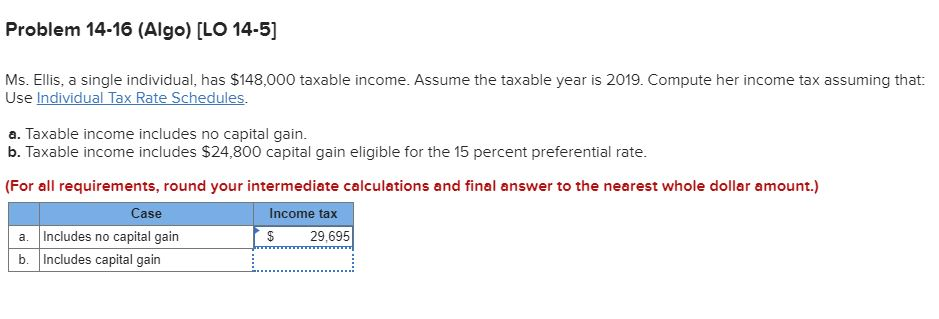

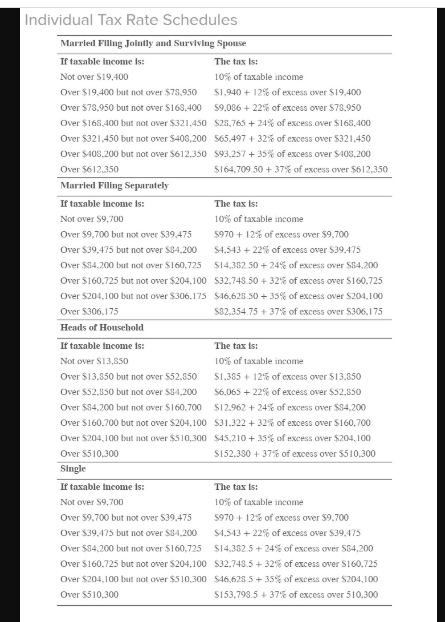

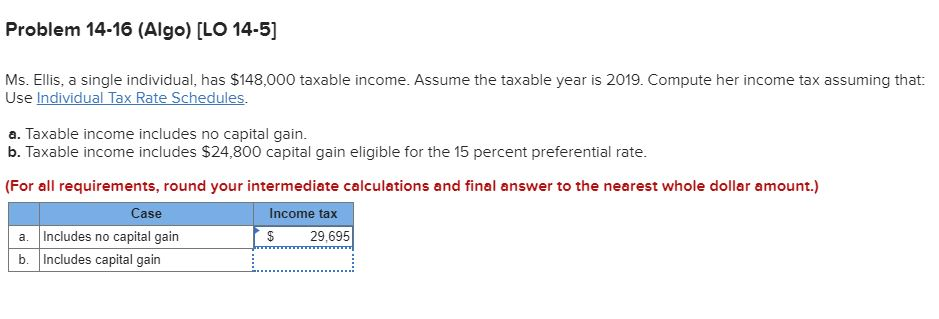

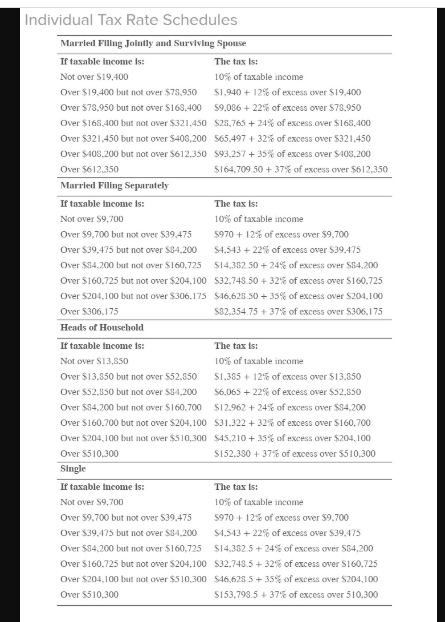

Problem 14-16 (Algo) [LO 14-5) Ms. Ellis, a single individual, has $148,000 taxable income. Assume the taxable year is 2019. Compute her income tax assuming that: Use Individual Tax Rate Schedules. a. Taxable income includes no capital gain. b. Taxable income includes $24.800 capital gain eligible for the 15 percent preferential rate. (For all requirements, round your intermediate calculations and final answer to the nearest whole dollar amount.) Case Income tax a. Includes no capital gain $ 29,695 b. Includes capital gain Individual Tax Rate Schedules Marrted Filling Jolutly and Surviving Sponse If taxable income is: The tax is: Not over $19.400 10% of taxable income Over $19.400 but not over $78,950 $1.940 +12% of excess over $19.400 Over $78,950 but not over $168.400 $9.086 +22% of excess over $78.950 Over $165.400 but not over $321.450 $28,765 +24% of excess over $168.400 Over 5321,450 but not over $405,200 65.497 +32% of excess over 5321,450 Over $408.200 but not over $612.350 $93.257 +35% of excess over $408.200 Over 5612.350 5164.709 50 + 37% of excess over 5612,350 Married Filing Separately If taxable income is: The tax is: Not over S9,700 10% of taxable income Over 59,700 but not over 539.475 $970 +12% of excess over $9,700 Over 539.475 but not over $84.200 54.543 + 22% of excess over $39.475 Over 554.200 but not giver $160,725 514.352 50 + 24% of excess wer 554.200 Over $160.725 but not over $204.100 S32.748.50 + 32% of excess over 5160.725 Over S204.100 but not over $306.175 $16.628.50 + 35% of excess over $204.100 Over 5306.175 $82.354.75 + 37% of excess over 5305. 175 Heads of Household If taxable income is: The tax is: Not over $13.550 10% of taxable income Over $13.550 but not over 552.550 51.385 +12% of excess over 513.850 Over $2.850 but not over $54,200 56,065 + 22% of excess over S52.850 Over $34.700 but not over $160.700 $12.962 +24% of excess over $84.200 Over $160.700 but not over S204.100 S31.222 + 32% of excess over $160.700 Over 5204,100 but not over $510,300 $45.210 + 35% of excess over $204,100 Over 5510.300 S152,380 + 37% of excess over 5510.300 Single If taxable income is: The tax is: Not over S9,700 10% of taxable income Over 59.700 but not over 539.475 5970 +12% of excess over $9.700 Over $39.475 but not over $34.200 $4.513 + 22% of excess over $39.475 Over $84.200 but not cwer 5160.725 $14.352 5+24% of excess over 564.200 Over $160.725 but not over S204.100 $32.748.5+ 32% of excess over S160.725 Over $204.100 but not over $510,300 $46,625 5 + 35% of excess over S204,100 Over 5510.300 $153.798.5 +376 of excess over 510.300