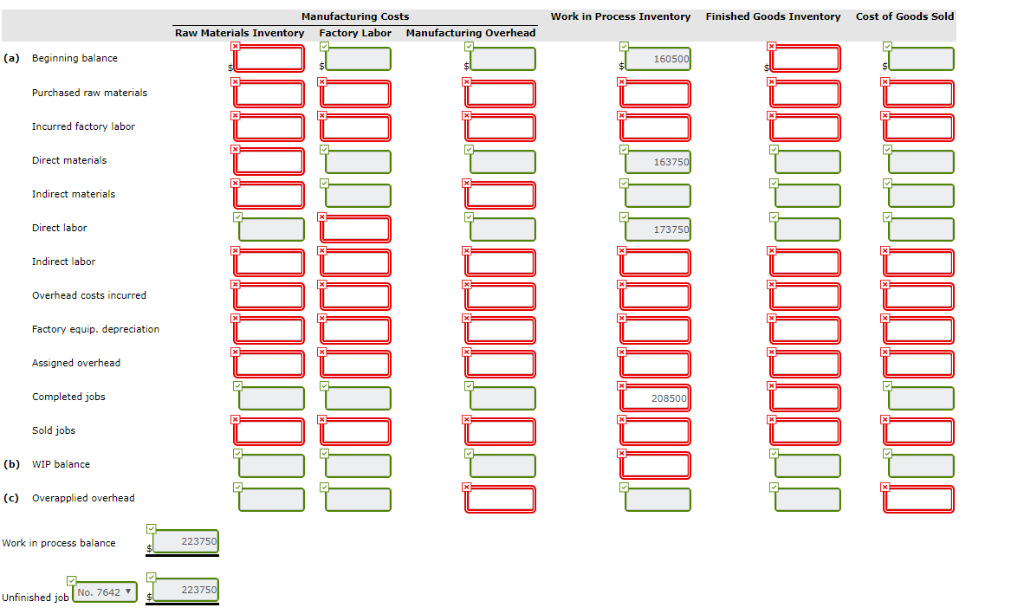

Problem 14-02A a-d (Part Level Submission) For the year ended December 31, 2017, the job cost sheets of Waterway Company contained the following data Job Number Direct ManufacturingTotal Overhead Direct Materials Labor Explanation Costs 7640 Balance 1/1 Current year's costs Balance 1/1 Current year's costs Current year's costs $31,250 $30,000 37,500 45,000 13,750 22,500 53,750 60,000 72,500 68,750 $36,000 $97,250 54,000 136,500 27,000 63,250 72,000 185,750 82,500 223,750 7641 7642 Other data: 1. Raw materials inventory totaled $18,750 on January 1. During the year, $175,000 of raw materials were purchased on account. Factory labor incurred was 2. Finished goods on January 1 consisted of Job No. 7638 for $108,750 and Job No. 7639 for $115,000 3. Job No. 7640 and Job No. 7641 were completed during the year. 4. Job Nos. 7638, 7639, and 7641 were sold 5. Manufacturing overhead incurred on account totaled $150,000 6. Other manufacturing overhead consisted of indirect materials $17,500, indirect labor $22,500, and depreciation on factory machinery $10,000 Your answer is partially correct. Try again (a) (1) Enter January 1 balances in Raw Materials Inventory, Work in Process Inventory, and Finished Goods Inventory. (b) Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. (2) Record the 2017 transactions. (c) Record the adjustment for over- or underapplied manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Manufacturing Costs Raw Materials Inventory Factory Labor Manufacturing Overhead Work in Process Inventory Finished Goods Inventory Cost of Goods Sold (a) Beginning balance 16050 Purchased raw materials Incurred factory labor Direct materials 16375 Indirect materials Direct labor 17375 Indirect labor Overhead costs incurred Factory equip. depreciation Assigned overhead 208500 Sold jobs (b) WIP balance (c) Overapplied overhead 223750 Work in process balance 2237 Unfinished jobNo. 7642